Sergio Caprioli

Denoising ESG: quantifying data uncertainty from missing data with Machine Learning and prediction intervals

Jul 29, 2024

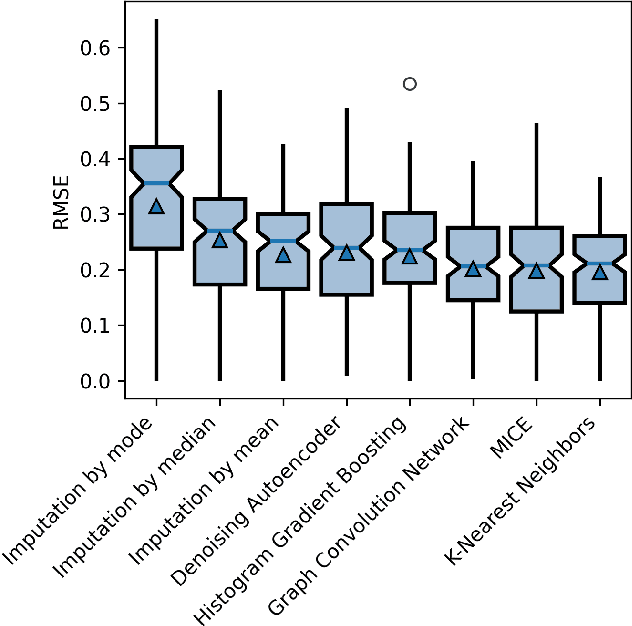

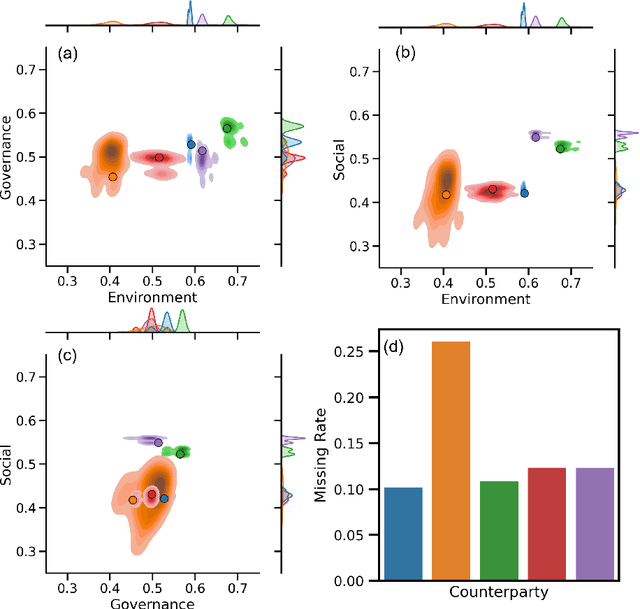

Abstract:Environmental, Social, and Governance (ESG) datasets are frequently plagued by significant data gaps, leading to inconsistencies in ESG ratings due to varying imputation methods. This paper explores the application of established machine learning techniques for imputing missing data in a real-world ESG dataset, emphasizing the quantification of uncertainty through prediction intervals. By employing multiple imputation strategies, this study assesses the robustness of imputation methods and quantifies the uncertainty associated with missing data. The findings highlight the importance of probabilistic machine learning models in providing better understanding of ESG scores, thereby addressing the inherent risks of wrong ratings due to incomplete data. This approach improves imputation practices to enhance the reliability of ESG ratings.

Quantifying Credit Portfolio sensitivity to asset correlations with interpretable generative neural networks

Sep 15, 2023Abstract:In this research, we propose a novel approach for the quantification of credit portfolio Value-at-Risk (VaR) sensitivity to asset correlations with the use of synthetic financial correlation matrices generated with deep learning models. In previous work Generative Adversarial Networks (GANs) were employed to demonstrate the generation of plausible correlation matrices, that capture the essential characteristics observed in empirical correlation matrices estimated on asset returns. Instead of GANs, we employ Variational Autoencoders (VAE) to achieve a more interpretable latent space representation. Through our analysis, we reveal that the VAE latent space can be a useful tool to capture the crucial factors impacting portfolio diversification, particularly in relation to credit portfolio sensitivity to asset correlations changes.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge