Zhengxin Joseph Ye

Trading through Earnings Seasons using Self-Supervised Contrastive Representation Learning

Sep 25, 2024

Abstract:Earnings release is a key economic event in the financial markets and crucial for predicting stock movements. Earnings data gives a glimpse into how a company is doing financially and can hint at where its stock might go next. However, the irregularity of its release cycle makes it a challenge to incorporate this data in a medium-frequency algorithmic trading model and the usefulness of this data fades fast after it is released, making it tough for models to stay accurate over time. Addressing this challenge, we introduce the Contrastive Earnings Transformer (CET) model, a self-supervised learning approach rooted in Contrastive Predictive Coding (CPC), aiming to optimise the utilisation of earnings data. To ascertain its effectiveness, we conduct a comparative study of CET against benchmark models across diverse sectors. Our research delves deep into the intricacies of stock data, evaluating how various models, and notably CET, handle the rapidly changing relevance of earnings data over time and over different sectors. The research outcomes shed light on CET's distinct advantage in extrapolating the inherent value of earnings data over time. Its foundation on CPC allows for a nuanced understanding, facilitating consistent stock predictions even as the earnings data ages. This finding about CET presents a fresh approach to better use earnings data in algorithmic trading for predicting stock price trends.

Capturing dynamics of post-earnings-announcement drift using genetic algorithm-optimised supervised learning

Sep 07, 2020

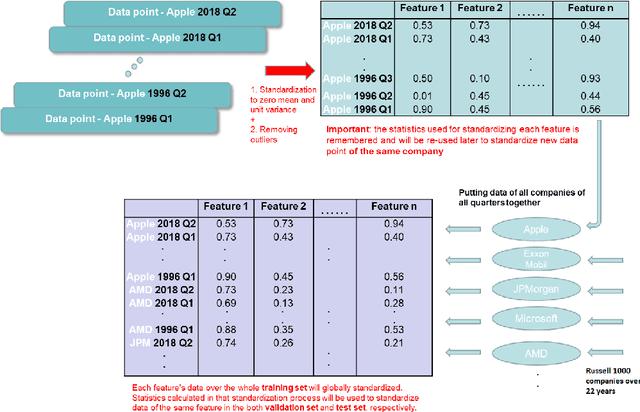

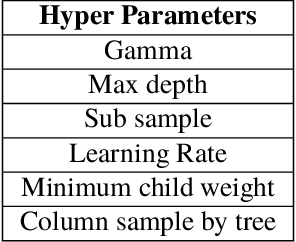

Abstract:While Post-Earnings-Announcement Drift (PEAD) is one of the most studied stock market anomalies, the current literature is often limited in explaining this phenomenon by a small number of factors using simpler regression methods. In this paper, we use a machine learning based approach instead, and aim to capture the PEAD dynamics using data from a large group of stocks and a wide range of both fundamental and technical factors. Our model is built around the Extreme Gradient Boosting (XGBoost) and uses a long list of engineered input features based on quarterly financial announcement data from 1,106 companies in the Russell 1000 index between 1997 and 2018. We perform numerous experiments on PEAD predictions and analysis and have the following contributions to the literature. First, we show how Post-Earnings-Announcement Drift can be analysed using machine learning methods and demonstrate such methods' prowess in producing credible forecasting on the drift direction. It is the first time PEAD dynamics are studied using XGBoost. We show that the drift direction is in fact driven by different factors for stocks from different industrial sectors and in different quarters and XGBoost is effective in understanding the changing drivers. Second, we show that an XGBoost well optimised by a Genetic Algorithm can help allocate out-of-sample stocks to form portfolios with higher positive returns to long and portfolios with lower negative returns to short, a finding that could be adopted in the process of developing market neutral strategies. Third, we show how theoretical event-driven stock strategies have to grapple with ever changing market prices in reality, reducing their effectiveness. We present a tactic to remedy the difficulty of buying into a moving market when dealing with PEAD signals.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge