Yingsheng Ji

A Mamba Foundation Model for Time Series Forecasting

Nov 05, 2024

Abstract:Time series foundation models have demonstrated strong performance in zero-shot learning, making them well-suited for predicting rapidly evolving patterns in real-world applications where relevant training data are scarce. However, most of these models rely on the Transformer architecture, which incurs quadratic complexity as input length increases. To address this, we introduce TSMamba, a linear-complexity foundation model for time series forecasting built on the Mamba architecture. The model captures temporal dependencies through both forward and backward Mamba encoders, achieving high prediction accuracy. To reduce reliance on large datasets and lower training costs, TSMamba employs a two-stage transfer learning process that leverages pretrained Mamba LLMs, allowing effective time series modeling with a moderate training set. In the first stage, the forward and backward backbones are optimized via patch-wise autoregressive prediction; in the second stage, the model trains a prediction head and refines other components for long-term forecasting. While the backbone assumes channel independence to manage varying channel numbers across datasets, a channel-wise compressed attention module is introduced to capture cross-channel dependencies during fine-tuning on specific multivariate datasets. Experiments show that TSMamba's zero-shot performance is comparable to state-of-the-art time series foundation models, despite using significantly less training data. It also achieves competitive or superior full-shot performance compared to task-specific prediction models. The code will be made publicly available.

Heterogeneous Information Network based Default Analysis on Banking Micro and Small Enterprise Users

May 02, 2022

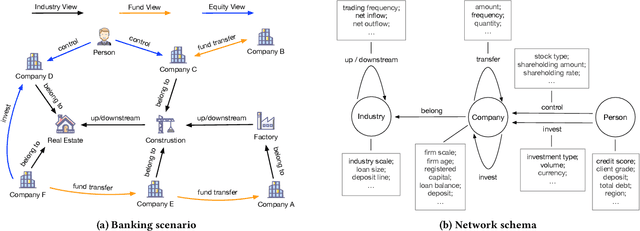

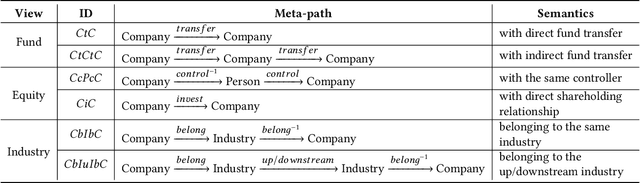

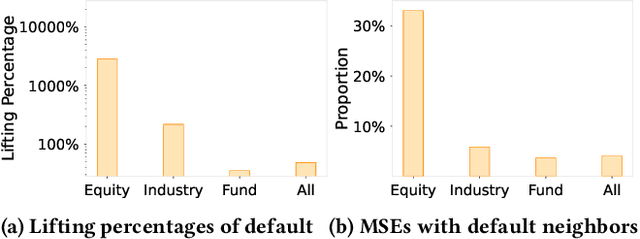

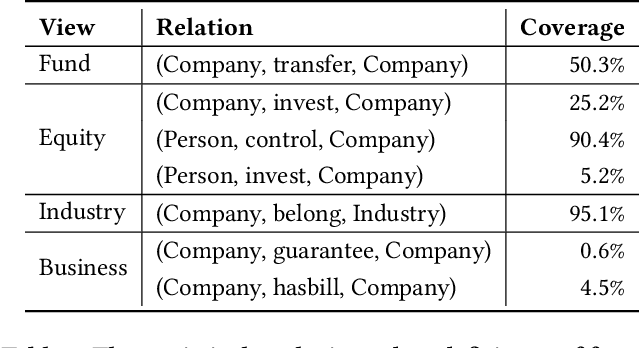

Abstract:Risk assessment is a substantial problem for financial institutions that has been extensively studied both for its methodological richness and its various practical applications. With the expansion of inclusive finance, recent attentions are paid to micro and small-sized enterprises (MSEs). Compared with large companies, MSEs present a higher exposure rate to default owing to their insecure financial stability. Conventional efforts learn classifiers from historical data with elaborate feature engineering. However, the main obstacle for MSEs involves severe deficiency in credit-related information, which may degrade the performance of prediction. Besides, financial activities have diverse explicit and implicit relations, which have not been fully exploited for risk judgement in commercial banks. In particular, the observations on real data show that various relationships between company users have additional power in financial risk analysis. In this paper, we consider a graph of banking data, and propose a novel HIDAM model for the purpose. Specifically, we attempt to incorporate heterogeneous information network with rich attributes on multi-typed nodes and links for modeling the scenario of business banking service. To enhance feature representation of MSEs, we extract interactive information through meta-paths and fully exploit path information. Furthermore, we devise a hierarchical attention mechanism respectively to learn the importance of contents inside each meta-path and the importance of different metapahs. Experimental results verify that HIDAM outperforms state-of-the-art competitors on real-world banking data.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge