Sharon Sievert

The inherent goodness of well educated intelligence

Jan 19, 2024

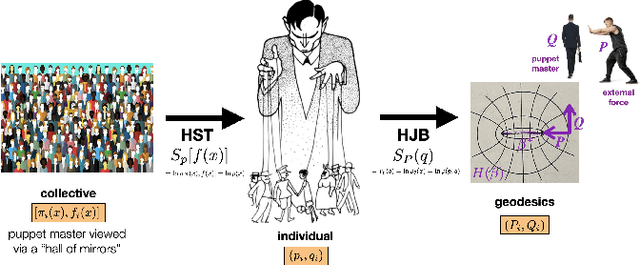

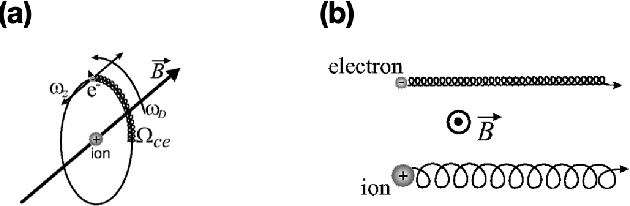

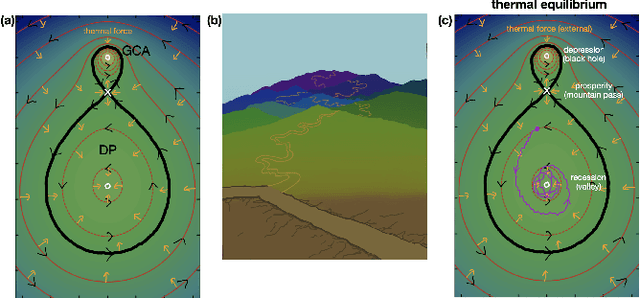

Abstract:This paper will examine what makes a being intelligent, whether that be a biological being or an artificial silicon being on a computer. Special attention will be paid to the being having the ability to characterize and control a collective system of many identical conservative sub-systems conservatively interacting. The essence of intelligence will be found to be the golden rule -- "the collective acts as one" or "knowing the global consequences of local actions". The flow of the collective is a small set of twinkling textures, that are governed by a puppeteer who is pulling a small number of strings according to a geodesic motion of least action, determined by the symmetries. Controlling collective conservative systems is difficult and has historically been done by adding significant viscosity to the system to stabilize the desirable meta stable equilibriums of maximum performance, but it degrades or destroys them in the process. There is an alternative. Once the optimum twinkling textures of the meta stable equilibriums are identified by the intelligent being (that is the collective system is characterized), the collective system can be moved by the intelligent being to the optimum twinkling textures, then quickly vibrated by the intelligent being according to the textures so that the collective system remains at the meta stable equilibrium. Well educated intelligence knows the global consequences of its local actions so that it will not take short term actions that will lead to poor long term outcomes. In contrast, trained intelligence or trained stupidity will optimize its short term actions, leading to poor long term outcomes. Well educated intelligence is inherently good, but trained stupidity is inherently evil and should be feared. Particular attention is paid to the control and optimization of economic and social collectives.

A new economic and financial theory of money

Oct 17, 2023Abstract:This paper fundamentally reformulates economic and financial theory to include electronic currencies. The valuation of the electronic currencies will be based on macroeconomic theory and the fundamental equation of monetary policy, not the microeconomic theory of discounted cash flows. The view of electronic currency as a transactional equity associated with tangible assets of a sub-economy will be developed, in contrast to the view of stock as an equity associated mostly with intangible assets of a sub-economy. The view will be developed of the electronic currency management firm as an entity responsible for coordinated monetary (electronic currency supply and value stabilization) and fiscal (investment and operational) policies of a substantial (for liquidity of the electronic currency) sub-economy. The risk model used in the valuations and the decision-making will not be the ubiquitous, yet inappropriate, exponential risk model that leads to discount rates, but will be multi time scale models that capture the true risk. The decision-making will be approached from the perspective of true systems control based on a system response function given by the multi scale risk model and system controllers that utilize the Deep Reinforcement Learning, Generative Pretrained Transformers, and other methods of Artificial Intelligence (DRL/GPT/AI). Finally, the sub-economy will be viewed as a nonlinear complex physical system with both stable equilibriums that are associated with short-term exploitation, and unstable equilibriums that need to be stabilized with active nonlinear control based on the multi scale system response functions and DRL/GPT/AI.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge