Margret Bjarnadottir

Paging Dr. GPT: Extracting Information from Clinical Notes to Enhance Patient Predictions

Apr 14, 2025Abstract:There is a long history of building predictive models in healthcare using tabular data from electronic medical records. However, these models fail to extract the information found in unstructured clinical notes, which document diagnosis, treatment, progress, medications, and care plans. In this study, we investigate how answers generated by GPT-4o-mini (ChatGPT) to simple clinical questions about patients, when given access to the patient's discharge summary, can support patient-level mortality prediction. Using data from 14,011 first-time admissions to the Coronary Care or Cardiovascular Intensive Care Units in the MIMIC-IV Note dataset, we implement a transparent framework that uses GPT responses as input features in logistic regression models. Our findings demonstrate that GPT-based models alone can outperform models trained on standard tabular data, and that combining both sources of information yields even greater predictive power, increasing AUC by an average of 5.1 percentage points and increasing positive predictive value by 29.9 percent for the highest-risk decile. These results highlight the value of integrating large language models (LLMs) into clinical prediction tasks and underscore the broader potential for using LLMs in any domain where unstructured text data remains an underutilized resource.

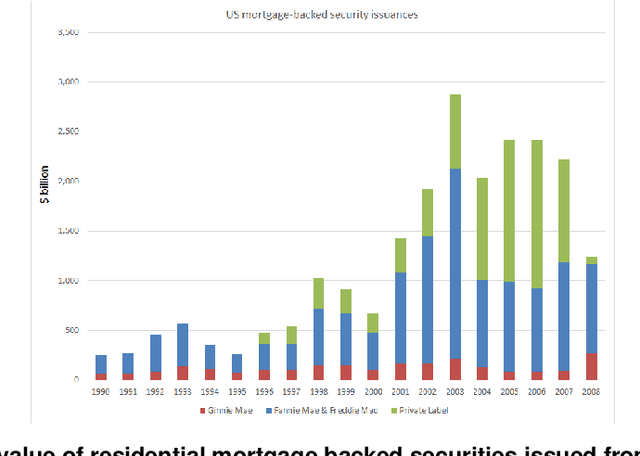

Modeling Complex Financial Products

Feb 03, 2021

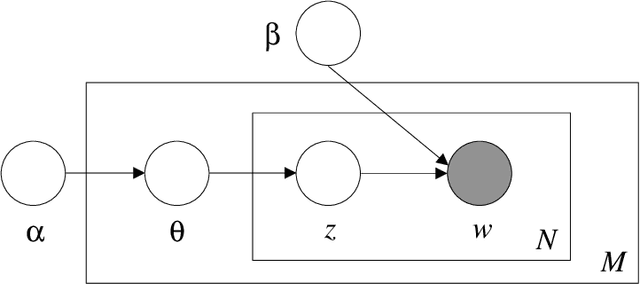

Abstract:The objective of this paper is to explore how financial big data and machine learning methods can be applied to model and understand complex financial products. We focus on residential mortgage backed securities, resMBS, that were at the heart of the 2008 US financial crisis. The securities are contained within a prospectus and have a complex payoff structure. Multiple financial institutions form a supply chain to create the prospectuses. We provide insight into the performance of the resMBS securities through a series of increasingly complex models. First, models at the security level directly identify salient features of resMBS securities that impact their performance. Second, we extend the model to include prospectus level features. We are the first to demonstrate that the composition of the prospectus is associated with the performance of securities. Finally, to develop a deeper understanding of the role of the supply chain, we use unsupervised probabilistic methods, in particular, dynamic topics models (DTM), to understand community formation and temporal evolution along the chain. A comprehensive model provides insight into the impact of DTM communities on the issuance and evolution of prospectuses, and eventually the performance of resMBS securities.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge