Can Deep Learning Predict Risky Retail Investors? A Case Study in Financial Risk Behavior Forecasting

Paper and Code

Jan 17, 2019

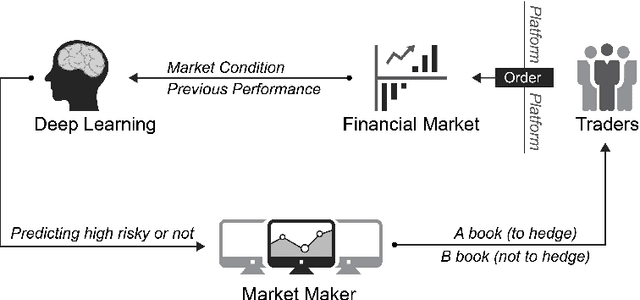

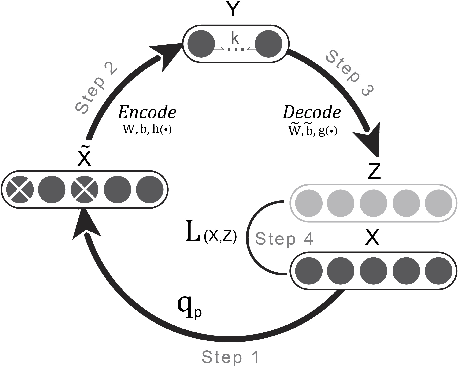

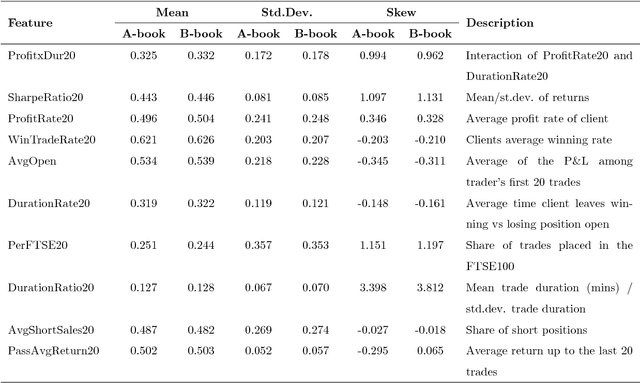

The success of deep learning for unstructured data analysis is well documented but little evidence has emerged related to the structured, tabular datasets used in decision support. We address this research gap by considering the potential of deep learning to support financial risk management. In particular, we develop a deep learning model for predicting whether individual spread traders are likely to secure profits from future trades. This embodies typical modeling challenges faced in risk and behavior forecasting. Conventional machine learning requires data that is representative of the feature-target relationship and relies on the often costly development, maintenance, and revision of handcrafted features. Consequently, modeling highly variable, heterogeneous patterns such as the behavior of traders is challenging. Deep learning promises a remedy. Learning hierarchical distributed representations of the raw data in an automatic manner (e.g. risk taking behavior), it uncovers generative features that determine the target (e.g., trader's profitability), avoids manual feature engineering, and is more robust toward change (e.g. dynamic market conditions). The results of employing a deep network for operational risk forecasting confirm the feature learning capability of deep learning, provide guidance on designing a suitable network architecture and demonstrate the superiority of deep learning over powerful machine learning benchmarks. Empirical results suggest that the financial institution which provided the data can increase annual profits by 16% through implementing a deep learning based risk management policy. The findings demonstrate the potential of applying deep learning methods for management science problems in finance, marketing, and accounting.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge