Luca Barbaglia

Sentiment Analysis of Economic Text: A Lexicon-Based Approach

Nov 21, 2024

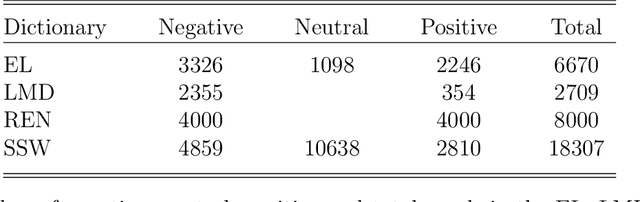

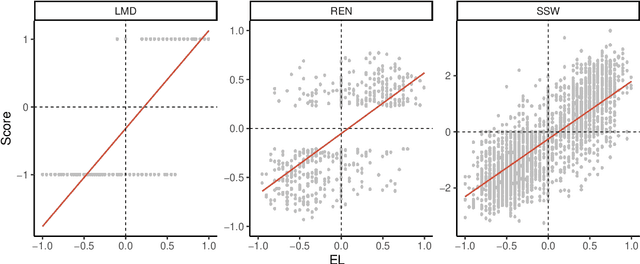

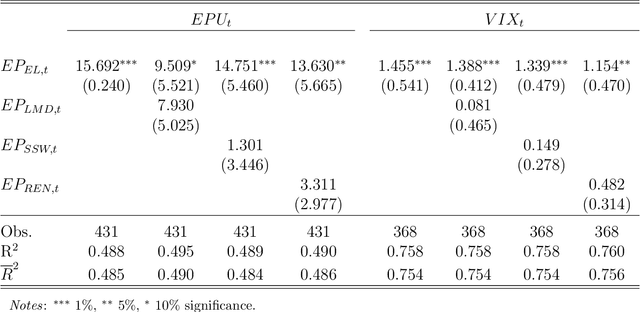

Abstract:We propose an Economic Lexicon (EL) specifically designed for textual applications in economics. We construct the dictionary with two important characteristics: 1) to have a wide coverage of terms used in documents discussing economic concepts, and 2) to provide a human-annotated sentiment score in the range [-1,1]. We illustrate the use of the EL in the context of a simple sentiment measure and consider several applications in economics. The comparison to other lexicons shows that the EL is superior due to its wider coverage of domain relevant terms and its more accurate categorization of the word sentiment.

* 37 pages, 9 figures, 6 tables, in press

Forecasting GDP in Europe with Textual Data

Jan 14, 2024Abstract:We evaluate the informational content of news-based sentiment indicators for forecasting Gross Domestic Product (GDP) and other macroeconomic variables of the five major European economies. Our data set includes over 27 million articles for 26 major newspapers in 5 different languages. The evidence indicates that these sentiment indicators are significant predictors to forecast macroeconomic variables and their predictive content is robust to controlling for other indicators available to forecasters in real-time.

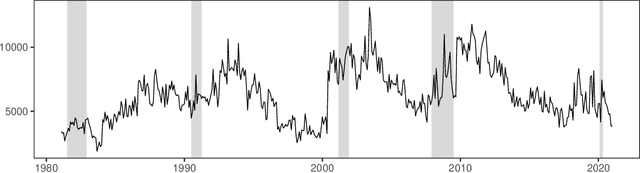

Forecasting with Economic News

Mar 29, 2022Abstract:The goal of this paper is to evaluate the informational content of sentiment extracted from news articles about the state of the economy. We propose a fine-grained aspect-based sentiment analysis that has two main characteristics: 1) we consider only the text in the article that is semantically dependent on a term of interest (aspect-based) and, 2) assign a sentiment score to each word based on a dictionary that we develop for applications in economics and finance (fine-grained). Our data set includes six large US newspapers, for a total of over 6.6 million articles and 4.2 billion words. Our findings suggest that several measures of economic sentiment track closely business cycle fluctuations and that they are relevant predictors for four major macroeconomic variables. We find that there are significant improvements in forecasting when sentiment is considered along with macroeconomic factors. In addition, we also find that sentiment matters to explains the tails of the probability distribution across several macroeconomic variables.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge