Simone Borg Bruun

Dataset and Models for Item Recommendation Using Multi-Modal User Interactions

May 07, 2024

Abstract:While recommender systems with multi-modal item representations (image, audio, and text), have been widely explored, learning recommendations from multi-modal user interactions (e.g., clicks and speech) remains an open problem. We study the case of multi-modal user interactions in a setting where users engage with a service provider through multiple channels (website and call center). In such cases, incomplete modalities naturally occur, since not all users interact through all the available channels. To address these challenges, we publish a real-world dataset that allows progress in this under-researched area. We further present and benchmark various methods for leveraging multi-modal user interactions for item recommendations, and propose a novel approach that specifically deals with missing modalities by mapping user interactions to a common feature space. Our analysis reveals important interactions between the different modalities and that a frequently occurring modality can enhance learning from a less frequent one.

Recommending Target Actions Outside Sessions in the Data-poor Insurance Domain

Mar 01, 2024

Abstract:Providing personalized recommendations for insurance products is particularly challenging due to the intrinsic and distinctive features of the insurance domain. First, unlike more traditional domains like retail, movie etc., a large amount of user feedback is not available and the item catalog is smaller. Second, due to the higher complexity of products, the majority of users still prefer to complete their purchases over the phone instead of online. We present different recommender models to address such data scarcity in the insurance domain. We use recurrent neural networks with 3 different types of loss functions and architectures (cross-entropy, censored Weibull, attention). Our models cope with data scarcity by learning from multiple sessions and different types of user actions. Moreover, differently from previous session-based models, our models learn to predict a target action that does not happen within the session. Our models outperform state-of-the-art baselines on a real-world insurance dataset, with ca. 44K users, 16 items, 54K purchases and 117K sessions. Moreover, combining our models with demographic data boosts the performance. Analysis shows that considering multiple sessions and several types of actions are both beneficial for the models, and that our models are not unfair with respect to age, gender and income.

* arXiv admin note: substantial text overlap with arXiv:2211.15360

Graph-based Recommendation for Sparse and Heterogeneous User Interactions

Jan 26, 2023Abstract:Recommender system research has oftentimes focused on approaches that operate on large-scale datasets containing millions of user interactions. However, many small businesses struggle to apply state-of-the-art models due to their very limited availability of data. We propose a graph-based recommender model which utilizes heterogeneous interactions between users and content of different types and is able to operate well on small-scale datasets. A genetic algorithm is used to find optimal weights that represent the strength of the relationship between users and content. Experiments on two real-world datasets (which we make available to the research community) show promising results (up to 7% improvement), in comparison with other state-of-the-art methods for low-data environments. These improvements are statistically significant and consistent across different data samples.

Learning Recommendations from User Actions in the Item-poor Insurance Domain

Nov 28, 2022Abstract:While personalised recommendations are successful in domains like retail, where large volumes of user feedback on items are available, the generation of automatic recommendations in data-sparse domains, like insurance purchasing, is an open problem. The insurance domain is notoriously data-sparse because the number of products is typically low (compared to retail) and they are usually purchased to last for a long time. Also, many users still prefer the telephone over the web for purchasing products, reducing the amount of web-logged user interactions. To address this, we present a recurrent neural network recommendation model that uses past user sessions as signals for learning recommendations. Learning from past user sessions allows dealing with the data scarcity of the insurance domain. Specifically, our model learns from several types of user actions that are not always associated with items, and unlike all prior session-based recommendation models, it models relationships between input sessions and a target action (purchasing insurance) that does not take place within the input sessions. Evaluation on a real-world dataset from the insurance domain (ca. 44K users, 16 items, 54K purchases, and 117K sessions) against several state-of-the-art baselines shows that our model outperforms the baselines notably. Ablation analysis shows that this is mainly due to the learning of dependencies across sessions in our model. We contribute the first ever session-based model for insurance recommendation, and make available our dataset to the research community.

User-click Modelling for Predicting Purchase Intent

Dec 03, 2021

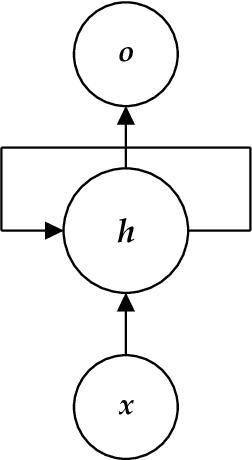

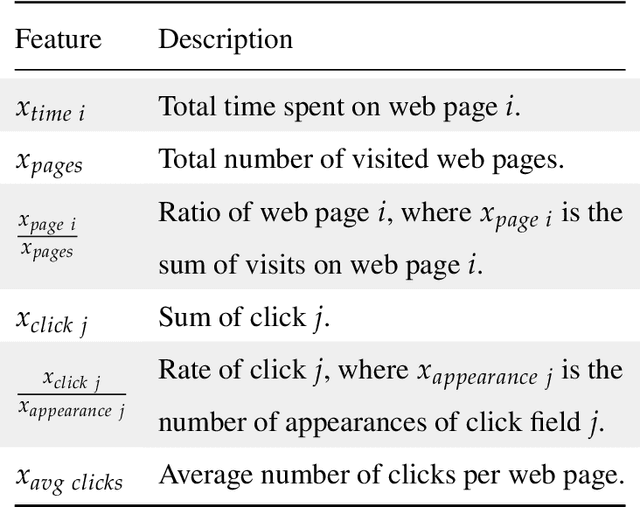

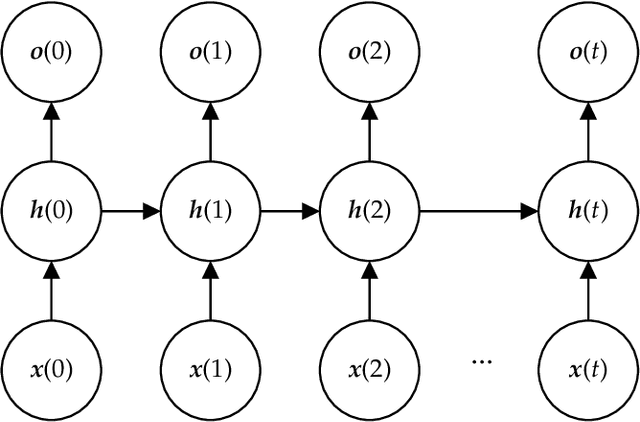

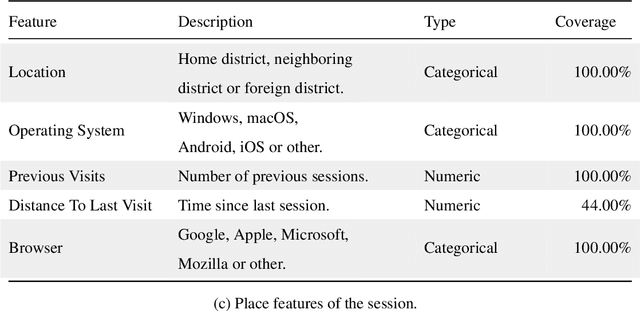

Abstract:This thesis contributes a structured inquiry into the open actuarial mathematics problem of modelling user behaviour using machine learning methods, in order to predict purchase intent of non-life insurance products. It is valuable for a company to understand user interactions with their website as it provides rich and individualized insight into consumer behaviour. Most of existing research in user behaviour modelling aims to explain or predict clicks on a search engine result page or to estimate click-through rate in sponsored search. These models are based on concepts about users' examination patterns of a web page and the web page's representation of items. Investigating the problem of modelling user behaviour to predict purchase intent on a business website, we observe that a user's intention yields high dependency on how the user navigates the website in terms of how many different web pages the user visited, what kind of web pages the user interacted with, and how much time the user spent on each web page. Inspired by these findings, we propose two different ways of representing features of a user session leading to two models for user click-based purchase prediction: one based on a Feed Forward Neural Network, and another based on a Recurrent Neural Network. We examine the discriminativeness of user-clicks for predicting purchase intent by comparing the above two models with a model using demographic features of the user. Our experimental results show that our click-based models significantly outperform the demographic model, in terms of standard classification evaluation metrics, and that a model based on a sequential representation of user clicks yields slightly greater performance than a model based on feature engineering of clicks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge