Giovanni Ricco

Deep Dynamic Factor Models

Jul 23, 2020

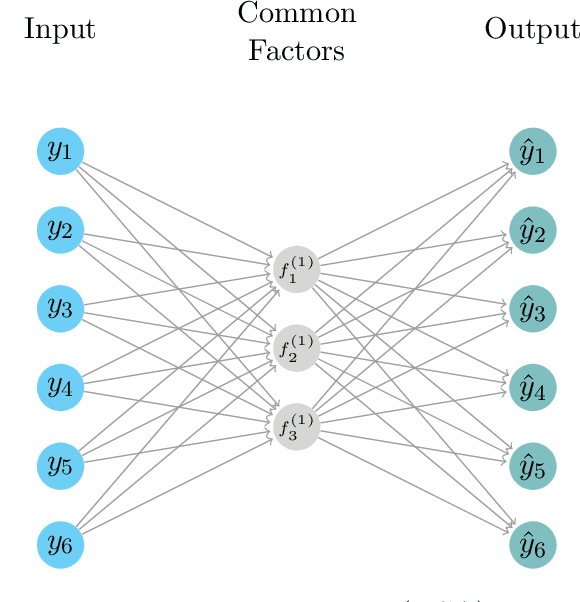

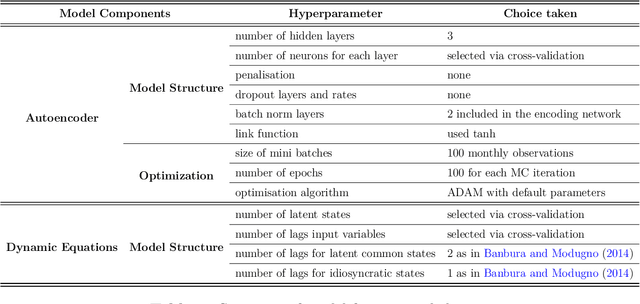

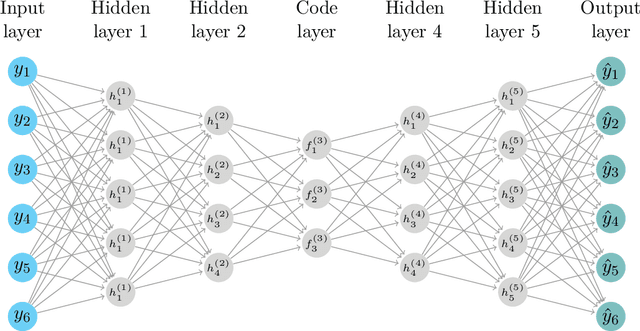

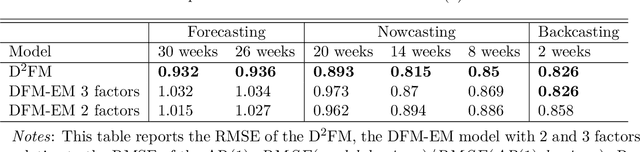

Abstract:We propose a novel deep neural net framework - that we refer to as Deep Dynamic Factor Model (D2FM) -, to encode the information available, from hundreds of macroeconomic and financial time-series into a handful of unobserved latent states. While similar in spirit to traditional dynamic factor models (DFMs), differently from those, this new class of models allows for nonlinearities between factors and observables due to the deep neural net structure. However, by design, the latent states of the model can still be interpreted as in a standard factor model. In an empirical application to the forecast and nowcast of economic conditions in the US, we show the potential of this framework in dealing with high dimensional, mixed frequencies and asynchronously published time series data. In a fully real-time out-of-sample exercise with US data, the D2FM improves over the performances of a state-of-the-art DFM.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge