Jonghun Kwak

ETF Portfolio Construction via Neural Network trained on Financial Statement Data

Jul 04, 2022

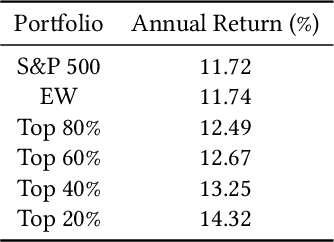

Abstract:Recently, the application of advanced machine learning methods for asset management has become one of the most intriguing topics. Unfortunately, the application of these methods, such as deep neural networks, is difficult due to the data shortage problem. To address this issue, we propose a novel approach using neural networks to construct a portfolio of exchange traded funds (ETFs) based on the financial statement data of their components. Although a number of ETFs and ETF-managed portfolios have emerged in the past few decades, the ability to apply neural networks to manage ETF portfolios is limited since the number and historical existence of ETFs are relatively smaller and shorter, respectively, than those of individual stocks. Therefore, we use the data of individual stocks to train our neural networks to predict the future performance of individual stocks and use these predictions and the portfolio deposit file (PDF) to construct a portfolio of ETFs. Multiple experiments have been performed, and we have found that our proposed method outperforms the baselines. We believe that our approach can be more beneficial when managing recently listed ETFs, such as thematic ETFs, of which there is relatively limited historical data for training advanced machine learning methods.

Shai-am: A Machine Learning Platform for Investment Strategies

Jul 01, 2022

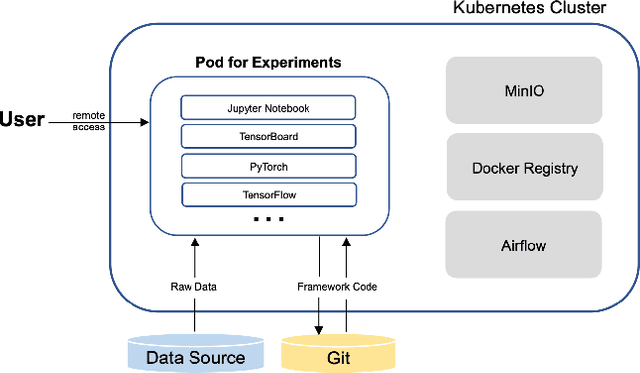

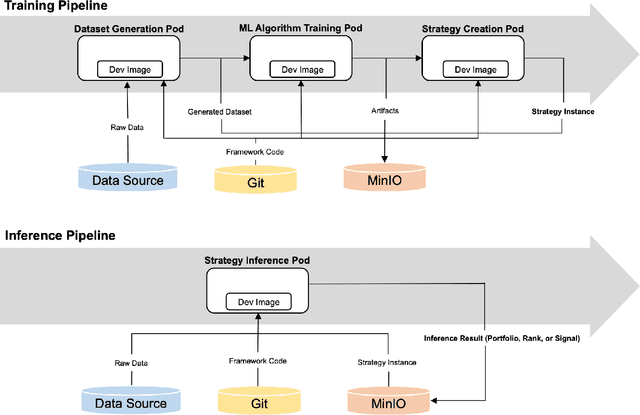

Abstract:The finance industry has adopted machine learning (ML) as a form of quantitative research to support better investment decisions, yet there are several challenges often overlooked in practice. (1) ML code tends to be unstructured and ad hoc, which hinders cooperation with others. (2) Resource requirements and dependencies vary depending on which algorithm is used, so a flexible and scalable system is needed. (3) It is difficult for domain experts in traditional finance to apply their experience and knowledge in ML-based strategies unless they acquire expertise in recent technologies. This paper presents Shai-am, an ML platform integrated with our own Python framework. The platform leverages existing modern open-source technologies, managing containerized pipelines for ML-based strategies with unified interfaces to solve the aforementioned issues. Each strategy implements the interface defined in the core framework. The framework is designed to enhance reusability and readability, facilitating collaborative work in quantitative research. Shai-am aims to be a pure AI asset manager for solving various tasks in financial markets.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge