Gbenga Ibikunle

DeXposure-FM: A Time-series, Graph Foundation Model for Credit Exposures and Stability on Decentralized Financial Networks

Feb 03, 2026Abstract:Credit exposure in Decentralized Finance (DeFi) is often implicit and token-mediated, creating a dense web of inter-protocol dependencies. Thus, a shock to one token may result in significant and uncontrolled contagion effects. As the DeFi ecosystem becomes increasingly linked with traditional financial infrastructure through instruments, such as stablecoins, the risk posed by this dynamic demands more powerful quantification tools. We introduce DeXposure-FM, the first time-series, graph foundation model for measuring and forecasting inter-protocol credit exposure on DeFi networks, to the best of our knowledge. Employing a graph-tabular encoder, with pre-trained weight initialization, and multiple task-specific heads, DeXposure-FM is trained on the DeXposure dataset that has 43.7 million data entries, across 4,300+ protocols on 602 blockchains, covering 24,300+ unique tokens. The training is operationalized for credit-exposure forecasting, predicting the joint dynamics of (1) protocol-level flows, and (2) the topology and weights of credit-exposure links. The DeXposure-FM is empirically validated on two machine learning benchmarks; it consistently outperforms the state-of-the-art approaches, including a graph foundation model and temporal graph neural networks. DeXposure-FM further produces financial economics tools that support macroprudential monitoring and scenario-based DeFi stress testing, by enabling protocol-level systemic-importance scores, sector-level spillover and concentration measures via a forecast-then-measure pipeline. Empirical verification fully supports our financial economics tools. The model and code have been publicly available. Model: https://huggingface.co/EVIEHub/DeXposure-FM. Code: https://github.com/EVIEHub/DeXposure-FM.

Minimal Batch Adaptive Learning Policy Engine for Real-Time Mid-Price Forecasting in High-Frequency Trading

Dec 26, 2024Abstract:High-frequency trading (HFT) has transformed modern financial markets, making reliable short-term price forecasting models essential. In this study, we present a novel approach to mid-price forecasting using Level 1 limit order book (LOB) data from NASDAQ, focusing on 100 U.S. stocks from the S&P 500 index during the period from September to November 2022. Expanding on our previous work with Radial Basis Function Neural Networks (RBFNN), which leveraged automated feature importance techniques based on mean decrease impurity (MDI) and gradient descent (GD), we introduce the Adaptive Learning Policy Engine (ALPE) - a reinforcement learning (RL)-based agent designed for batch-free, immediate mid-price forecasting. ALPE incorporates adaptive epsilon decay to dynamically balance exploration and exploitation, outperforming a diverse range of highly effective machine learning (ML) and deep learning (DL) models in forecasting performance.

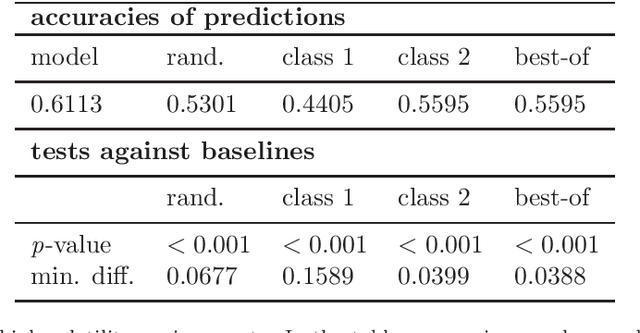

Predictive intraday correlations in stable and volatile market environments: Evidence from deep learning

Feb 24, 2020

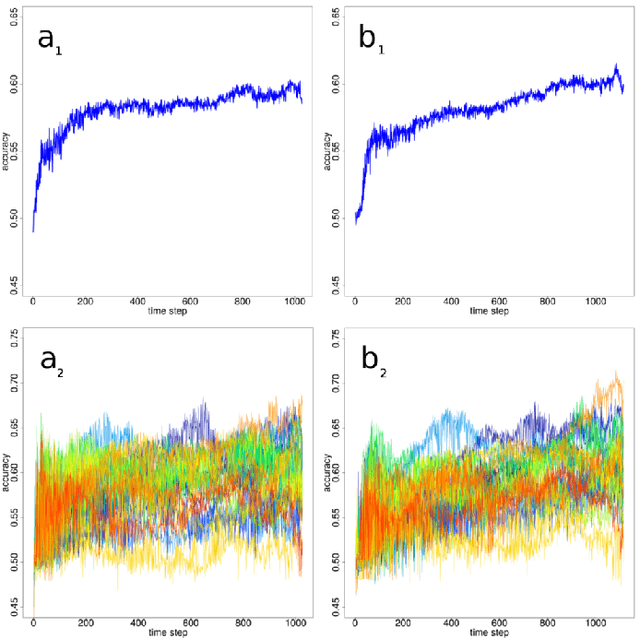

Abstract:Standard methods and theories in finance can be ill-equipped to capture highly non-linear interactions in financial prediction problems based on large-scale datasets, with deep learning offering a way to gain insights into correlations in markets as complex systems. In this paper, we apply deep learning to econometrically constructed gradients to learn and exploit lagged correlations among S&P 500 stocks to compare model behaviour in stable and volatile market environments, and under the exclusion of target stock information for predictions. In order to measure the effect of time horizons, we predict intraday and daily stock price movements in varying interval lengths and gauge the complexity of the problem at hand with a modification of our model architecture. Our findings show that accuracies, while remaining significant and demonstrating the exploitability of lagged correlations in stock markets, decrease with shorter prediction horizons. We discuss implications for modern finance theory and our work's applicability as an investigative tool for portfolio managers. Lastly, we show that our model's performance is consistent in volatile markets by exposing it to the environment of the recent financial crisis of 2007/2008.

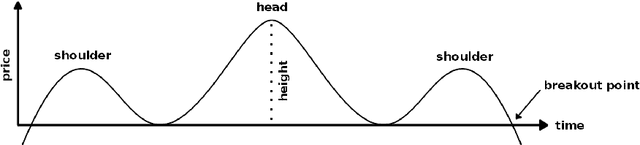

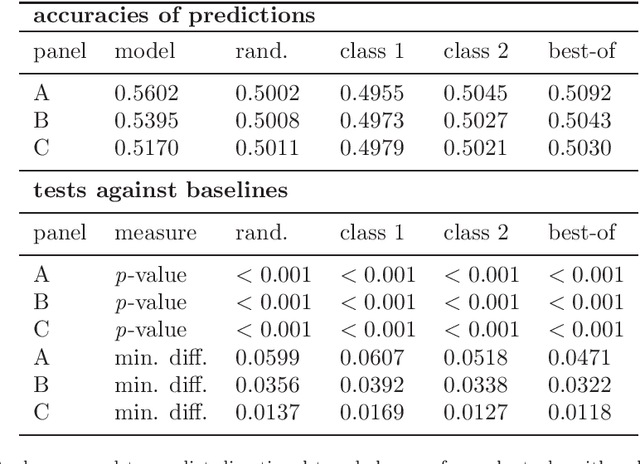

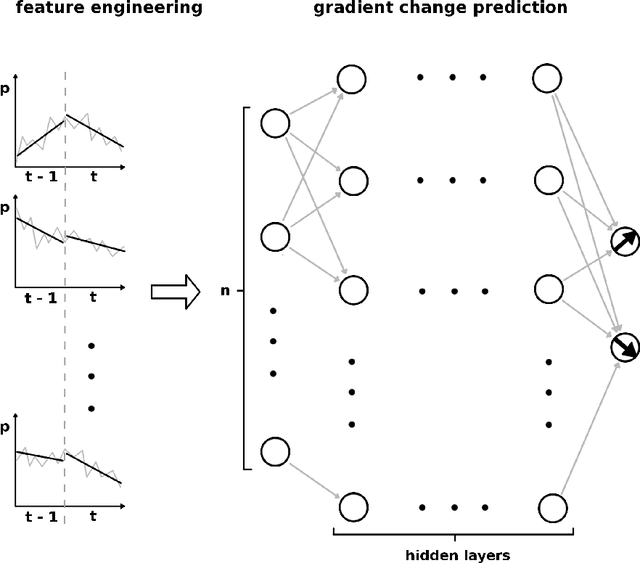

Lagged correlation-based deep learning for directional trend change prediction in financial time series

Nov 29, 2018

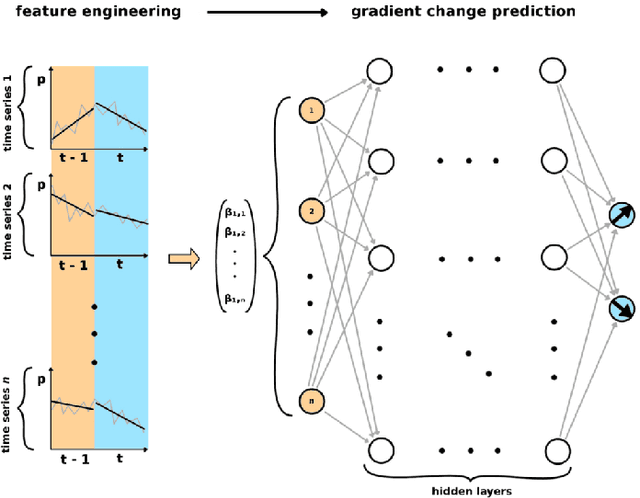

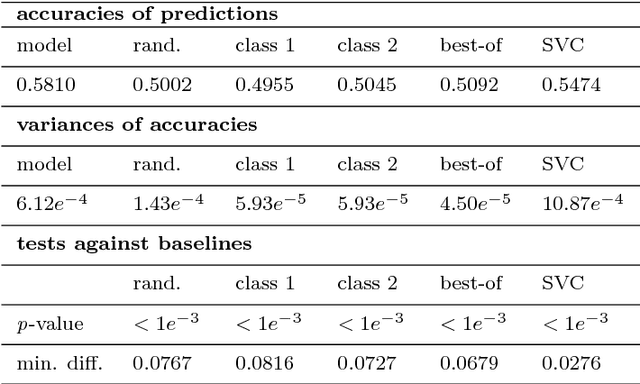

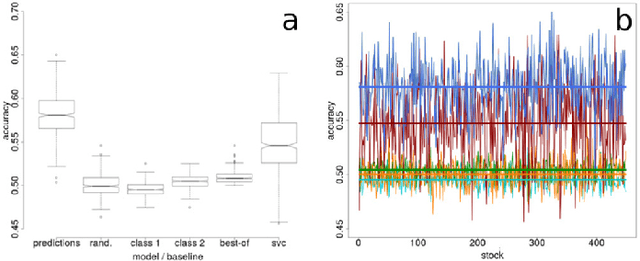

Abstract:Trend change prediction in complex systems with a large number of noisy time series is a problem with many applications for real-world phenomena, with stock markets as a notoriously difficult to predict example of such systems. We approach predictions of directional trend changes via complex lagged correlations between them, excluding any information about the target series from the respective inputs to achieve predictions purely based on such correlations with other series. We propose the use of deep neural networks that employ step-wise linear regressions with exponential smoothing in the preparatory feature engineering for this task, with regression slopes as trend strength indicators for a given time interval. We apply this method to historical stock market data from 2011 to 2016 as a use case example of lagged correlations between large numbers of time series that are heavily influenced by externally arising new information as a random factor. The results demonstrate the viability of the proposed approach, with state-of-the-art accuracies and accounting for the statistical significance of the results for additional validation, as well as important implications for modern financial economics.

* 11 pages, 4 figures

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge