Avinash Barnwal

Survival regression with accelerated failure time model in XGBoost

Jun 11, 2020

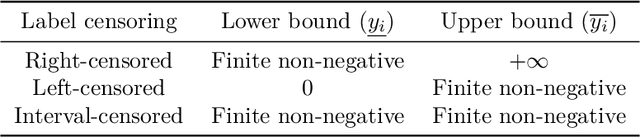

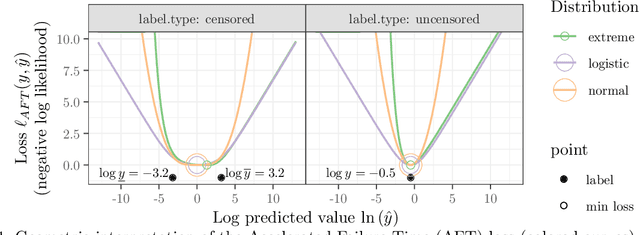

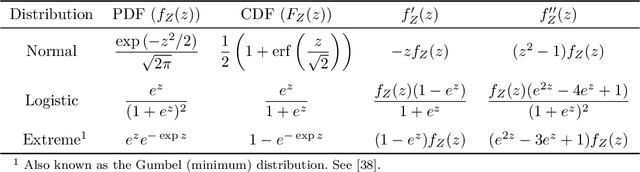

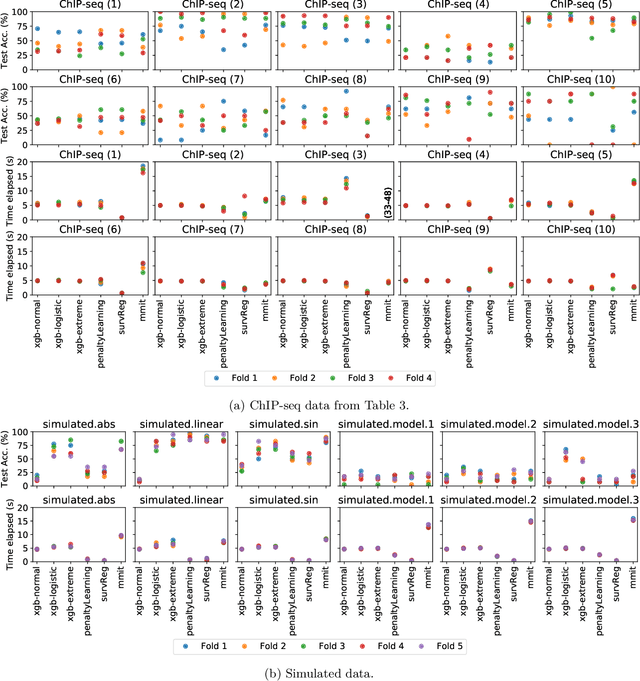

Abstract:Survival regression is used to estimate the relation between time-to-event and feature variables, and is important in application domains such as medicine, marketing, risk management and sales management. Nonlinear tree based machine learning algorithms as implemented in libraries such as XGBoost, scikit-learn, LightGBM, and CatBoost are often more accurate in practice than linear models. However, existing implementations of tree-based models have offered limited support for survival regression. In this work, we propose and implement loss functions for learning accelerated failure time (AFT) models in XGBoost, to increase the support for survival modeling for different kinds of label censoring. The AFT model assumes effects that directly accelerate or decelerate the survival time for different kinds of censored data sets. We demonstrate with real and simulated experiments the effectiveness of AFT in XGBoost with respect to a number of baselines, in two respects: generalization performance and training speed. Furthermore, we take advantage of the support for NVIDIA GPUs in XGBoost to achieve substantial speedup over multi-coreCPUs. To our knowledge, our work is the first implementation of AFT that utilizes the processing power of NVIDIA GPUs.

Network Elastic Net for Identifying Smoking specific gene expression for lung cancer

Aug 30, 2019

Abstract:Survival month for non-small lung cancer patients depend upon which stage of lung cancer is present. Our aim is to identify smoking specific gene expression biomarkers in the prognosis of lung cancer patients. In this paper, we introduce the network elastic net, a generalization of network lasso that allows for simultaneous clustering and regression on graphs. In Network elastic net, we consider similar patients based on smoking cigarettes per year to form the network. We then further find the suitable cluster among patients based on coefficients of genes having different survival month structures and showed the efficacy of the clusters using stage enrichment. This can be used to identify the stage of cancer using gene expression and smoking behavior of patients without doing any tests.

Stacking with Neural network for Cryptocurrency investment

Feb 22, 2019

Abstract:Predicting the direction of assets have been an active area of study and a difficult task. Machine learning models have been used to build robust models to model the above task. Ensemble methods is one of them showing results better than a single supervised method. In this paper, we have used generative and discriminative classifiers to create the stack, particularly 3 generative and 6 discriminative classifiers and optimized over one-layer Neural Network to model the direction of price cryptocurrencies. Features used are technical indicators used are not limited to trend, momentum, volume, volatility indicators, and sentiment analysis has also been used to gain useful insight combined with the above features. For Cross-validation, Purged Walk forward cross-validation has been used. In terms of accuracy, we have done a comparative analysis of the performance of Ensemble method with Stacking and Ensemble method with blending. We have also developed a methodology for combined features importance for the stacked model. Important indicators are also identified based on feature importance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge