Meredith Trotter

Collusion Detection in Team-Based Multiplayer Games

Mar 10, 2022

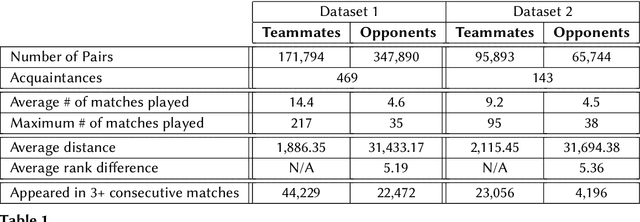

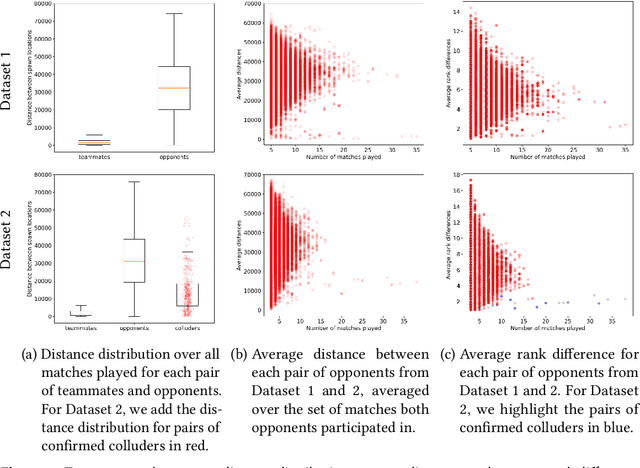

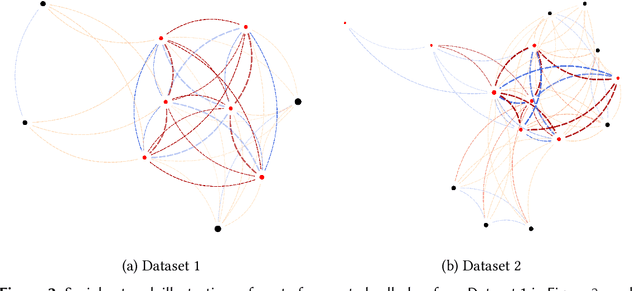

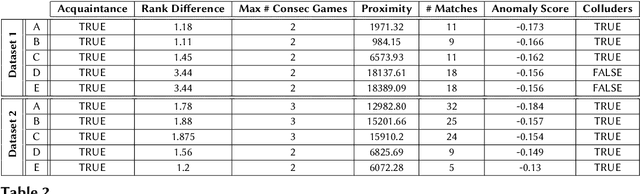

Abstract:In the context of competitive multiplayer games, collusion happens when two or more teams decide to collaborate towards a common goal, with the intention of gaining an unfair advantage from this cooperation. The task of identifying colluders from the player population is however infeasible to game designers due to the sheer size of the player population. In this paper, we propose a system that detects colluding behaviors in team-based multiplayer games and highlights the players that most likely exhibit colluding behaviors. The game designers then proceed to analyze a smaller subset of players and decide what action to take. For this reason, it is important and necessary to be extremely careful with false positives when automating the detection. The proposed method analyzes the players' social relationships paired with their in-game behavioral patterns and, using tools from graph theory, infers a feature set that allows us to detect and measure the degree of collusion exhibited by each pair of players from opposing teams. We then automate the detection using Isolation Forest, an unsupervised learning technique specialized in highlighting outliers, and show the performance and efficiency of our approach on two real datasets, each with over 170,000 unique players and over 100,000 different matches.

Accurate and Interpretable Machine Learning for Transparent Pricing of Health Insurance Plans

Sep 23, 2020

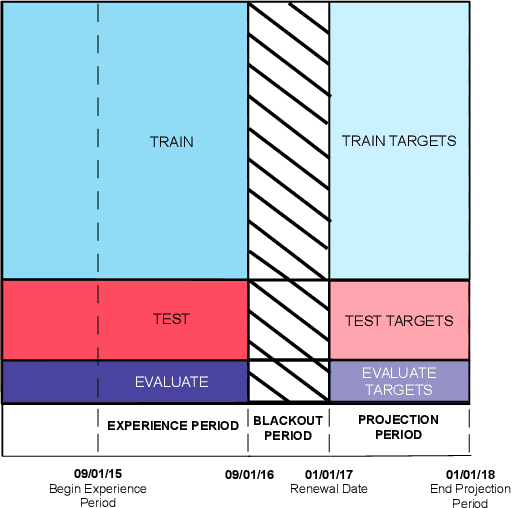

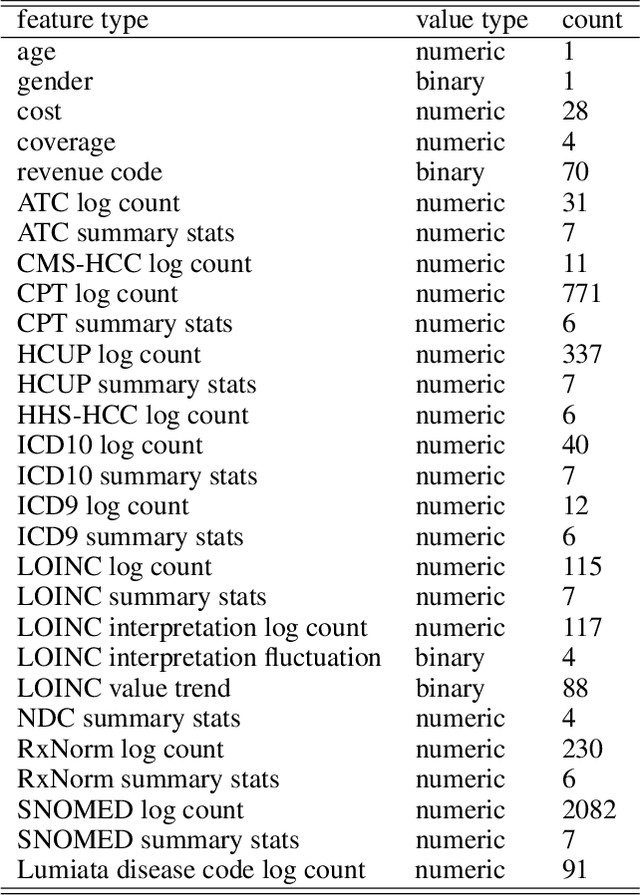

Abstract:Health insurance companies cover half of the United States population through commercial employer-sponsored health plans and pay 1.2 trillion US dollars every year to cover medical expenses for their members. The actuary and underwriter roles at a health insurance company serve to assess which risks to take on and how to price those risks to ensure profitability of the organization. While Bayesian hierarchical models are the current standard in the industry to estimate risk, interest in machine learning as a way to improve upon these existing methods is increasing. Lumiata, a healthcare analytics company, ran a study with a large health insurance company in the United States. We evaluated the ability of machine learning models to predict the per member per month cost of employer groups in their next renewal period, especially those groups who will cost less than 95\% of what an actuarial model predicts (groups with "concession opportunities"). We developed a sequence of two models, an individual patient-level and an employer-group-level model, to predict the annual per member per month allowed amount for employer groups, based on a population of 14 million patients. Our models performed 20\% better than the insurance carrier's existing pricing model, and identified 84\% of the concession opportunities. This study demonstrates the application of a machine learning system to compute an accurate and fair price for health insurance products and analyzes how explainable machine learning models can exceed actuarial models' predictive accuracy while maintaining interpretability.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge