Rinald Murataj

Low-volatility Anomaly and the Adaptive Multi-Factor Model

Mar 16, 2020

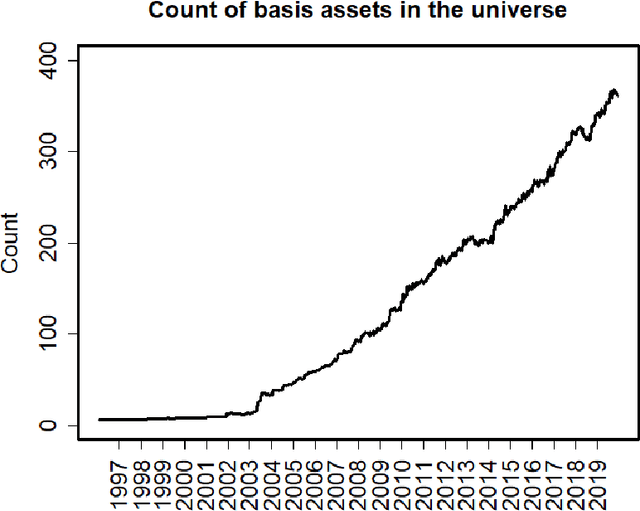

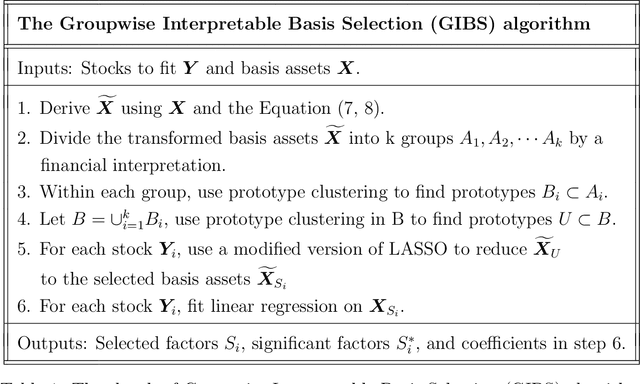

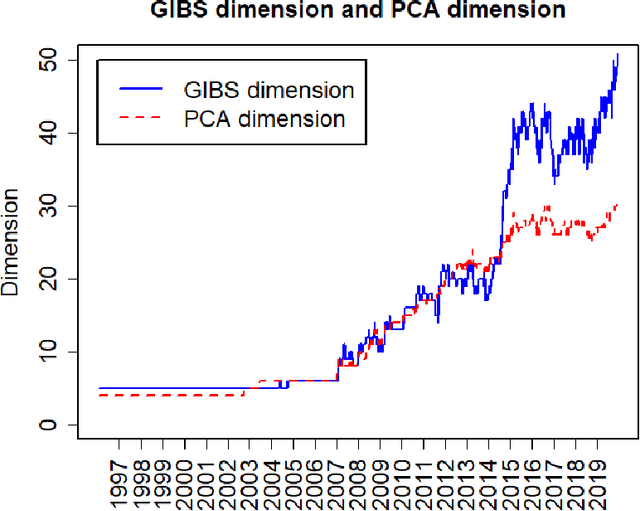

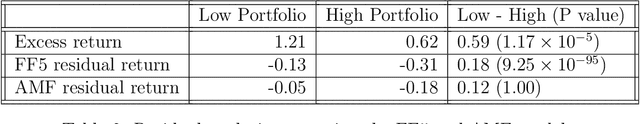

Abstract:The paper explains the low-volatility anomaly from a new perspective. We use the Adaptive Multi-Factor (AMF) model estimated by the Groupwise Interpretable Basis Selection (GIBS) algorithm to find the basis assets significantly related to each of the portfolios. The AMF results show that the two portfolios load on very different factors, which indicates that the volatility is not an independent measure of risk, but are related to the basis assets and risk factors in the related industries. It is the performance of the loaded factors that results in the low-volatility anomaly. The out-performance of the low-volatility portfolio may not because of its low-risk (which contradicts the risk-premium theory), but because of the out-performance of the risk factors the low-volatility portfolio is loaded on. Also, we compare the AMF model with the traditional Fama-French 5-factor (FF5) model in various aspects, which shows the superior performance of the AMF model over FF5 in many perspectives.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge