Joaquin Salas

Learning Inter-Annual Flood Loss Risk Models From Historical Flood Insurance Claims and Extreme Rainfall Data

Dec 15, 2022

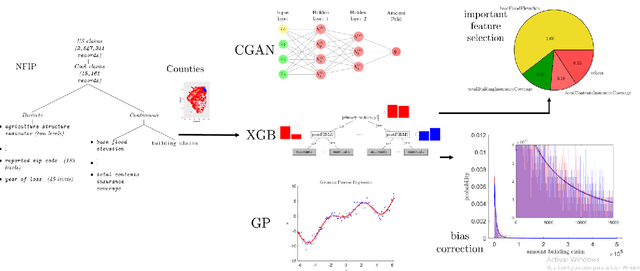

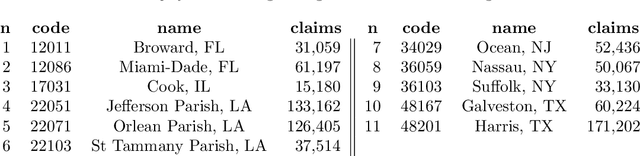

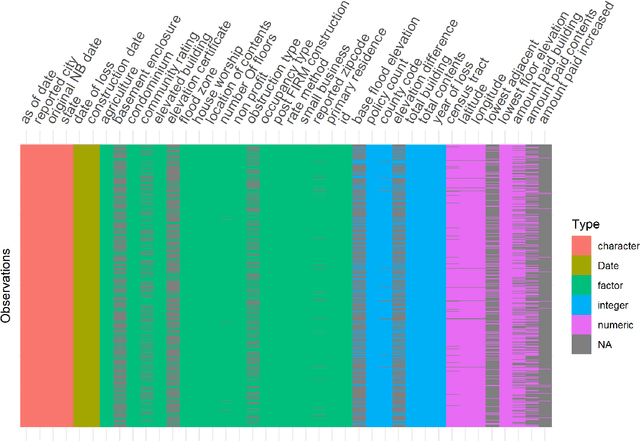

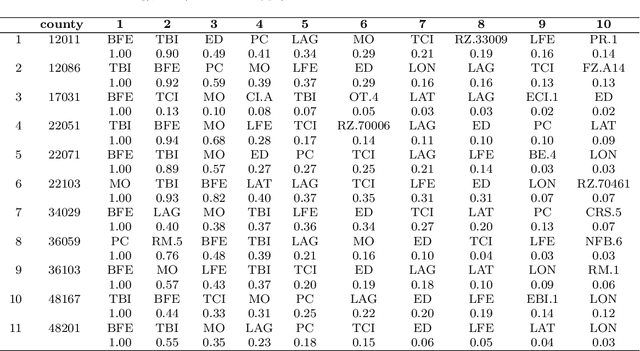

Abstract:Flooding is one of the most disastrous natural hazards, responsible for substantial economic losses. A predictive model for flood-induced financial damages is useful for many applications such as climate change adaptation planning and insurance underwriting. This research assesses the predictive capability of regressors constructed on the National Flood Insurance Program (NFIP) dataset using neural networks (Conditional Generative Adversarial Networks), decision trees (Extreme Gradient Boosting), and kernel-based regressors (Gaussian Process). The assessment highlights the most informative predictors for regression. The distribution for claims amount inference is modeled with a Burr distribution permitting the introduction of a bias correction scheme and increasing the regressor's predictive capability. Aiming to study the interaction with physical variables, we incorporate Daymet rainfall estimation to NFIP as an additional predictor. A study on the coastal counties in the eight US South-West states resulted in an $R^2=0.807$. Further analysis of 11 counties with a significant number of claims in the NFIP dataset reveals that Extreme Gradient Boosting provides the best results, that bias correction significantly improves the similarity with the reference distribution, and that the rainfall predictor strengthens the regressor performance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge