Peter Gabrovšek

Forex trading and Twitter: Spam, bots, and reputation manipulation

Apr 16, 2018

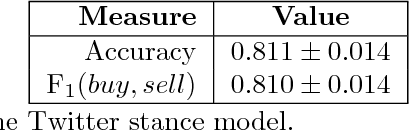

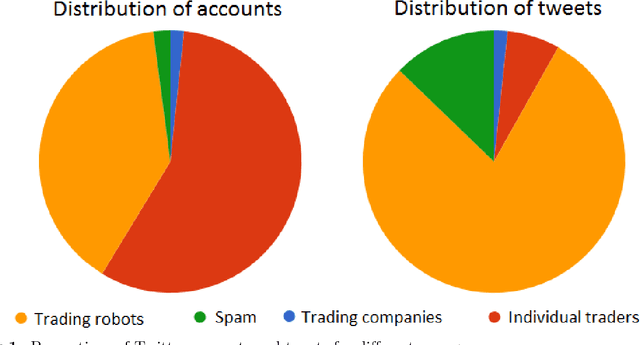

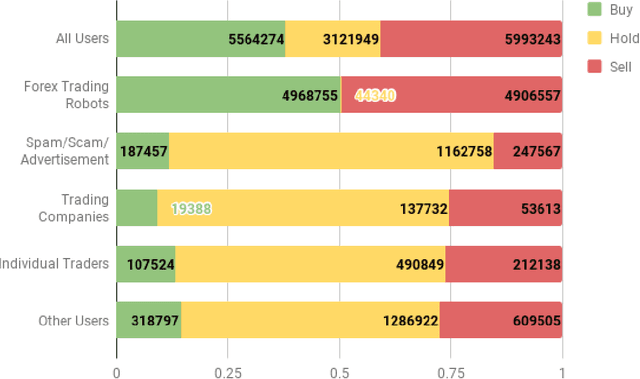

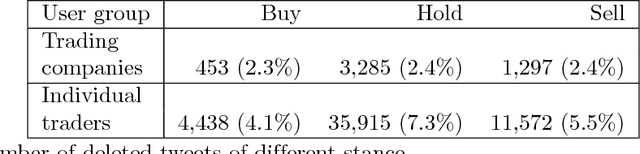

Abstract:Currency trading (Forex) is the largest world market in terms of volume. We analyze trading and tweeting about the EUR-USD currency pair over a period of three years. First, a large number of tweets were manually labeled, and a Twitter stance classification model is constructed. The model then classifies all the tweets by the trading stance signal: buy, hold, or sell (EUR vs. USD). The Twitter stance is compared to the actual currency rates by applying the event study methodology, well-known in financial economics. It turns out that there are large differences in Twitter stance distribution and potential trading returns between the four groups of Twitter users: trading robots, spammers, trading companies, and individual traders. Additionally, we observe attempts of reputation manipulation by post festum removal of tweets with poor predictions, and deleting/reposting of identical tweets to increase the visibility without tainting one's Twitter timeline.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge