J. Doyne Farmer

Learning to Manage Investment Portfolios beyond Simple Utility Functions

Oct 30, 2025

Abstract:While investment funds publicly disclose their objectives in broad terms, their managers optimize for complex combinations of competing goals that go beyond simple risk-return trade-offs. Traditional approaches attempt to model this through multi-objective utility functions, but face fundamental challenges in specification and parameterization. We propose a generative framework that learns latent representations of fund manager strategies without requiring explicit utility specification. Our approach directly models the conditional probability of a fund's portfolio weights, given stock characteristics, historical returns, previous weights, and a latent variable representing the fund's strategy. Unlike methods based on reinforcement learning or imitation learning, which require specified rewards or labeled expert objectives, our GAN-based architecture learns directly from the joint distribution of observed holdings and market data. We validate our framework on a dataset of 1436 U.S. equity mutual funds. The learned representations successfully capture known investment styles, such as "growth" and "value," while also revealing implicit manager objectives. For instance, we find that while many funds exhibit characteristics of Markowitz-like optimization, they do so with heterogeneous realizations for turnover, concentration, and latent factors. To analyze and interpret the end-to-end model, we develop a series of tests that explain the model, and we show that the benchmark's expert labeling are contained in our model's encoding in a linear interpretable way. Our framework provides a data-driven approach for characterizing investment strategies for applications in market simulation, strategy attribution, and regulatory oversight.

Calibrating Agent-based Models to Microdata with Graph Neural Networks

Jun 15, 2022

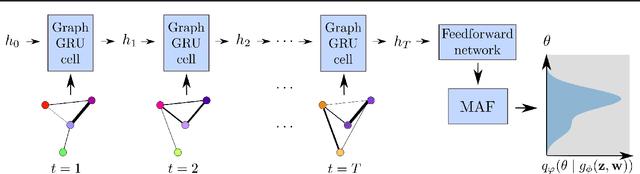

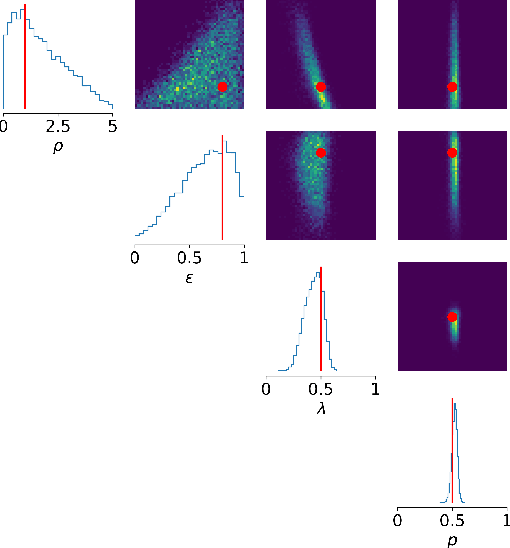

Abstract:Calibrating agent-based models (ABMs) to data is among the most fundamental requirements to ensure the model fulfils its desired purpose. In recent years, simulation-based inference methods have emerged as powerful tools for performing this task when the model likelihood function is intractable, as is often the case for ABMs. In some real-world use cases of ABMs, both the observed data and the ABM output consist of the agents' states and their interactions over time. In such cases, there is a tension between the desire to make full use of the rich information content of such granular data on the one hand, and the need to reduce the dimensionality of the data to prevent difficulties associated with high-dimensional learning tasks on the other. A possible resolution is to construct lower-dimensional time-series through the use of summary statistics describing the macrostate of the system at each time point. However, a poor choice of summary statistics can result in an unacceptable loss of information from the original dataset, dramatically reducing the quality of the resulting calibration. In this work, we instead propose to learn parameter posteriors associated with granular microdata directly using temporal graph neural networks. We will demonstrate that such an approach offers highly compelling inductive biases for Bayesian inference using the raw ABM microstates as output.

Black-box Bayesian inference for economic agent-based models

Feb 01, 2022

Abstract:Simulation models, in particular agent-based models, are gaining popularity in economics. The considerable flexibility they offer, as well as their capacity to reproduce a variety of empirically observed behaviours of complex systems, give them broad appeal, and the increasing availability of cheap computing power has made their use feasible. Yet a widespread adoption in real-world modelling and decision-making scenarios has been hindered by the difficulty of performing parameter estimation for such models. In general, simulation models lack a tractable likelihood function, which precludes a straightforward application of standard statistical inference techniques. Several recent works have sought to address this problem through the application of likelihood-free inference techniques, in which parameter estimates are determined by performing some form of comparison between the observed data and simulation output. However, these approaches are (a) founded on restrictive assumptions, and/or (b) typically require many hundreds of thousands of simulations. These qualities make them unsuitable for large-scale simulations in economics and can cast doubt on the validity of these inference methods in such scenarios. In this paper, we investigate the efficacy of two classes of black-box approximate Bayesian inference methods that have recently drawn significant attention within the probabilistic machine learning community: neural posterior estimation and neural density ratio estimation. We present benchmarking experiments in which we demonstrate that neural network based black-box methods provide state of the art parameter inference for economic simulation models, and crucially are compatible with generic multivariate time-series data. In addition, we suggest appropriate assessment criteria for future benchmarking of approximate Bayesian inference procedures for economic simulation models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge