Fumihide Tanaka

A Scalable Reinforcement Learning-based System Using On-Chain Data for Cryptocurrency Portfolio Management

Jul 04, 2023

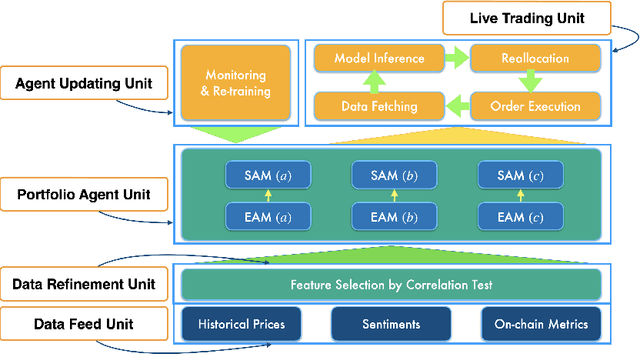

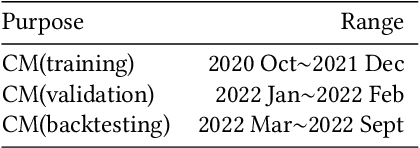

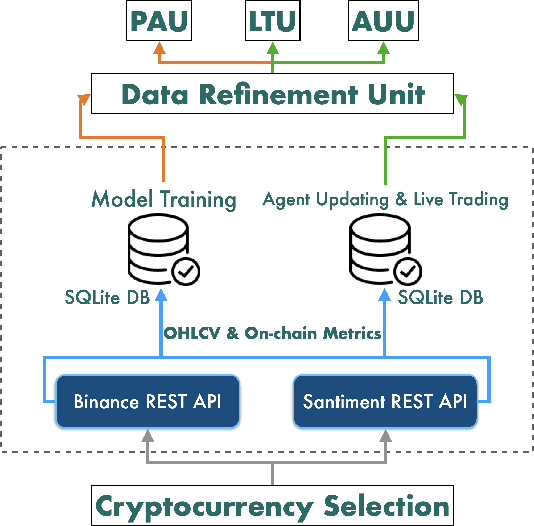

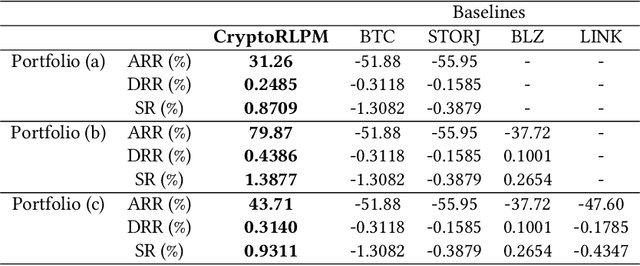

Abstract:On-chain data (metrics) of blockchain networks, akin to company fundamentals, provide crucial and comprehensive insights into the networks. Despite their informative nature, on-chain data have not been utilized in reinforcement learning (RL)-based systems for cryptocurrency (crypto) portfolio management (PM). An intriguing subject is the extent to which the utilization of on-chain data can enhance an RL-based system's return performance compared to baselines. Therefore, in this study, we propose CryptoRLPM, a novel RL-based system incorporating on-chain data for end-to-end crypto PM. CryptoRLPM consists of five units, spanning from information comprehension to trading order execution. In CryptoRLPM, the on-chain data are tested and specified for each crypto to solve the issue of ineffectiveness of metrics. Moreover, the scalable nature of CryptoRLPM allows changes in the portfolios' cryptos at any time. Backtesting results on three portfolios indicate that CryptoRLPM outperforms all the baselines in terms of accumulated rate of return (ARR), daily rate of return (DRR), and Sortino ratio (SR). Particularly, when compared to Bitcoin, CryptoRLPM enhances the ARR, DRR, and SR by at least 83.14%, 0.5603%, and 2.1767 respectively.

A Modularized and Scalable Multi-Agent Reinforcement Learning-based System for Financial Portfolio Management

Feb 09, 2021

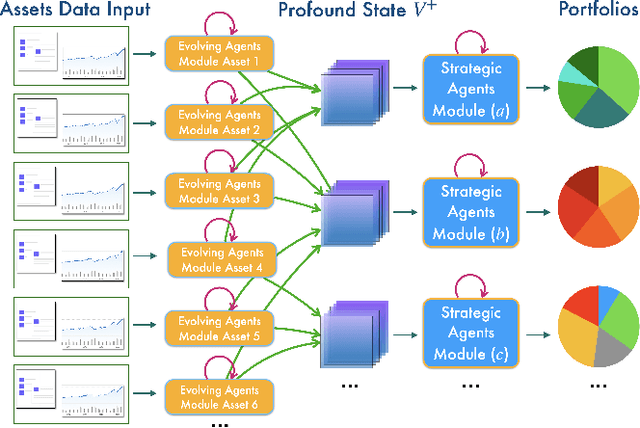

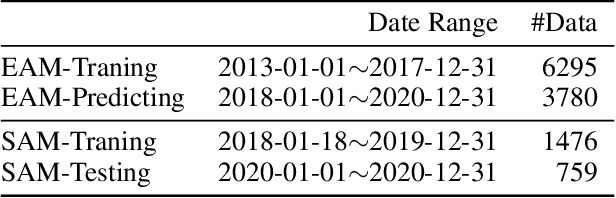

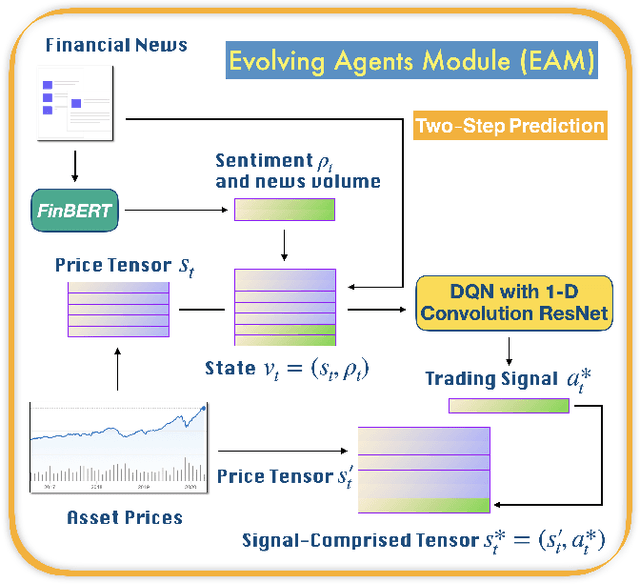

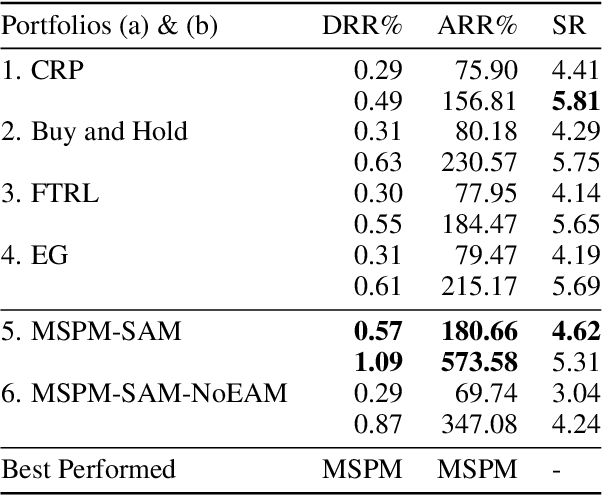

Abstract:Financial Portfolio Management is one of the most applicable problems in Reinforcement Learning (RL) by its sequential decision-making nature. Existing RL-based approaches, while inspiring, often lack scalability, reusability, or profundity of intake information to accommodate the ever-changing capital markets. In this paper, we design and develop MSPM, a novel Multi-agent Reinforcement learning-based system with a modularized and scalable architecture for portfolio management. MSPM involves two asynchronously updated units: Evolving Agent Module (EAM) and Strategic Agent Module (SAM). A self-sustained EAM produces signal-comprised information for a specific asset using heterogeneous data inputs, and each EAM possesses its reusability to have connections to multiple SAMs. A SAM is responsible for the assets reallocation of a portfolio using profound information from the EAMs connected. With the elaborate architecture and the multi-step condensation of the volatile market information, MSPM aims to provide a customizable, stable, and dedicated solution to portfolio management that existing approaches do not. We also tackle data-shortage issue of newly-listed stocks by transfer learning, and validate the necessity of EAM. Experiments on 8-year U.S. stock markets data prove the effectiveness of MSPM in profits accumulation by its outperformance over existing benchmarks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge