Khalid El-Awady

VAE for Modified 1-Hot Generative Materials Modeling, A Step Towards Inverse Material Design

Dec 25, 2023Abstract:We investigate the construction of generative models capable of encoding physical constraints that can be hard to express explicitly. For the problem of inverse material design, where one seeks to design a material with a prescribed set of properties, a significant challenge is ensuring synthetic viability of a proposed new material. We encode an implicit dataset relationships, namely that certain materials can be decomposed into other ones in the dataset, and present a VAE model capable of preserving this property in the latent space and generating new samples with the same. This is particularly useful in sequential inverse material design, an emergent research area that seeks to design a material with specific properties by sequentially adding (or removing) elements using policies trained through deep reinforcement learning.

AdsorbRL: Deep Multi-Objective Reinforcement Learning for Inverse Catalysts Design

Dec 04, 2023

Abstract:A central challenge of the clean energy transition is the development of catalysts for low-emissions technologies. Recent advances in Machine Learning for quantum chemistry drastically accelerate the computation of catalytic activity descriptors such as adsorption energies. Here we introduce AdsorbRL, a Deep Reinforcement Learning agent aiming to identify potential catalysts given a multi-objective binding energy target, trained using offline learning on the Open Catalyst 2020 and Materials Project data sets. We experiment with Deep Q-Network agents to traverse the space of all ~160,000 possible unary, binary and ternary compounds of 55 chemical elements, with very sparse rewards based on adsorption energy known for only between 2,000 and 3,000 catalysts per adsorbate. To constrain the actions space, we introduce Random Edge Traversal and train a single-objective DQN agent on the known states subgraph, which we find strengthens target binding energy by an average of 4.1 eV. We extend this approach to multi-objective, goal-conditioned learning, and train a DQN agent to identify materials with the highest (respectively lowest) adsorption energies for multiple simultaneous target adsorbates. We experiment with Objective Sub-Sampling, a novel training scheme aimed at encouraging exploration in the multi-objective setup, and demonstrate simultaneous adsorption energy improvement across all target adsorbates, by an average of 0.8 eV. Overall, our results suggest strong potential for Deep Reinforcement Learning applied to the inverse catalysts design problem.

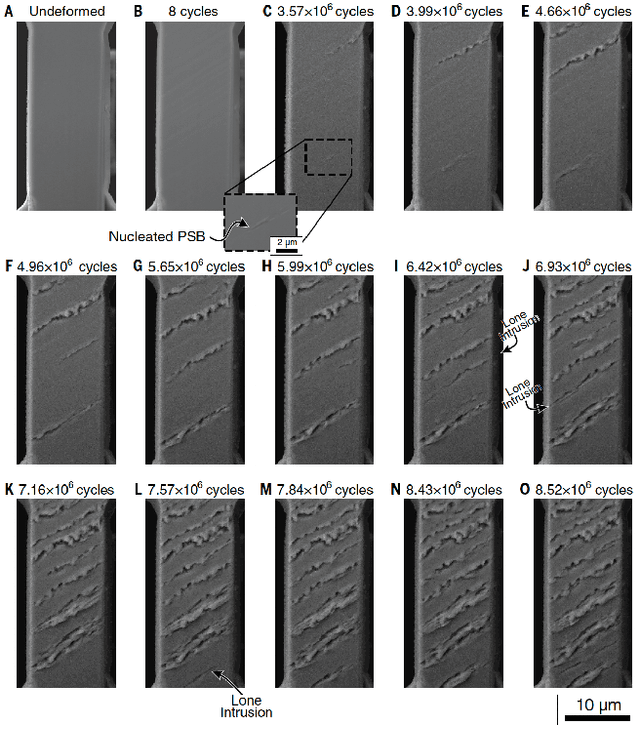

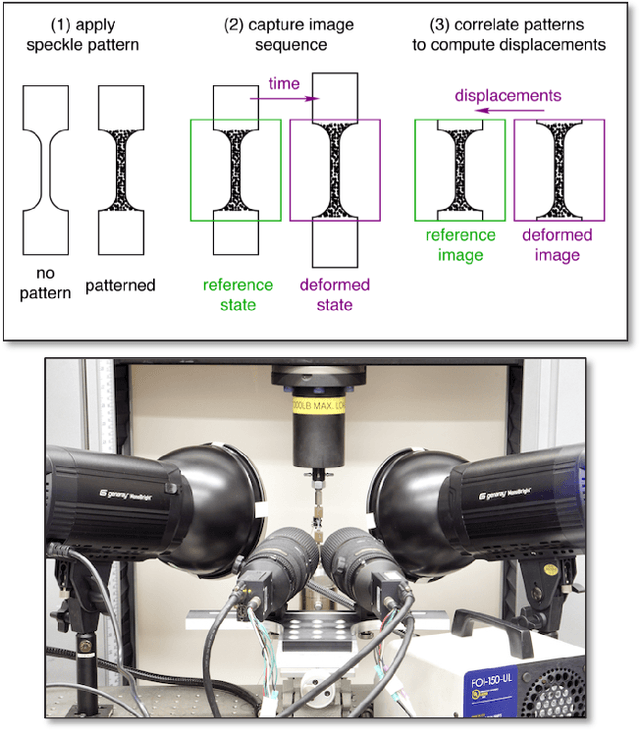

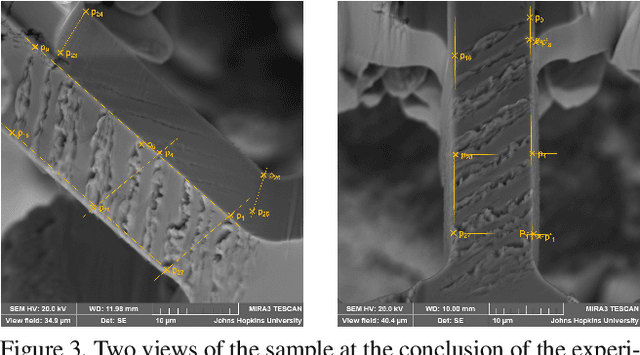

Microstructure Surface Reconstruction from SEM Images: An Alternative to Digital Image Correlation (DIC)

Mar 25, 2022

Abstract:We reconstruct a 3D model of the surface of a material undergoing fatigue testing and experiencing cracking. Specifically we reconstruct the surface depth (out of plane intrusions and extrusions) and lateral (in-plane) motion from multiple views of the sample at the end of the experiment, combined with a reverse optical flow propagation backwards in time that utilizes interim single view images. These measurements can be mapped to a material strain tensor which helps to understand material life and predict failure. This approach offers an alternative to the commonly used Digital Image Correlation (DIC) technique which relies on tracking a speckle pattern applied to the material surface. DIC only produces in-plane (2D) measurements whereas our approach is 3D and non-invasive (requires no pattern being applied to the material).

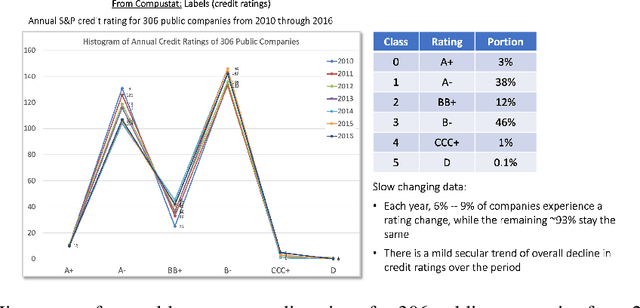

Applicability of Large Corporate Credit Models to Small Business Risk Assessment

Dec 14, 2021

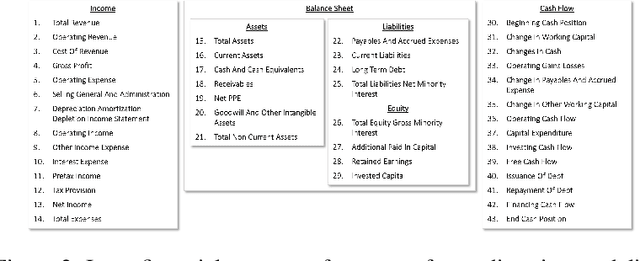

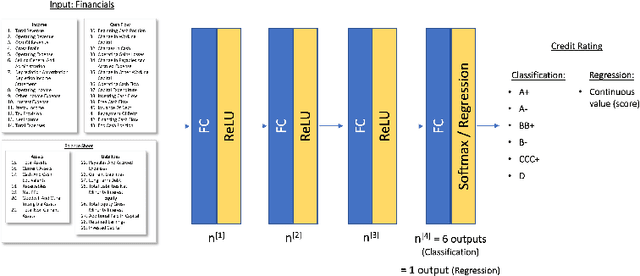

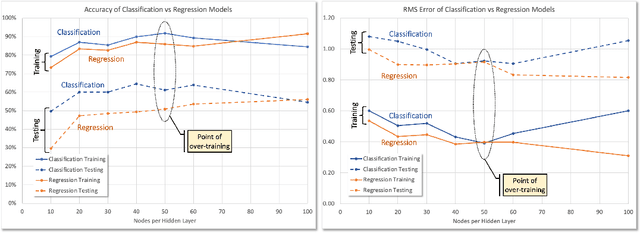

Abstract:There is a massive underserved market for small business lending in the US with the Federal Reserve estimating over \$650B in unmet annual financing needs. Assessing the credit risk of a small business is key to making good decisions whether to lend and at what terms. Large corporations have a well-established credit assessment ecosystem, but small businesses suffer from limited publicly available data and few (if any) credit analysts who cover them closely. We explore the applicability of (DL-based) large corporate credit risk models to small business credit rating.

Adaptive Stress Testing for Adversarial Learning in a Financial Environment

Jul 08, 2021

Abstract:We demonstrate the use of Adaptive Stress Testing to detect and address potential vulnerabilities in a financial environment. We develop a simplified model for credit card fraud detection that utilizes a linear regression classifier based on historical payment transaction data coupled with business rules. We then apply the reinforcement learning model known as Adaptive Stress Testing to train an agent, that can be thought of as a potential fraudster, to find the most likely path to system failure -- successfully defrauding the system. We show the connection between this most likely failure path and the limits of the classifier and discuss how the fraud detection system's business rules can be further augmented to mitigate these failure modes.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge