Ruoxin Xiao

co-first author

Encoding feature supervised UNet++: Redesigning Supervision for liver and tumor segmentation

Nov 15, 2022Abstract:Liver tumor segmentation in CT images is a critical step in the diagnosis, surgical planning and postoperative evaluation of liver disease. An automatic liver and tumor segmentation method can greatly relieve physicians of the heavy workload of examining CT images and better improve the accuracy of diagnosis. In the last few decades, many modifications based on U-Net model have been proposed in the literature. However, there are relatively few improvements for the advanced UNet++ model. In our paper, we propose an encoding feature supervised UNet++(ES-UNet++) and apply it to the liver and tumor segmentation. ES-UNet++ consists of an encoding UNet++ and a segmentation UNet++. The well-trained encoding UNet++ can extract the encoding features of label map which are used to additionally supervise the segmentation UNet++. By adding supervision to the each encoder of segmentation UNet++, U-Nets of different depths that constitute UNet++ outperform the original version by average 5.7% in dice score and the overall dice score is thus improved by 2.1%. ES-UNet++ is evaluated with dataset LiTS, achieving 95.6% for liver segmentation and 67.4% for tumor segmentation in dice score. In this paper, we also concluded some valuable properties of ES-UNet++ by conducting comparative anaylsis between ES-UNet++ and UNet++:(1) encoding feature supervision can accelerate the convergence of the model.(2) encoding feature supervision enhances the effect of model pruning by achieving huge speedup while providing pruned models with fairly good performance.

Optimal consumption-investment choices under wealth-driven risk aversion

Oct 03, 2022

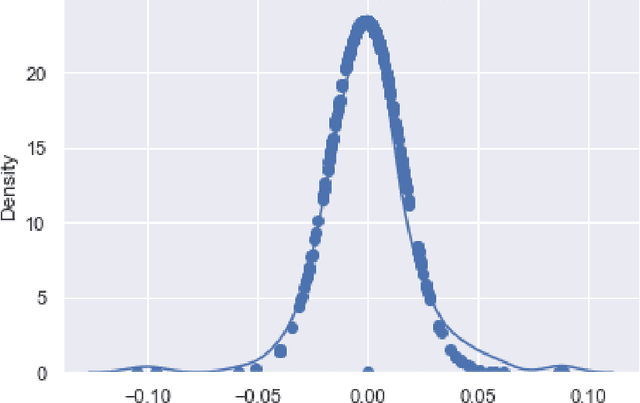

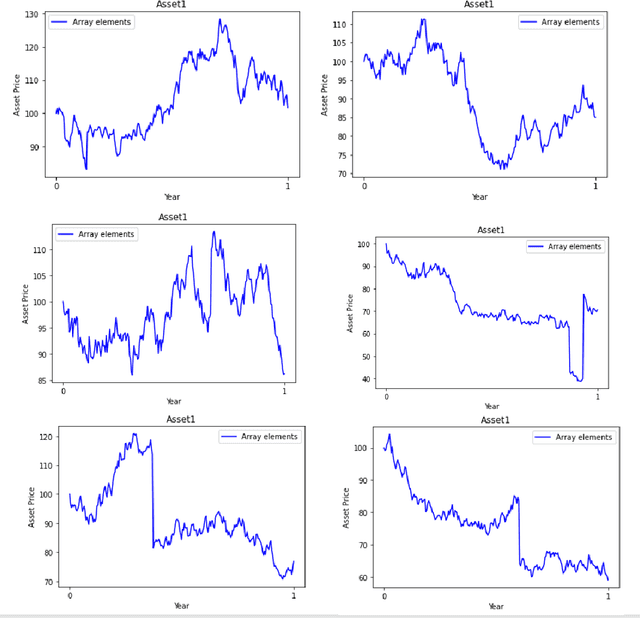

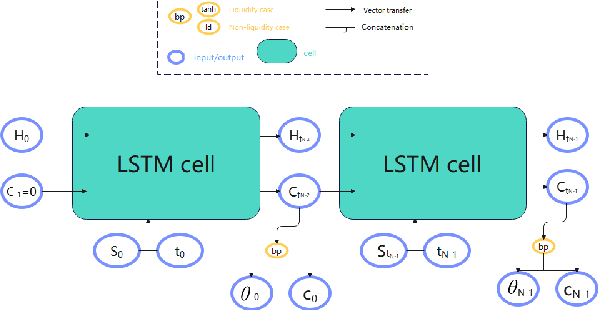

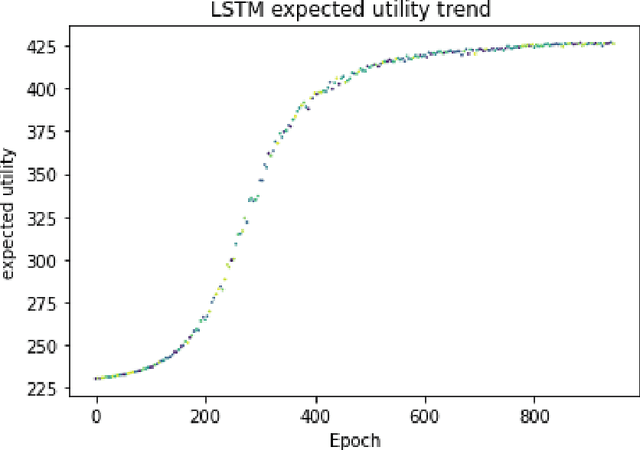

Abstract:CRRA utility where the risk aversion coefficient is a constant is commonly seen in various economics models. But wealth-driven risk aversion rarely shows up in investor's investment problems. This paper mainly focus on numerical solutions to the optimal consumption-investment choices under wealth-driven aversion done by neural network. A jump-diffusion model is used to simulate the artificial data that is needed for the neural network training. The WDRA Model is set up for describing the investment problem and there are two parameters that require to be optimized, which are the investment rate of the wealth on the risky assets and the consumption during the investment time horizon. Under this model, neural network LSTM with one objective function is implemented and shows promising results.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge