Jimei Shen

AlphaMLDigger: A Novel Machine Learning Solution to Explore Excess Return on Investment

Jun 22, 2022

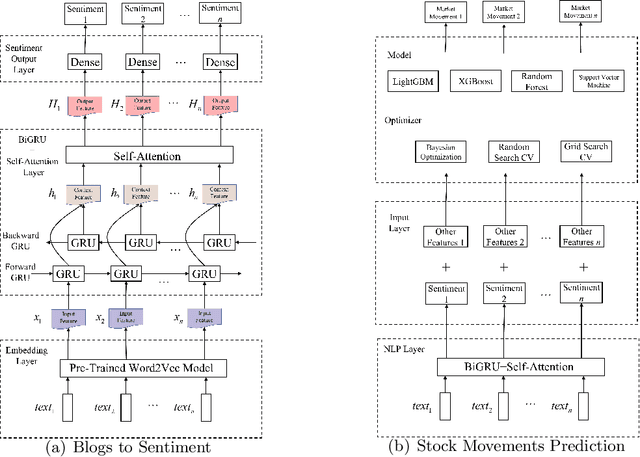

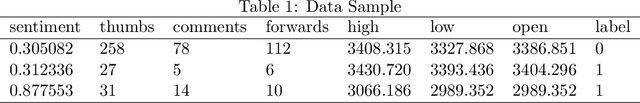

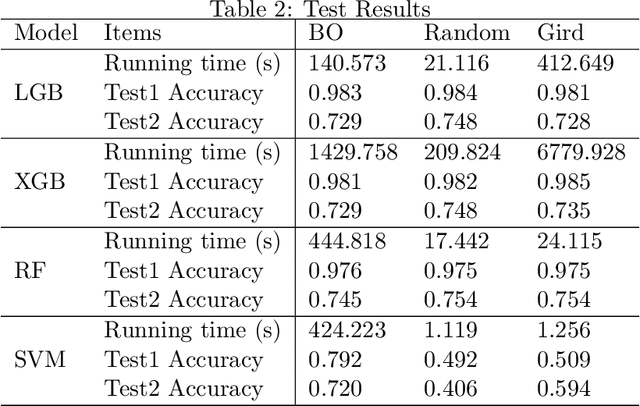

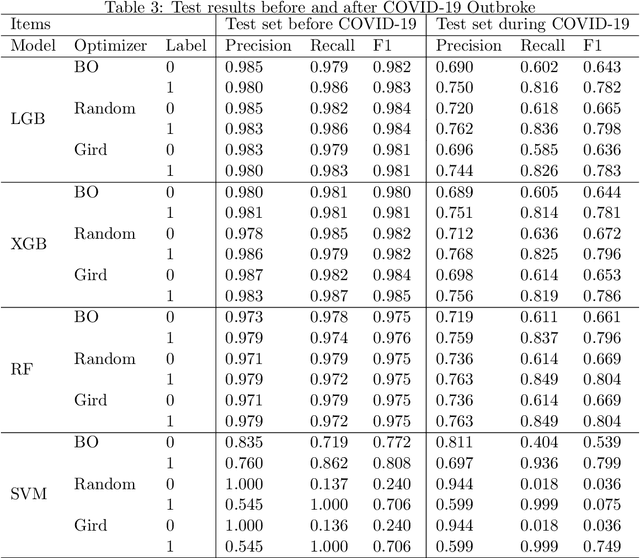

Abstract:How to quickly and automatically mine effective information and serve investment decisions has attracted more and more attention from academia and industry. And new challenges have been raised with the global pandemic. This paper proposes a two-phase AlphaMLDigger that effectively finds excessive returns in the highly fluctuated market. In phase 1, a deep sequential NLP model is proposed to transfer blogs on Sina Microblog to market sentiment. In phase 2, the predicted market sentiment is combined with social network indicator features and stock market history features to predict the stock movements with different Machine Learning models and optimizers. The results show that our AlphaMLDigger achieves higher accuracy in the test set than previous works and is robust to the negative impact of COVID-19 to some extent.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge