Fairness in Multi-agent Reinforcement Learning for Stock Trading

Paper and Code

Dec 14, 2019

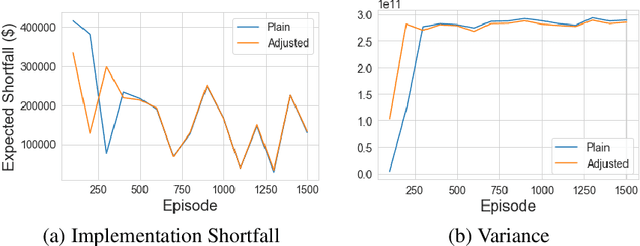

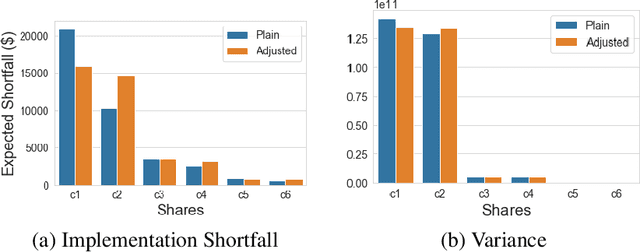

Unfair stock trading strategies have been shown to be one of the most negative perceptions that customers can have concerning trading and may result in long-term losses for a company. Investment banks usually place trading orders for multiple clients with the same target assets but different order sizes and diverse requirements such as time frame and risk aversion level, thereby total earning and individual earning cannot be optimized at the same time. Orders executed earlier would affect the market price level, so late execution usually means additional implementation cost. In this paper, we propose a novel scheme that utilizes multi-agent reinforcement learning systems to derive stock trading strategies for all clients which keep a balance between revenue and fairness. First, we demonstrate that Reinforcement learning (RL) is able to learn from experience and adapt the trading strategies to the complex market environment. Secondly, we show that the Multi-agent RL system allows developing trading strategies for all clients individually, thus optimizing individual revenue. Thirdly, we use the Generalized Gini Index (GGI) aggregation function to control the fairness level of the revenue across all clients. Lastly, we empirically demonstrate the superiority of the novel scheme in improving fairness meanwhile maintaining optimization of revenue.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge