Vipula D. Rawte

FETILDA: An Effective Framework For Fin-tuned Embeddings For Long Financial Text Documents

Jun 14, 2022

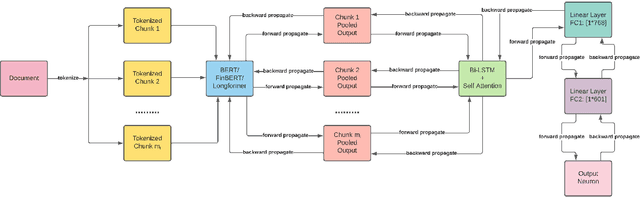

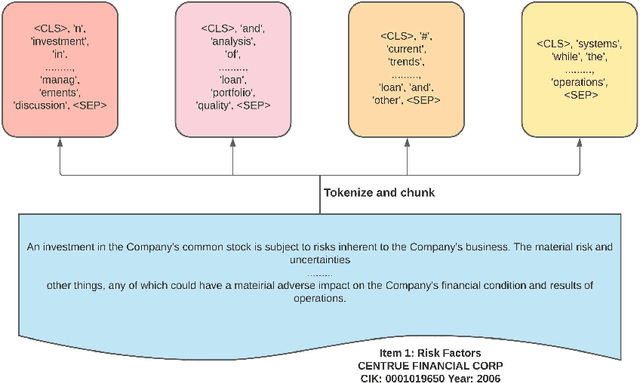

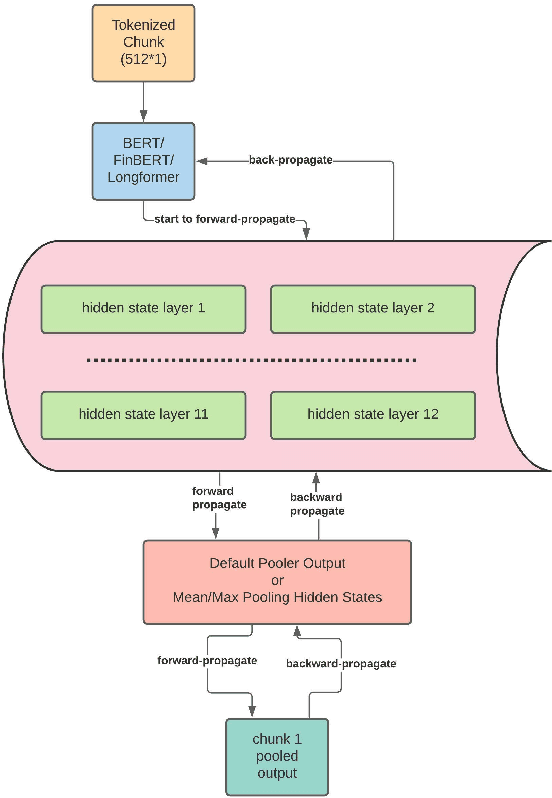

Abstract:Unstructured data, especially text, continues to grow rapidly in various domains. In particular, in the financial sphere, there is a wealth of accumulated unstructured financial data, such as the textual disclosure documents that companies submit on a regular basis to regulatory agencies, such as the Securities and Exchange Commission (SEC). These documents are typically very long and tend to contain valuable soft information about a company's performance. It is therefore of great interest to learn predictive models from these long textual documents, especially for forecasting numerical key performance indicators (KPIs). Whereas there has been a great progress in pre-trained language models (LMs) that learn from tremendously large corpora of textual data, they still struggle in terms of effective representations for long documents. Our work fills this critical need, namely how to develop better models to extract useful information from long textual documents and learn effective features that can leverage the soft financial and risk information for text regression (prediction) tasks. In this paper, we propose and implement a deep learning framework that splits long documents into chunks and utilizes pre-trained LMs to process and aggregate the chunks into vector representations, followed by self-attention to extract valuable document-level features. We evaluate our model on a collection of 10-K public disclosure reports from US banks, and another dataset of reports submitted by US companies. Overall, our framework outperforms strong baseline methods for textual modeling as well as a baseline regression model using only numerical data. Our work provides better insights into how utilizing pre-trained domain-specific and fine-tuned long-input LMs in representing long documents can improve the quality of representation of textual data, and therefore, help in improving predictive analyses.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge