A Deep Learning Approach to Anomaly Detection in High-Frequency Trading Data

Paper and Code

Mar 31, 2025

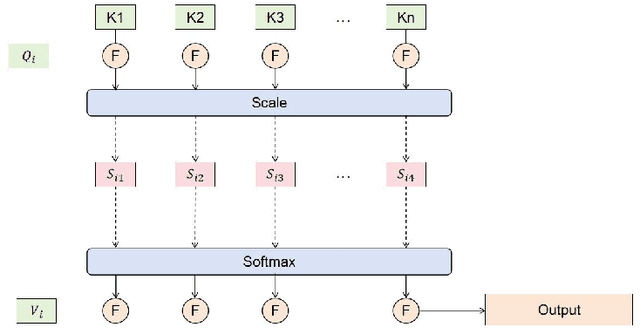

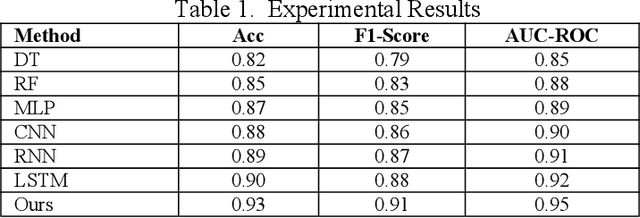

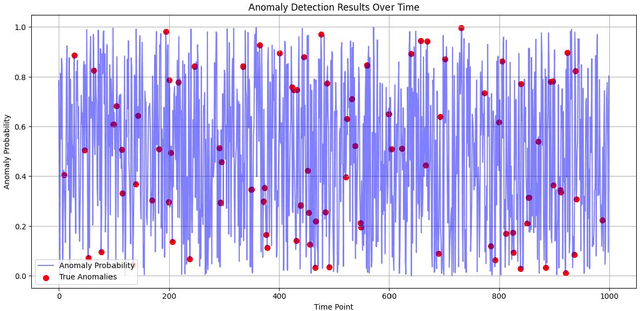

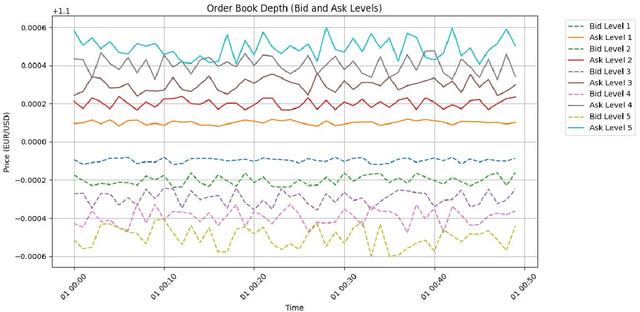

This paper proposes an algorithm based on a staged sliding window Transformer architecture to detect abnormal behaviors in the microstructure of the foreign exchange market, focusing on high-frequency EUR/USD trading data. The method captures multi-scale temporal features through a staged sliding window, extracts global and local dependencies by combining the self-attention mechanism and weighted attention mechanism of the Transformer, and uses a classifier to identify abnormal events. Experimental results on a real high-frequency dataset containing order book depth, spread, and trading volume show that the proposed method significantly outperforms traditional machine learning (such as decision trees and random forests) and deep learning methods (such as MLP, CNN, RNN, LSTM) in terms of accuracy (0.93), F1-Score (0.91), and AUC-ROC (0.95). Ablation experiments verify the contribution of each component, and the visualization of order book depth and anomaly detection further reveals the effectiveness of the model under complex market dynamics. Despite the false positive problem, the model still provides important support for market supervision. In the future, noise processing can be optimized and extended to other markets to improve generalization and real-time performance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge