Yuanrong Wang

Homological Convolutional Neural Networks

Aug 26, 2023

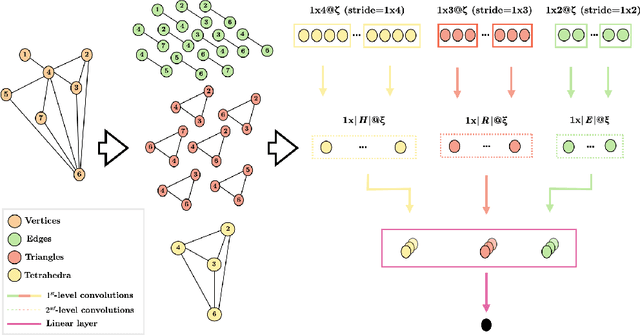

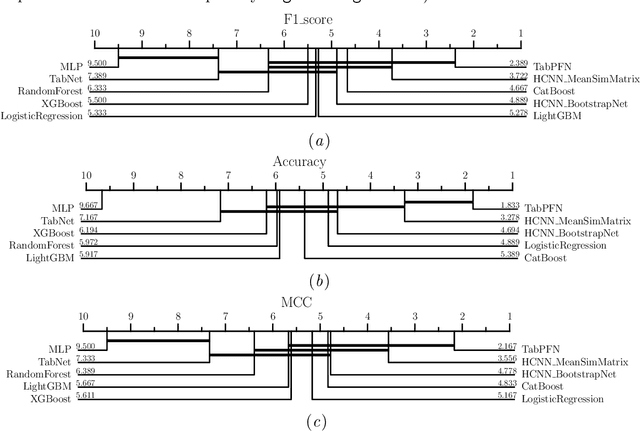

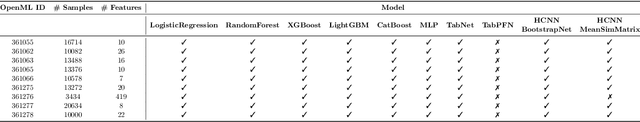

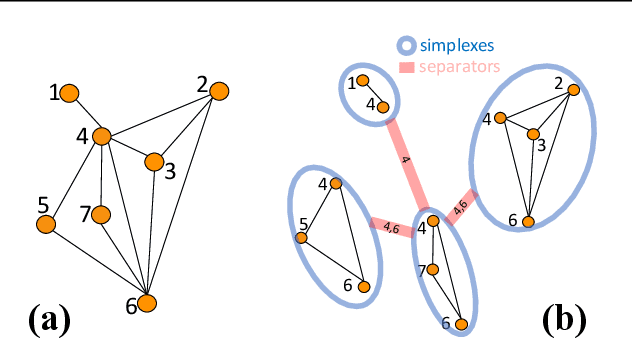

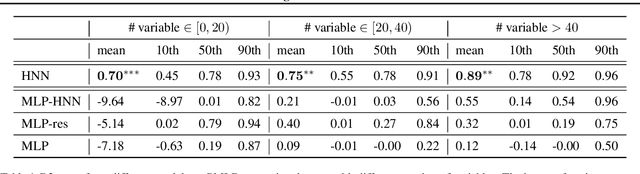

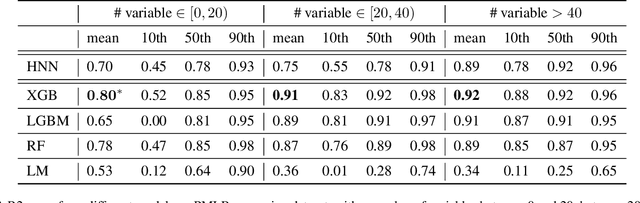

Abstract:Deep learning methods have demonstrated outstanding performances on classification and regression tasks on homogeneous data types (e.g., image, audio, and text data). However, tabular data still poses a challenge with classic machine learning approaches being often computationally cheaper and equally effective than increasingly complex deep learning architectures. The challenge arises from the fact that, in tabular data, the correlation among features is weaker than the one from spatial or semantic relationships in images or natural languages, and the dependency structures need to be modeled without any prior information. In this work, we propose a novel deep learning architecture that exploits the data structural organization through topologically constrained network representations to gain spatial information from sparse tabular data. The resulting model leverages the power of convolutions and is centered on a limited number of concepts from network topology to guarantee (i) a data-centric, deterministic building pipeline; (ii) a high level of interpretability over the inference process; and (iii) an adequate room for scalability. We test our model on 18 benchmark datasets against 5 classic machine learning and 3 deep learning models demonstrating that our approach reaches state-of-the-art performances on these challenging datasets. The code to reproduce all our experiments is provided at https://github.com/FinancialComputingUCL/HomologicalCNN.

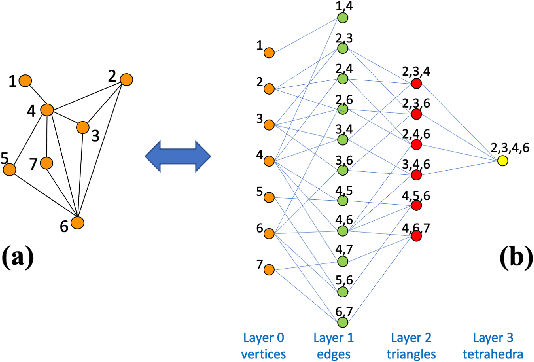

Homological Neural Networks: A Sparse Architecture for Multivariate Complexity

Jun 27, 2023

Abstract:The rapid progress of Artificial Intelligence research came with the development of increasingly complex deep learning models, leading to growing challenges in terms of computational complexity, energy efficiency and interpretability. In this study, we apply advanced network-based information filtering techniques to design a novel deep neural network unit characterized by a sparse higher-order graphical architecture built over the homological structure of underlying data. We demonstrate its effectiveness in two application domains which are traditionally challenging for deep learning: tabular data and time series regression problems. Results demonstrate the advantages of this novel design which can tie or overcome the results of state-of-the-art machine learning and deep learning models using only a fraction of parameters.

Deep Reinforcement Learning for Gas Trading

Jan 19, 2023

Abstract:Deep Reinforcement Learning (Deep RL) has been explored for a number of applications in finance and stock trading. In this paper, we present a practical implementation of Deep RL for trading natural gas futures contracts. The Sharpe Ratio obtained exceeds benchmarks given by trend following and mean reversion strategies as well as results reported in literature. Moreover, we propose a simple but effective ensemble learning scheme for trading, which significantly improves performance through enhanced model stability and robustness as well as lower turnover and hence lower transaction cost. We discuss the resulting Deep RL strategy in terms of model explainability, trading frequency and risk measures.

Deep Reinforcement Learning for Power Trading

Jan 19, 2023Abstract:The Dutch power market includes a day-ahead market and an auction-like intraday balancing market. The varying supply and demand of power and its uncertainty induces an imbalance, which causes differing power prices in these two markets and creates an opportunity for arbitrage. In this paper, we present collaborative dual-agent reinforcement learning (RL) for bi-level simulation and optimization of European power arbitrage trading. Moreover, we propose two novel practical implementations specifically addressing the electricity power market. Leveraging the concept of imitation learning, the RL agent's reward is reformed by taking into account prior domain knowledge results in better convergence during training and, moreover, improves and generalizes performance. In addition, tranching of orders improves the bidding success rate and significantly raises the P&L. We show that each method contributes significantly to the overall performance uplifting, and the integrated methodology achieves about three-fold improvement in cumulative P&L over the original agent, as well as outperforms the highest benchmark policy by around 50% while exhibits efficient computational performance.

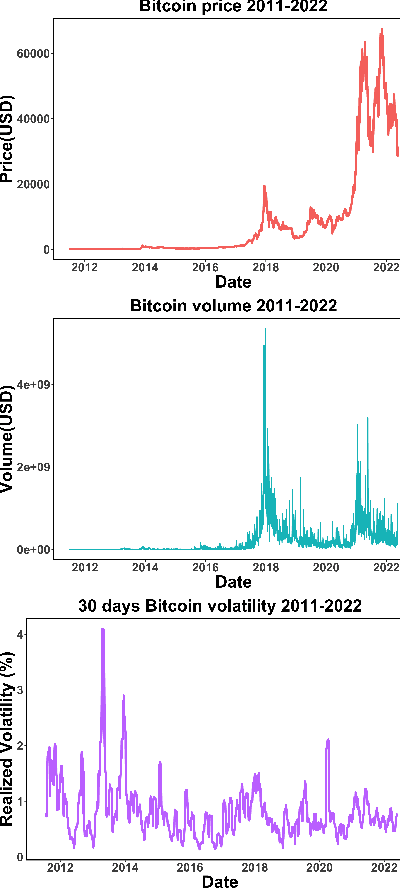

Regime-based Implied Stochastic Volatility Model for Crypto Option Pricing

Aug 15, 2022

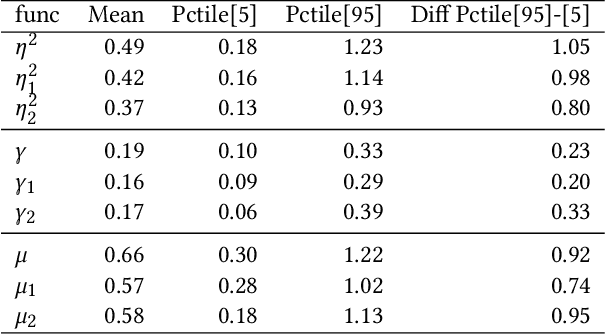

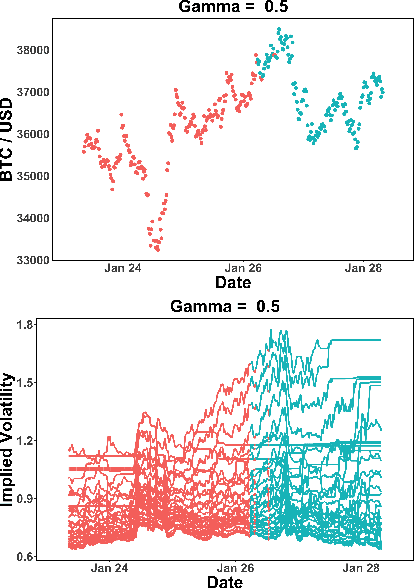

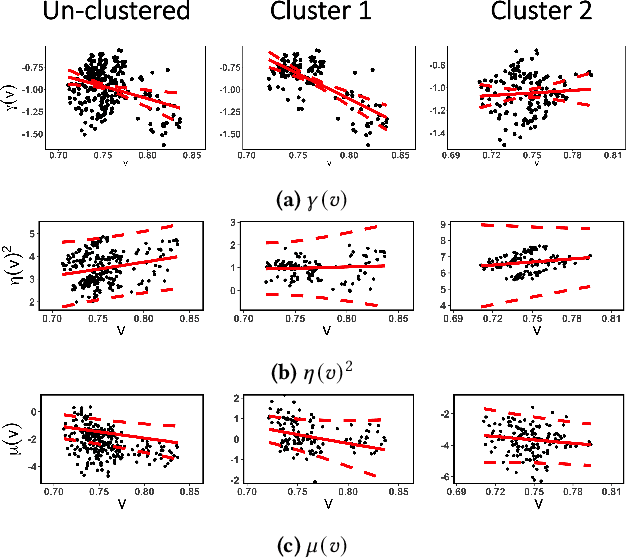

Abstract:The increasing adoption of Digital Assets (DAs), such as Bitcoin (BTC), rises the need for accurate option pricing models. Yet, existing methodologies fail to cope with the volatile nature of the emerging DAs. Many models have been proposed to address the unorthodox market dynamics and frequent disruptions in the microstructure caused by the non-stationarity, and peculiar statistics, in DA markets. However, they are either prone to the curse of dimensionality, as additional complexity is required to employ traditional theories, or they overfit historical patterns that may never repeat. Instead, we leverage recent advances in market regime (MR) clustering with the Implied Stochastic Volatility Model (ISVM). Time-regime clustering is a temporal clustering method, that clusters the historic evolution of a market into different volatility periods accounting for non-stationarity. ISVM can incorporate investor expectations in each of the sentiment-driven periods by using implied volatility (IV) data. In this paper, we applied this integrated time-regime clustering and ISVM method (termed MR-ISVM) to high-frequency data on BTC options at the popular trading platform Deribit. We demonstrate that MR-ISVM contributes to overcome the burden of complex adaption to jumps in higher order characteristics of option pricing models. This allows us to price the market based on the expectations of its participants in an adaptive fashion.

Sparsification and Filtering for Spatial-temporal GNN in Multivariate Time-series

Mar 08, 2022

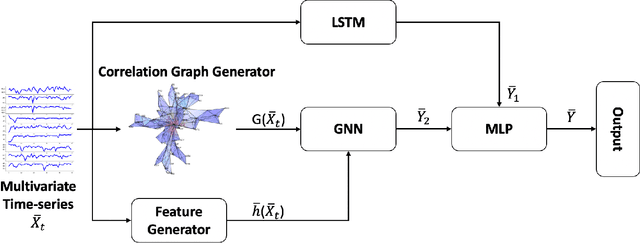

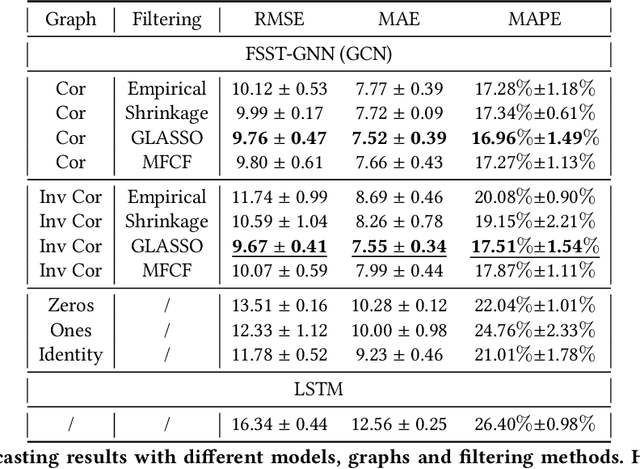

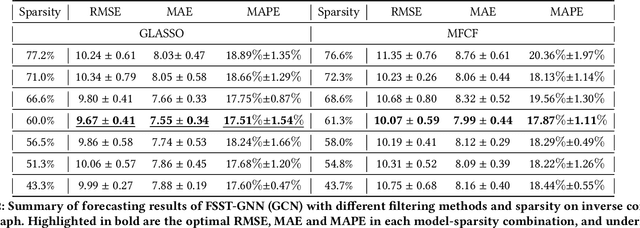

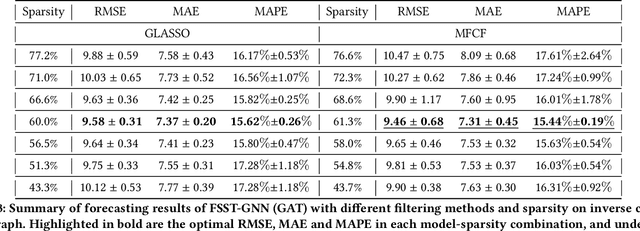

Abstract:We propose an end-to-end architecture for multivariate time-series prediction that integrates a spatial-temporal graph neural network with a matrix filtering module. This module generates filtered (inverse) correlation graphs from multivariate time series before inputting them into a GNN. In contrast with existing sparsification methods adopted in graph neural network, our model explicitly leverage time-series filtering to overcome the low signal-to-noise ratio typical of complex systems data. We present a set of experiments, where we predict future sales from a synthetic time-series sales dataset. The proposed spatial-temporal graph neural network displays superior performances with respect to baseline approaches, with no graphical information, and with fully connected, disconnected graphs and unfiltered graphs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge