Andrea Visentin

Zero-Shot Image-Based Large Language Model Approach to Road Pavement Monitoring

Apr 09, 2025Abstract:Effective and rapid evaluation of pavement surface condition is critical for prioritizing maintenance, ensuring transportation safety, and minimizing vehicle wear and tear. While conventional manual inspections suffer from subjectivity, existing machine learning-based methods are constrained by their reliance on large and high-quality labeled datasets, which require significant resources and limit adaptability across varied road conditions. The revolutionary advancements in Large Language Models (LLMs) present significant potential for overcoming these challenges. In this study, we propose an innovative automated zero-shot learning approach that leverages the image recognition and natural language understanding capabilities of LLMs to assess road conditions effectively. Multiple LLM-based assessment models were developed, employing prompt engineering strategies aligned with the Pavement Surface Condition Index (PSCI) standards. These models' accuracy and reliability were evaluated against official PSCI results, with an optimized model ultimately selected. Extensive tests benchmarked the optimized model against evaluations from various levels experts using Google Street View road images. The results reveal that the LLM-based approach can effectively assess road conditions, with the optimized model -employing comprehensive and structured prompt engineering strategies -outperforming simpler configurations by achieving high accuracy and consistency, even surpassing expert evaluations. Moreover, successfully applying the optimized model to Google Street View images demonstrates its potential for future city-scale deployments. These findings highlight the transformative potential of LLMs in automating road damage evaluations and underscore the pivotal role of detailed prompt engineering in achieving reliable assessments.

Machine Learning Applications to Diffuse Reflectance Spectroscopy in Optical Diagnosis; A Systematic Review

Mar 03, 2025Abstract:Diffuse Reflectance Spectroscopy has demonstrated a strong aptitude for identifying and differentiating biological tissues. However, the broadband and smooth nature of these signals require algorithmic processing, as they are often difficult for the human eye to distinguish. The implementation of machine learning models for this task has demonstrated high levels of diagnostic accuracies and led to a wide range of proposed methodologies for applications in various illnesses and conditions. In this systematic review, we summarise the state of the art of these applications, highlight current gaps in research and identify future directions. This review was conducted in accordance with the PRISMA guidelines. 77 studies were retrieved and in-depth analysis was conducted. It is concluded that diffuse reflectance spectroscopy and machine learning have strong potential for tissue differentiation in clinical applications, but more rigorous sample stratification in tandem with in-vivo validation and explainable algorithm development is required going forward.

Conformal Prediction for Electricity Price Forecasting in the Day-Ahead and Real-Time Balancing Market

Feb 07, 2025Abstract:The integration of renewable energy into electricity markets poses significant challenges to price stability and increases the complexity of market operations. Accurate and reliable electricity price forecasting is crucial for effective market participation, where price dynamics can be significantly more challenging to predict. Probabilistic forecasting, through prediction intervals, efficiently quantifies the inherent uncertainties in electricity prices, supporting better decision-making for market participants. This study explores the enhancement of probabilistic price prediction using Conformal Prediction (CP) techniques, specifically Ensemble Batch Prediction Intervals and Sequential Predictive Conformal Inference. These methods provide precise and reliable prediction intervals, outperforming traditional models in validity metrics. We propose an ensemble approach that combines the efficiency of quantile regression models with the robust coverage properties of time series adapted CP techniques. This ensemble delivers both narrow prediction intervals and high coverage, leading to more reliable and accurate forecasts. We further evaluate the practical implications of CP techniques through a simulated trading algorithm applied to a battery storage system. The ensemble approach demonstrates improved financial returns in energy trading in both the Day-Ahead and Balancing Markets, highlighting its practical benefits for market participants.

Optimizing Quantile-based Trading Strategies in Electricity Arbitrage

Jun 19, 2024

Abstract:Efficiently integrating renewable resources into electricity markets is vital for addressing the challenges of matching real-time supply and demand while reducing the significant energy wastage resulting from curtailments. To address this challenge effectively, the incorporation of storage devices can enhance the reliability and efficiency of the grid, improving market liquidity and reducing price volatility. In short-term electricity markets, participants navigate numerous options, each presenting unique challenges and opportunities, underscoring the critical role of the trading strategy in maximizing profits. This study delves into the optimization of day-ahead and balancing market trading, leveraging quantile-based forecasts. Employing three trading approaches with practical constraints, our research enhances forecast assessment, increases trading frequency, and employs flexible timestamp orders. Our findings underscore the profit potential of simultaneous participation in both day-ahead and balancing markets, especially with larger battery storage systems; despite increased costs and narrower profit margins associated with higher-volume trading, the implementation of high-frequency strategies plays a significant role in maximizing profits and addressing market challenges. Finally, we modelled four commercial battery storage systems and evaluated their economic viability through a scenario analysis, with larger batteries showing a shorter return on investment.

Electricity Price Forecasting in the Irish Balancing Market

Feb 09, 2024Abstract:Short-term electricity markets are becoming more relevant due to less-predictable renewable energy sources, attracting considerable attention from the industry. The balancing market is the closest to real-time and the most volatile among them. Its price forecasting literature is limited, inconsistent and outdated, with few deep learning attempts and no public dataset. This work applies to the Irish balancing market a variety of price prediction techniques proven successful in the widely studied day-ahead market. We compare statistical, machine learning, and deep learning models using a framework that investigates the impact of different training sizes. The framework defines hyperparameters and calibration settings; the dataset and models are made public to ensure reproducibility and to be used as benchmarks for future works. An extensive numerical study shows that well-performing models in the day-ahead market do not perform well in the balancing one, highlighting that these markets are fundamentally different constructs. The best model is LEAR, a statistical approach based on LASSO, which outperforms more complex and computationally demanding approaches.

SATfeatPy - A Python-based Feature Extraction System for Satisfiability

Apr 29, 2022

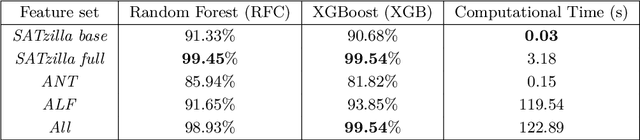

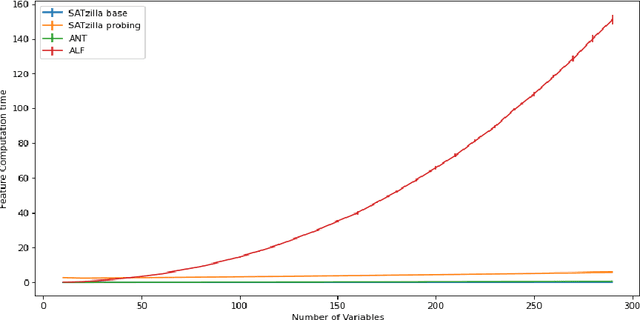

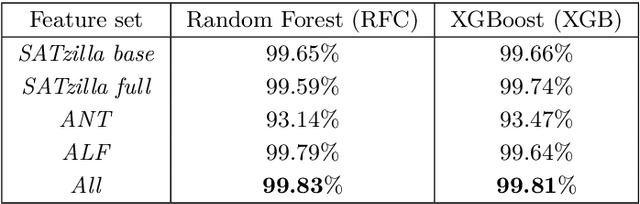

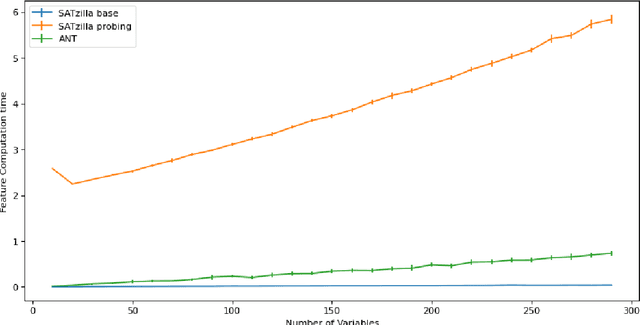

Abstract:Feature extraction is a fundamental task in the application of machine learning methods to SAT solving. It is used in algorithm selection and configuration for solver portfolios and satisfiability classification. Many approaches have been proposed to extract meaningful attributes from CNF instances. Most of them lack a working/updated implementation, and the limited descriptions lack clarity affecting the reproducibility. Furthermore, the literature misses a comparison among the features. This paper introduces SATfeatPy, a library that offers feature extraction techniques for SAT problems in the CNF form. This package offers the implementation of all the structural and statistical features from there major papers in the field. The library is provided in an up-to-date, easy-to-use Python package alongside a detailed feature description. We show the high accuracy of SAT/UNSAT and problem category classification, using five sets of features generated using our library from a dataset of 3000 SAT and UNSAT instances, over ten different classes of problems. Finally, we compare the usefulness of the features and importance for predicting a SAT instance's original structure in an ablation study.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge