Tetsuya Kaji

Approximate Bayesian Computation via Classification

Nov 22, 2021

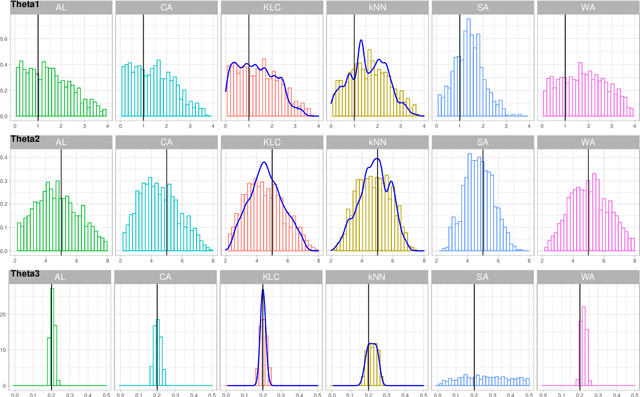

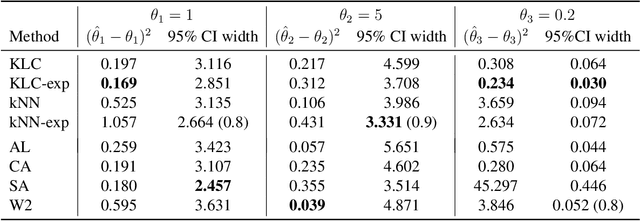

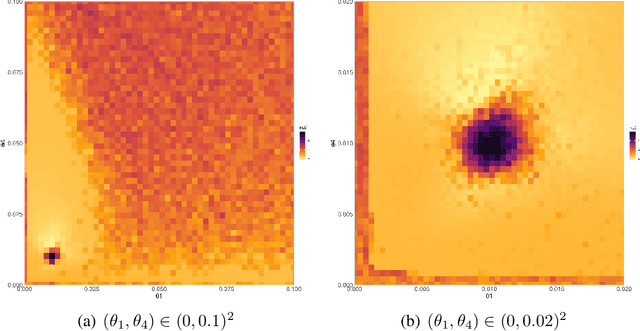

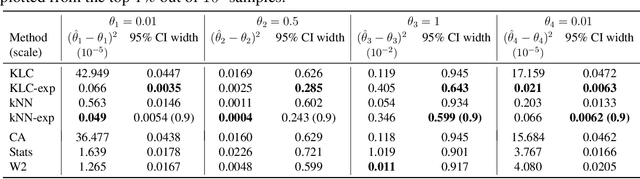

Abstract:Approximate Bayesian Computation (ABC) enables statistical inference in complex models whose likelihoods are difficult to calculate but easy to simulate from. ABC constructs a kernel-type approximation to the posterior distribution through an accept/reject mechanism which compares summary statistics of real and simulated data. To obviate the need for summary statistics, we directly compare empirical distributions with a Kullback-Leibler (KL) divergence estimator obtained via classification. In particular, we blend flexible machine learning classifiers within ABC to automate fake/real data comparisons. We consider the traditional accept/reject kernel as well as an exponential weighting scheme which does not require the ABC acceptance threshold. Our theoretical results show that the rate at which our ABC posterior distributions concentrate around the true parameter depends on the estimation error of the classifier. We derive limiting posterior shape results and find that, with a properly scaled exponential kernel, asymptotic normality holds. We demonstrate the usefulness of our approach on simulated examples as well as real data in the context of stock volatility estimation.

An Adversarial Approach to Structural Estimation

Jul 13, 2020

Abstract:We propose a new simulation-based estimation method, adversarial estimation, for structural models. The estimator is formulated as the solution to a minimax problem between a generator (which generates synthetic observations using the structural model) and a discriminator (which classifies if an observation is synthetic). The discriminator maximizes the accuracy of its classification while the generator minimizes it. We show that, with a sufficiently rich discriminator, the adversarial estimator attains parametric efficiency under correct specification and the parametric rate under misspecification. We advocate the use of a neural network as a discriminator that can exploit adaptivity properties and attain fast rates of convergence. We apply our method to the elderly's saving decision model and show that including gender and health profiles in the discriminator uncovers the bequest motive as an important source of saving across the wealth distribution, not only for the rich.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge