Applicability of Large Corporate Credit Models to Small Business Risk Assessment

Paper and Code

Dec 14, 2021

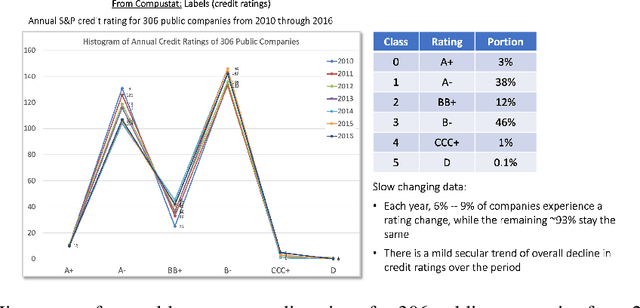

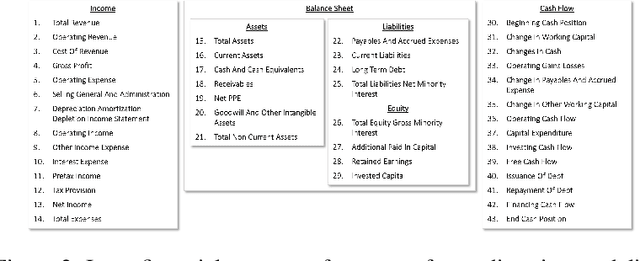

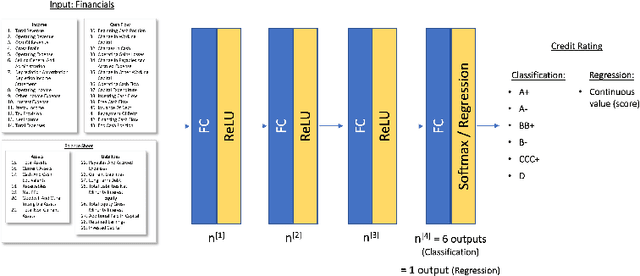

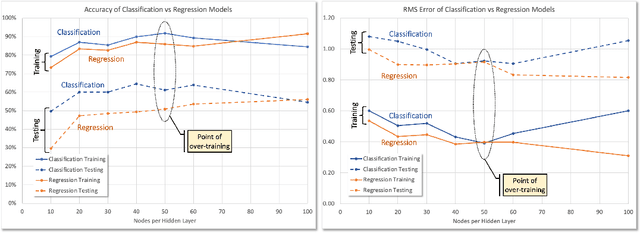

There is a massive underserved market for small business lending in the US with the Federal Reserve estimating over \$650B in unmet annual financing needs. Assessing the credit risk of a small business is key to making good decisions whether to lend and at what terms. Large corporations have a well-established credit assessment ecosystem, but small businesses suffer from limited publicly available data and few (if any) credit analysts who cover them closely. We explore the applicability of (DL-based) large corporate credit risk models to small business credit rating.

* 5 pages

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge