Wenhang Bao

Fairness in Multi-agent Reinforcement Learning for Stock Trading

Dec 14, 2019

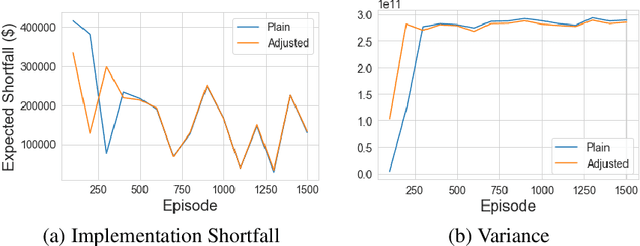

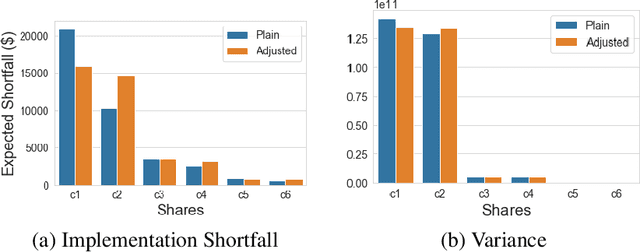

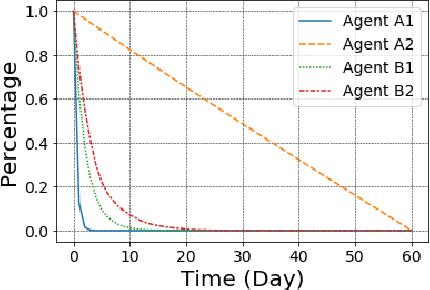

Abstract:Unfair stock trading strategies have been shown to be one of the most negative perceptions that customers can have concerning trading and may result in long-term losses for a company. Investment banks usually place trading orders for multiple clients with the same target assets but different order sizes and diverse requirements such as time frame and risk aversion level, thereby total earning and individual earning cannot be optimized at the same time. Orders executed earlier would affect the market price level, so late execution usually means additional implementation cost. In this paper, we propose a novel scheme that utilizes multi-agent reinforcement learning systems to derive stock trading strategies for all clients which keep a balance between revenue and fairness. First, we demonstrate that Reinforcement learning (RL) is able to learn from experience and adapt the trading strategies to the complex market environment. Secondly, we show that the Multi-agent RL system allows developing trading strategies for all clients individually, thus optimizing individual revenue. Thirdly, we use the Generalized Gini Index (GGI) aggregation function to control the fairness level of the revenue across all clients. Lastly, we empirically demonstrate the superiority of the novel scheme in improving fairness meanwhile maintaining optimization of revenue.

Spatial Influence-aware Reinforcement Learning for Intelligent Transportation System

Dec 14, 2019

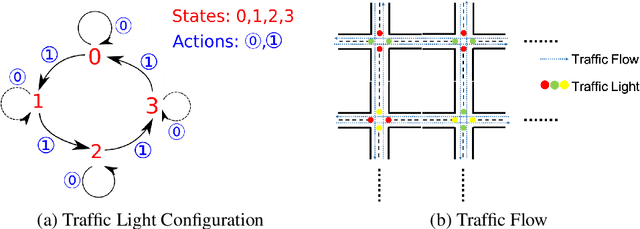

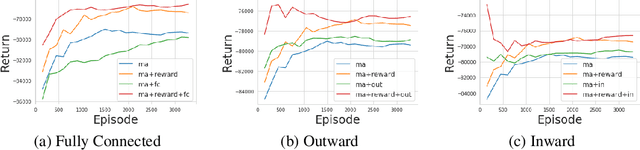

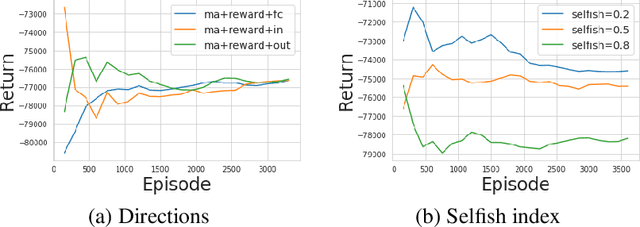

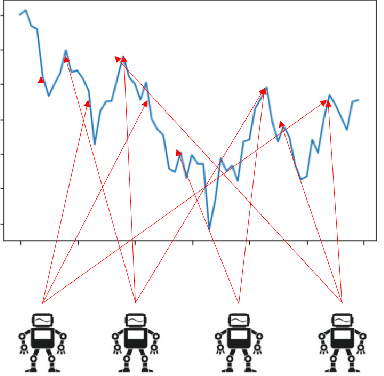

Abstract:Intelligent transportation systems (ITSs) are envisioned to be crucial for smart cities, which aims at improving traffic flow to improve the life quality of urban residents and reducing congestion to improve the efficiency of commuting. However, several challenges need to be resolved before such systems can be deployed, for example, conventional solutions for Markov decision process (MDP) and single-agent Reinforcement Learning (RL) algorithms suffer from poor scalability, and multi-agent systems suffer from poor communication and coordination. In this paper, we explore the potential of mutual information sharing, or in other words, spatial influence based communication, to optimize traffic light control policy. First, we mathematically analyze the transportation system. We conclude that the transportation system does not have stationary Nash Equilibrium, thereby reinforcement learning algorithms offer suitable solutions. Secondly, we describe how to build a multi-agent Deep Deterministic Policy Gradient (DDPG) system with spatial influence and social group utility incorporated. Then we utilize the grid topology road network to empirically demonstrate the scalability of the new system. We demonstrate three types of directed communications to show the effect of directions of social influence on the entire network utility and individual utility. Lastly, we define "selfish index" and analyze the effect of it on total group utility.

Multi-Agent Deep Reinforcement Learning for Liquidation Strategy Analysis

Jun 24, 2019

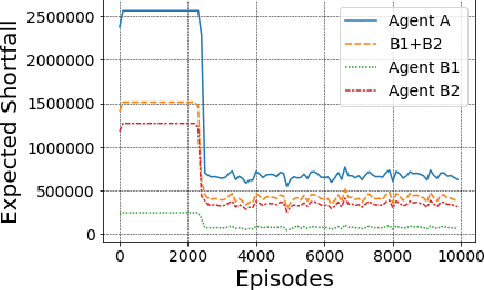

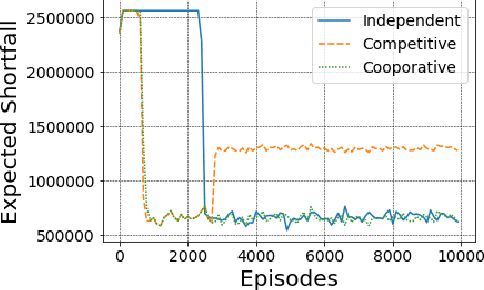

Abstract:Liquidation is the process of selling a large number of shares of one stock sequentially within a given time frame, taking into consideration the costs arising from market impact and a trader's risk aversion. The main challenge in optimizing liquidation is to find an appropriate modeling system that can incorporate the complexities of the stock market and generate practical trading strategies. In this paper, we propose to use multi-agent deep reinforcement learning model, which better captures high-level complexities comparing to various machine learning methods, such that agents can learn how to make the best selling decisions. First, we theoretically analyze the Almgren and Chriss model and extend its fundamental mechanism so it can be used as the multi-agent trading environment. Our work builds the foundation for future multi-agent environment trading analysis. Secondly, we analyze the cooperative and competitive behaviours between agents by adjusting the reward functions for each agent, which overcomes the limitation of single-agent reinforcement learning algorithms. Finally, we simulate trading and develop an optimal trading strategy with practical constraints by using a reinforcement learning method, which shows the capabilities of reinforcement learning methods in solving realistic liquidation problems.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge