Luca Tiozzo Pezzoli

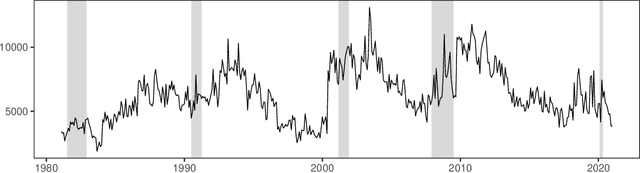

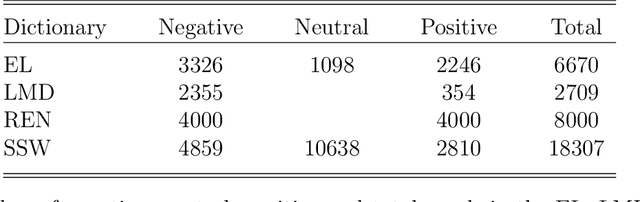

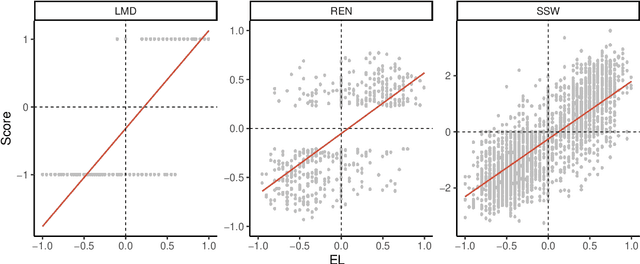

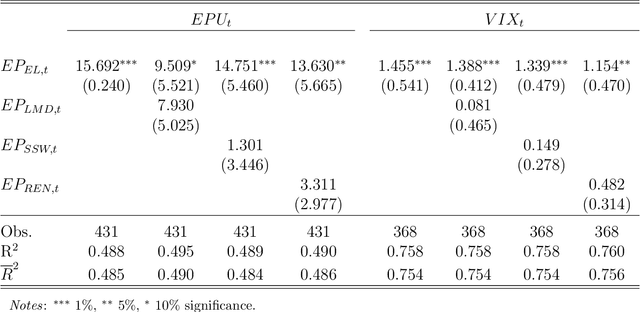

Sentiment Analysis of Economic Text: A Lexicon-Based Approach

Nov 21, 2024

Abstract:We propose an Economic Lexicon (EL) specifically designed for textual applications in economics. We construct the dictionary with two important characteristics: 1) to have a wide coverage of terms used in documents discussing economic concepts, and 2) to provide a human-annotated sentiment score in the range [-1,1]. We illustrate the use of the EL in the context of a simple sentiment measure and consider several applications in economics. The comparison to other lexicons shows that the EL is superior due to its wider coverage of domain relevant terms and its more accurate categorization of the word sentiment.

* 37 pages, 9 figures, 6 tables, in press

Neural Forecasting of the Italian Sovereign Bond Market with Economic News

Mar 11, 2022

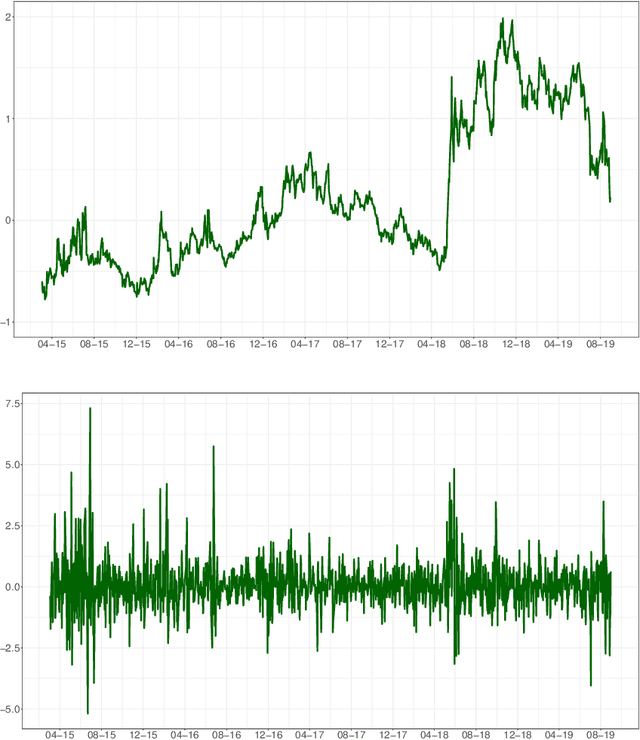

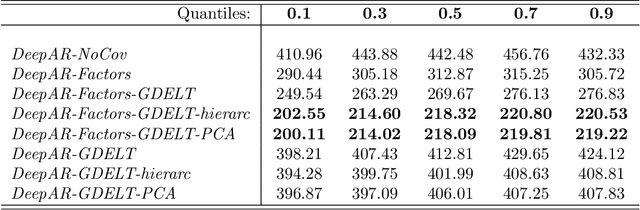

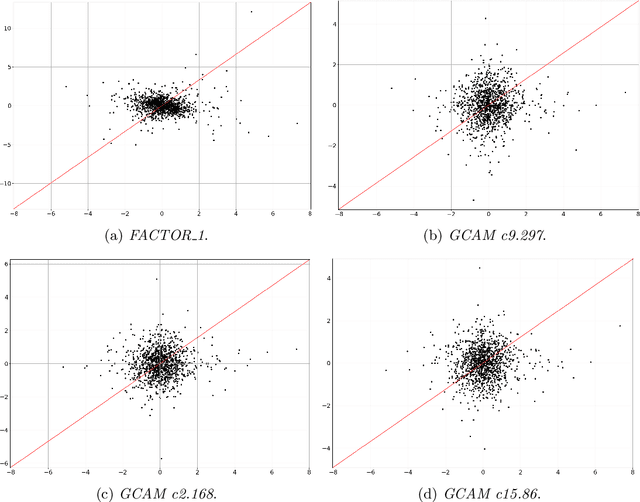

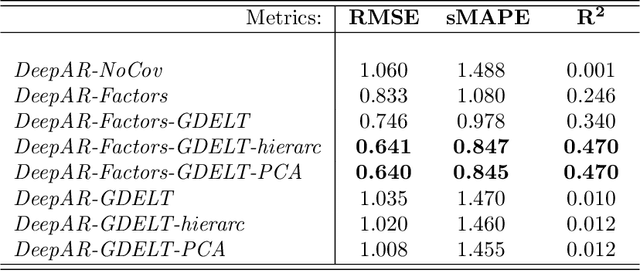

Abstract:In this paper we employ economic news within a neural network framework to forecast the Italian 10-year interest rate spread. We use a big, open-source, database known as Global Database of Events, Language and Tone to extract topical and emotional news content linked to bond markets dynamics. We deploy such information within a probabilistic forecasting framework with autoregressive recurrent networks (DeepAR). Our findings suggest that a deep learning network based on Long-Short Term Memory cells outperforms classical machine learning techniques and provides a forecasting performance that is over and above that obtained by using conventional determinants of interest rates alone.

* 24 pages, 8 figures, in press

Emotions in Macroeconomic News and their Impact on the European Bond Market

Jun 15, 2021

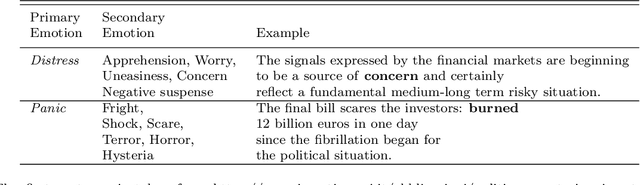

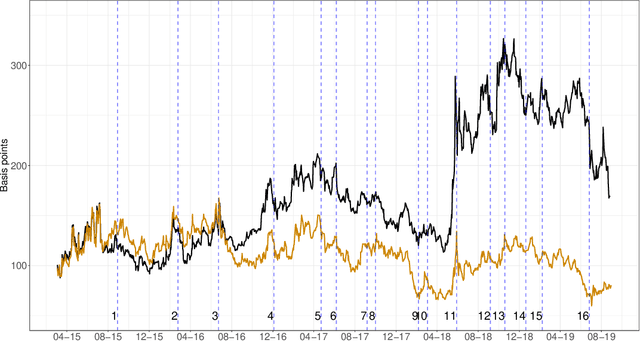

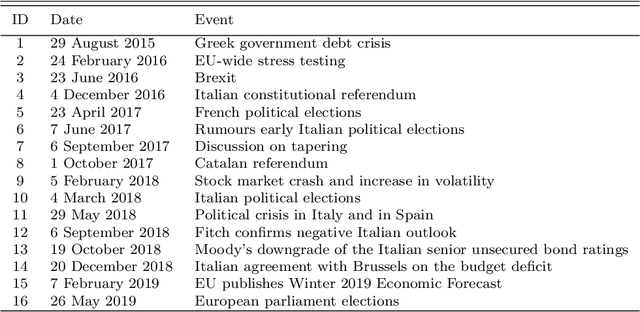

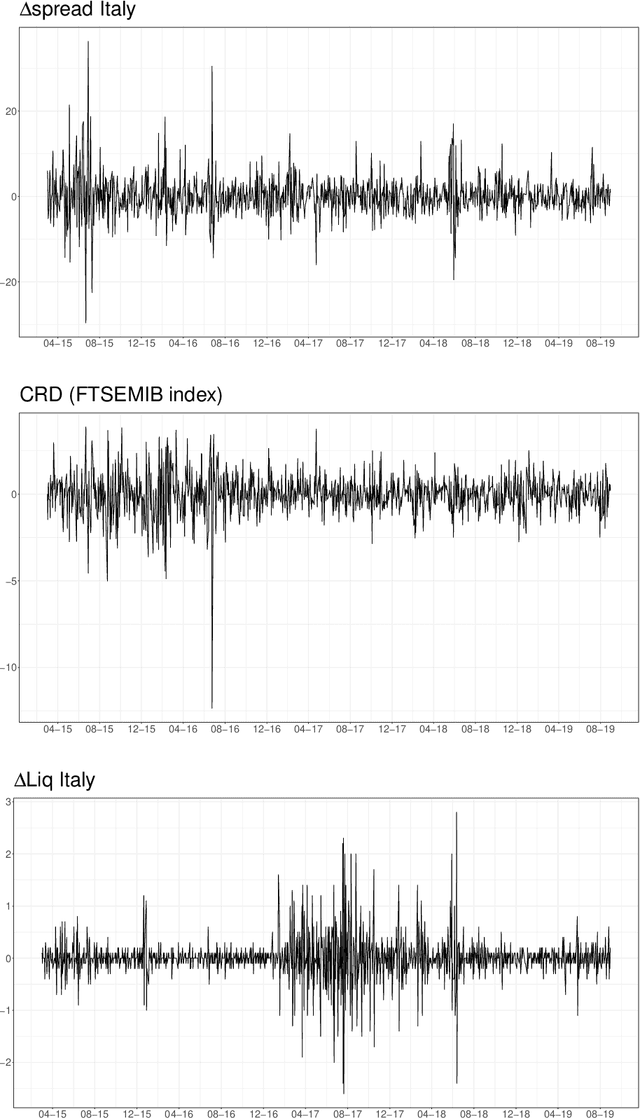

Abstract:We show how emotions extracted from macroeconomic news can be used to explain and forecast future behaviour of sovereign bond yield spreads in Italy and Spain. We use a big, open-source, database known as Global Database of Events, Language and Tone to construct emotion indicators of bond market affective states. We find that negative emotions extracted from news improve the forecasting power of government yield spread models during distressed periods even after controlling for the number of negative words present in the text. In addition, stronger negative emotions, such as panic, reveal useful information for predicting changes in spread at the short-term horizon, while milder emotions, such as distress, are useful at longer time horizons. Emotions generated by the Italian political turmoil propagate to the Spanish news affecting this neighbourhood market.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge