Justina Deveikyte

A Hybrid Model for Forecasting Short-Term Electricity Demand

May 20, 2022

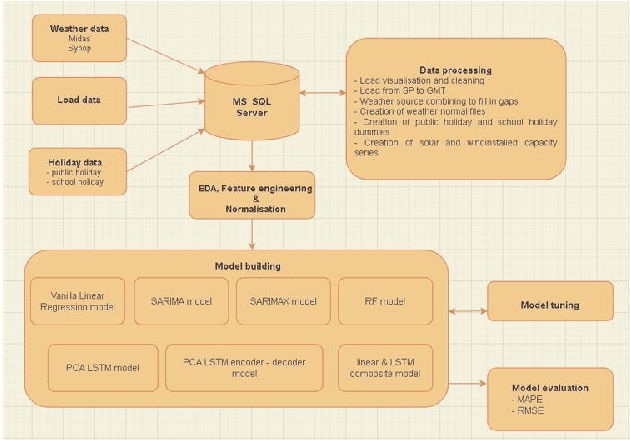

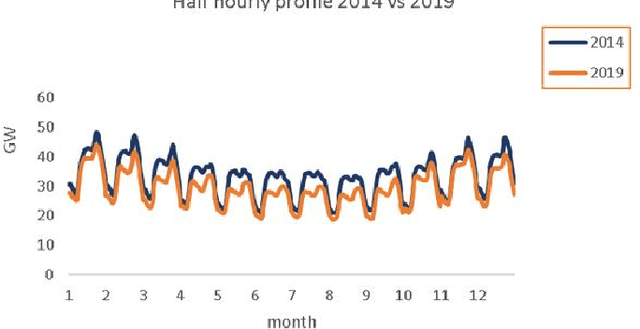

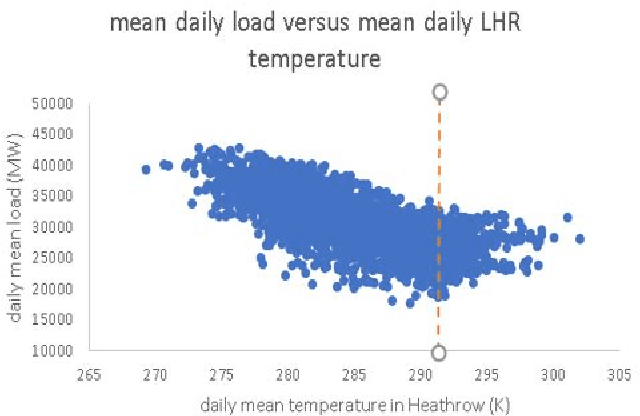

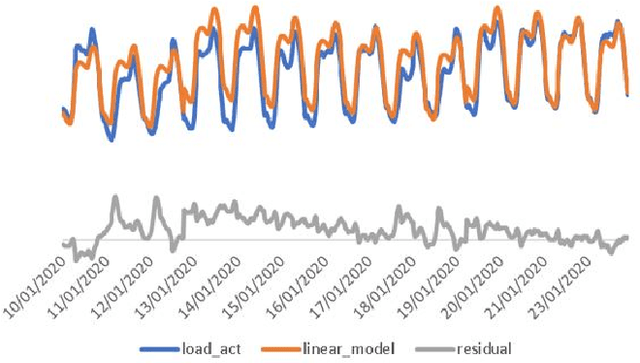

Abstract:Currently the UK Electric market is guided by load (demand) forecasts published every thirty minutes by the regulator. A key factor in predicting demand is weather conditions, with forecasts published every hour. We present HYENA: a hybrid predictive model that combines feature engineering (selection of the candidate predictor features), mobile-window predictors and finally LSTM encoder-decoders to achieve higher accuracy with respect to mainstream models from the literature. HYENA decreased MAPE loss by 16\% and RMSE loss by 10\% over the best available benchmark model, thus establishing a new state of the art for the UK electric load (and price) forecasting.

A Sentiment Analysis Approach to the Prediction of Market Volatility

Dec 10, 2020

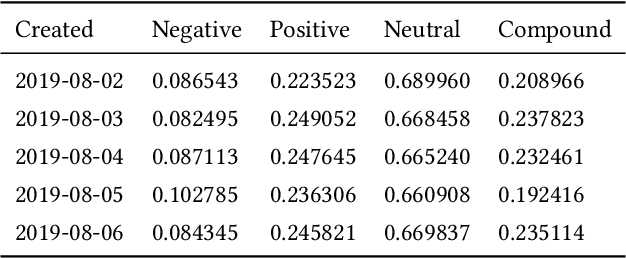

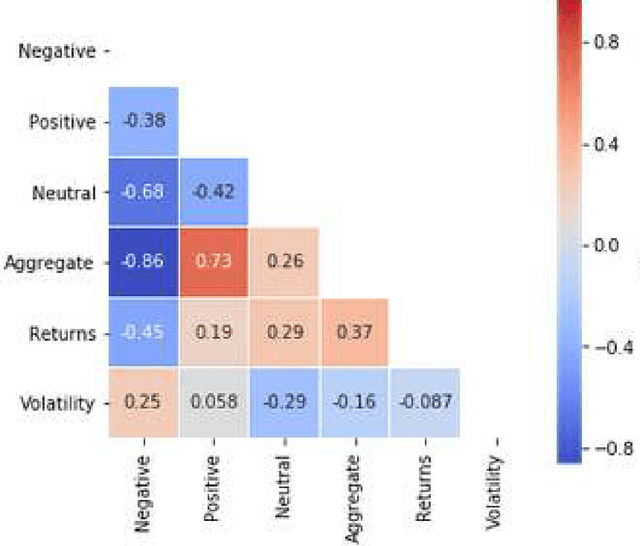

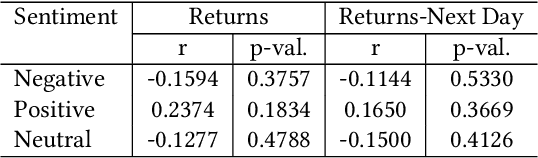

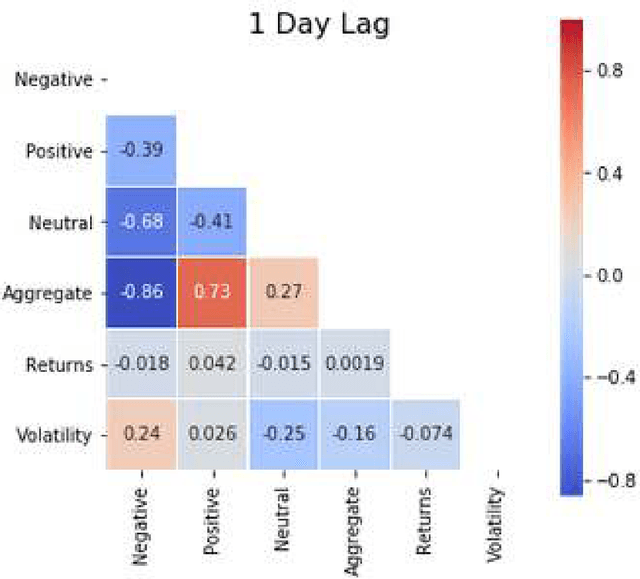

Abstract:Prediction and quantification of future volatility and returns play an important role in financial modelling, both in portfolio optimization and risk management. Natural language processing today allows to process news and social media comments to detect signals of investors' confidence. We have explored the relationship between sentiment extracted from financial news and tweets and FTSE100 movements. We investigated the strength of the correlation between sentiment measures on a given day and market volatility and returns observed the next day. The findings suggest that there is evidence of correlation between sentiment and stock market movements: the sentiment captured from news headlines could be used as a signal to predict market returns; the same does not apply for volatility. Also, in a surprising finding, for the sentiment found in Twitter comments we obtained a correlation coefficient of -0.7, and p-value below 0.05, which indicates a strong negative correlation between positive sentiment captured from the tweets on a given day and the volatility observed the next day. We developed an accurate classifier for the prediction of market volatility in response to the arrival of new information by deploying topic modelling, based on Latent Dirichlet Allocation, to extract feature vectors from a collection of tweets and financial news. The obtained features were used as additional input to the classifier. Thanks to the combination of sentiment and topic modelling our classifier achieved a directional prediction accuracy for volatility of 63%.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge