Moirangthem Tiken Singh

Operationalizing Fairness: Post-Hoc Threshold Optimization Under Hard Resource Limits

Feb 26, 2026Abstract:The deployment of machine learning in high-stakes domains requires a balance between predictive safety and algorithmic fairness. However, existing fairness interventions often as- sume unconstrained resources and employ group-specific decision thresholds that violate anti- discrimination regulations. We introduce a post-hoc, model-agnostic threshold optimization framework that jointly balances safety, efficiency, and equity under strict and hard capacity constraints. To ensure legal compliance, the framework enforces a single, global decision thresh- old. We formulated a parameterized ethical loss function coupled with a bounded decision rule that mathematically prevents intervention volumes from exceeding the available resources. An- alytically, we prove the key properties of the deployed threshold, including local monotonicity with respect to ethical weighting and the formal identification of critical capacity regimes. We conducted extensive experimental evaluations on diverse high-stakes datasets. The principal re- sults demonstrate that capacity constraints dominate ethical priorities; the strict resource limit determines the final deployed threshold in over 80% of the tested configurations. Furthermore, under a restrictive 25% capacity limit, the proposed framework successfully maintains high risk identification (recall ranging from 0.409 to 0.702), whereas standard unconstrained fairness heuristics collapse to a near-zero utility. We conclude that theoretical fairness objectives must be explicitly subordinated to operational capacity limits to remain in deployment. By decou- pling predictive scoring from policy evaluation and strictly bounding intervention rates, this framework provides a practical and legally compliant mechanism for stakeholders to navigate unavoidable ethical trade-offs in resource-constrained environments.

Reinforcement-Learned Unequal Error Protection for Quantized Semantic Embeddings

Jan 01, 2026Abstract:This paper tackles the pressing challenge of preserving semantic meaning in communication systems constrained by limited bandwidth. We introduce a novel reinforcement learning framework that achieves per-dimension unequal error protection via adaptive repetition coding. Central to our approach is a composite semantic distortion metric that balances global embedding similarity with entity-level preservation, empowering the reinforcement learning agent to allocate protection in a context-aware manner. Experiments show statistically significant gains over uniform protection, achieving 6.8% higher chrF scores and 9.3% better entity preservation at 1 dB SNR. The key innovation of our framework is the demonstration that simple, intelligently allocated repetition coding enables fine-grained semantic protection -- an advantage unattainable with conventional codes such as LDPC or Reed-Solomon. Our findings challenge traditional channel coding paradigms by establishing that code structure must align with semantic granularity. This approach is particularly suited to edge computing and IoT scenarios, where bandwidth is scarce, but semantic fidelity is critical, providing a practical pathway for next-generation semantic-aware networks.

Optimized Hybrid Feature Engineering for Resource-Efficient Arrhythmia Detection in ECG Signals: An Optimization Framework

Jan 01, 2026Abstract:Cardiovascular diseases, particularly arrhythmias, remain a leading global cause of mortality, necessitating continuous monitoring via the Internet of Medical Things (IoMT). However, state-of-the-art deep learning approaches often impose prohibitive computational overheads, rendering them unsuitable for resource-constrained edge devices. This study proposes a resource-efficient, data-centric framework that prioritizes feature engineering over complexity. Our optimized pipeline makes the complex, high-dimensional arrhythmia data linearly separable. This is achieved by integrating time-frequency wavelet decompositions with graph-theoretic structural descriptors, such as PageRank centrality. This hybrid feature space, combining wavelet decompositions and graph-theoretic descriptors, is then refined using mutual information and recursive elimination, enabling interpretable, ultra-lightweight linear classifiers. Validation on the MIT-BIH and INCART datasets yields 98.44% diagnostic accuracy with an 8.54 KB model footprint. The system achieves 0.46 $μ$s classification inference latency within a 52 ms per-beat pipeline, ensuring real-time operation. These outcomes provide an order-of-magnitude efficiency gain over compressed models, such as KD-Light (25 KB, 96.32% accuracy), advancing battery-less cardiac sensors.

Graph-Based Fault Diagnosis for Rotating Machinery: Adaptive Segmentation and Structural Feature Integration

Apr 29, 2025Abstract:This paper proposes a novel graph-based framework for robust and interpretable multiclass fault diagnosis in rotating machinery. The method integrates entropy-optimized signal segmentation, time-frequency feature extraction, and graph-theoretic modeling to transform vibration signals into structured representations suitable for classification. Graph metrics, such as average shortest path length, modularity, and spectral gap, are computed and combined with local features to capture global and segment-level fault characteristics. The proposed method achieves high diagnostic accuracy when evaluated on two benchmark datasets, the CWRU bearing dataset (under 0-3 HP loads) and the SU gearbox and bearing datasets (under different speed-load configurations). Classification scores reach up to 99.8% accuracy on Case Western Reserve University (CWRU) and 100% accuracy on the Southeast University datasets using a logistic regression classifier. Furthermore, the model exhibits strong noise resilience, maintaining over 95.4% accuracy at high noise levels (standard deviation = 0.5), and demonstrates excellent cross-domain transferability with up to 99.7% F1-score in load-transfer scenarios. Compared to traditional techniques, this approach requires no deep learning architecture, enabling lower complexity while ensuring interpretability. The results confirm the method's scalability, reliability, and potential for real-time deployment in industrial diagnostics.

Ensemble-Enhanced Graph Autoencoder with GAT and Transformer-Based Encoders for Robust Fault Diagnosis

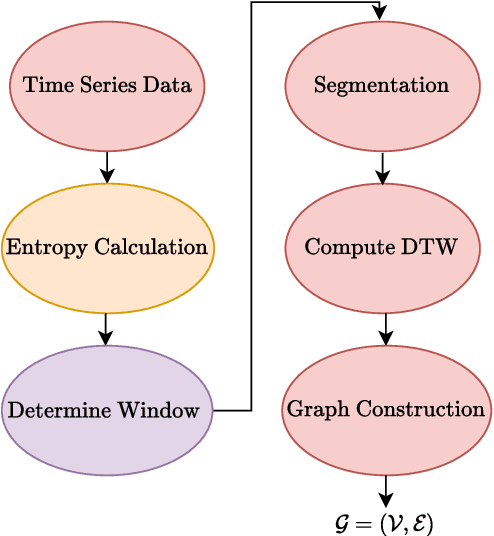

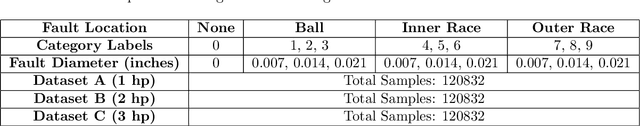

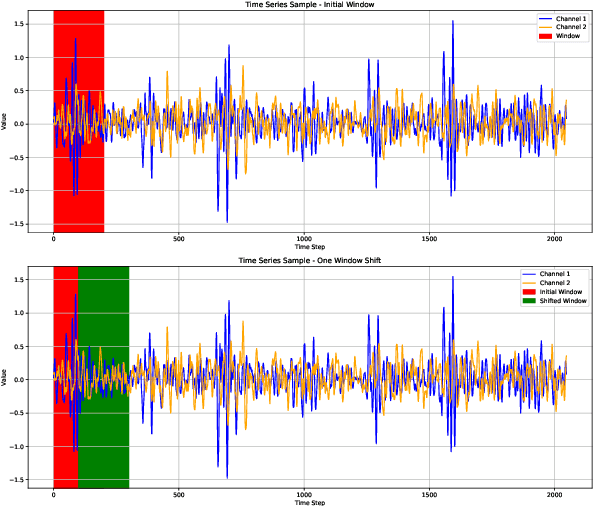

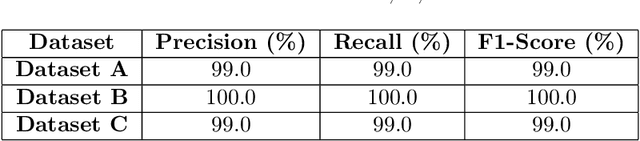

Apr 13, 2025Abstract:Fault classification in industrial machinery is vital for enhancing reliability and reducing downtime, yet it remains challenging due to the variability of vibration patterns across diverse operating conditions. This study introduces a novel graph-based framework for fault classification, converting time-series vibration data from machinery operating at varying horsepower levels into a graph representation. We utilize Shannon's entropy to determine the optimal window size for data segmentation, ensuring each segment captures significant temporal patterns, and employ Dynamic Time Warping (DTW) to define graph edges based on segment similarity. A Graph Auto Encoder (GAE) with a deep graph transformer encoder, decoder, and ensemble classifier is developed to learn latent graph representations and classify faults across various categories. The GAE's performance is evaluated on the Case Western Reserve University (CWRU) dataset, with cross-dataset generalization assessed on the HUST dataset. Results show that GAE achieves a mean F1-score of 0.99 on the CWRU dataset, significantly outperforming baseline models-CNN, LSTM, RNN, GRU, and Bi-LSTM (F1-scores: 0.94-0.97, p < 0.05, Wilcoxon signed-rank test for Bi-LSTM: p < 0.05) -- particularly in challenging classes (e.g., Class 8: 0.99 vs. 0.71 for Bi-LSTM). Visualization of dataset characteristics reveals that datasets with amplified vibration patterns and diverse fault dynamics enhance generalization. This framework provides a robust solution for fault diagnosis under varying conditions, offering insights into dataset impacts on model performance.

Spatial-Temporal Bearing Fault Detection Using Graph Attention Networks and LSTM

Oct 15, 2024

Abstract:Purpose: This paper aims to enhance bearing fault diagnosis in industrial machinery by introducing a novel method that combines Graph Attention Network (GAT) and Long Short-Term Memory (LSTM) networks. This approach captures both spatial and temporal dependencies within sensor data, improving the accuracy of bearing fault detection under various conditions. Methodology: The proposed method converts time series sensor data into graph representations. GAT captures spatial relationships between components, while LSTM models temporal patterns. The model is validated using the Case Western Reserve University (CWRU) Bearing Dataset, which includes data under different horsepower levels and both normal and faulty conditions. Its performance is compared with methods such as K-Nearest Neighbors (KNN), Local Outlier Factor (LOF), Isolation Forest (IForest) and GNN-based method for bearing fault detection (GNNBFD). Findings: The model achieved outstanding results, with precision, recall, and F1-scores reaching 100\% across various testing conditions. It not only identifies faults accurately but also generalizes effectively across different operational scenarios, outperforming traditional methods. Originality: This research presents a unique combination of GAT and LSTM for fault detection, overcoming the limitations of traditional time series methods by capturing complex spatial-temporal dependencies. Its superior performance demonstrates significant potential for predictive maintenance in industrial applications.

Heterogeneous Graph Auto-Encoder for CreditCard Fraud Detection

Oct 10, 2024

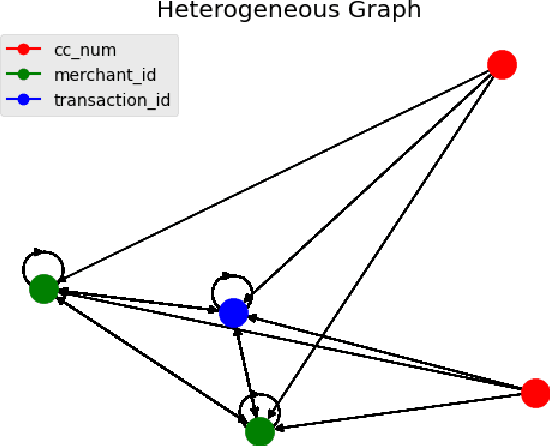

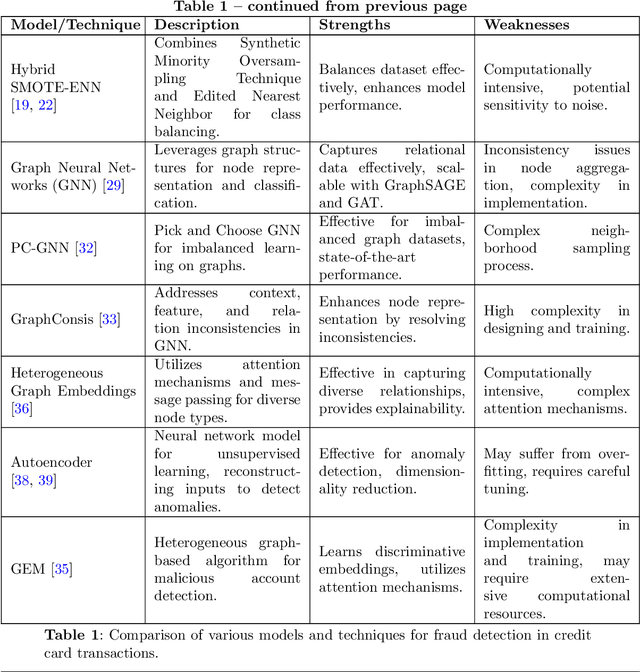

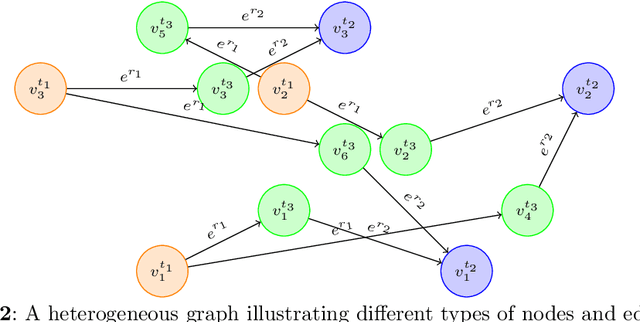

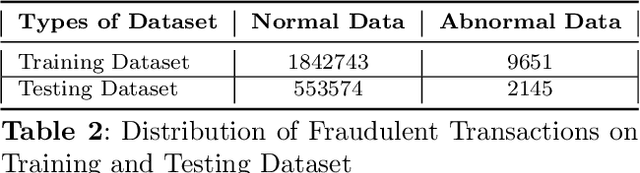

Abstract:The digital revolution has significantly impacted financial transactions, leading to a notable increase in credit card usage. However, this convenience comes with a trade-off: a substantial rise in fraudulent activities. Traditional machine learning methods for fraud detection often struggle to capture the inherent interconnectedness within financial data. This paper proposes a novel approach for credit card fraud detection that leverages Graph Neural Networks (GNNs) with attention mechanisms applied to heterogeneous graph representations of financial data. Unlike homogeneous graphs, heterogeneous graphs capture intricate relationships between various entities in the financial ecosystem, such as cardholders, merchants, and transactions, providing a richer and more comprehensive data representation for fraud analysis. To address the inherent class imbalance in fraud data, where genuine transactions significantly outnumber fraudulent ones, the proposed approach integrates an autoencoder. This autoencoder, trained on genuine transactions, learns a latent representation and flags deviations during reconstruction as potential fraud. This research investigates two key questions: (1) How effectively can a GNN with an attention mechanism detect and prevent credit card fraud when applied to a heterogeneous graph? (2) How does the efficacy of the autoencoder with attention approach compare to traditional methods? The results are promising, demonstrating that the proposed model outperforms benchmark algorithms such as Graph Sage and FI-GRL, achieving a superior AUC-PR of 0.89 and an F1-score of 0.81. This research significantly advances fraud detection systems and the overall security of financial transactions by leveraging GNNs with attention mechanisms and addressing class imbalance through an autoencoder.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge