Álvaro Leitao

Parametric Numerical Integration with (Differential) Machine Learning

Dec 12, 2025

Abstract:In this work, we introduce a machine/deep learning methodology to solve parametric integrals. Besides classical machine learning approaches, we consider a differential learning framework that incorporates derivative information during training, emphasizing its advantageous properties. Our study covers three representative problem classes: statistical functionals (including moments and cumulative distribution functions), approximation of functions via Chebyshev expansions, and integrals arising directly from differential equations. These examples range from smooth closed-form benchmarks to challenging numerical integrals. Across all cases, the differential machine learning-based approach consistently outperforms standard architectures, achieving lower mean squared error, enhanced scalability, and improved sample efficiency.

On Calibration Neural Networks for extracting implied information from American options

Jan 31, 2020

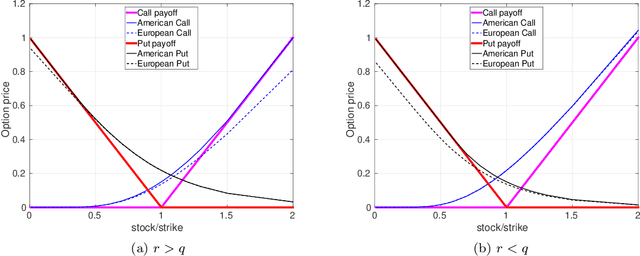

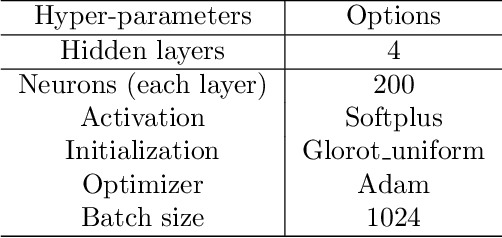

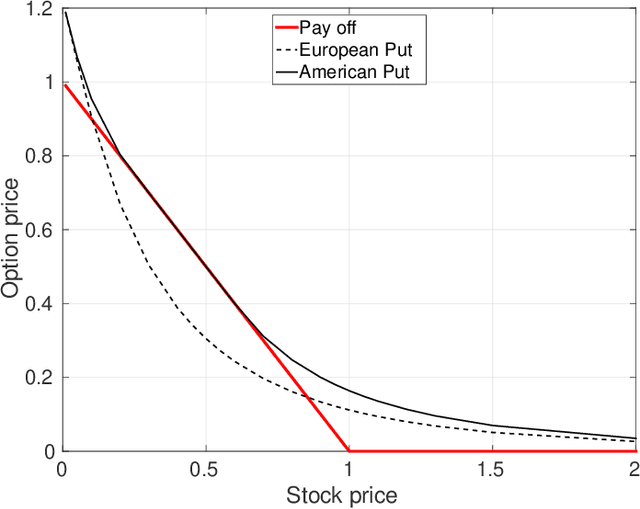

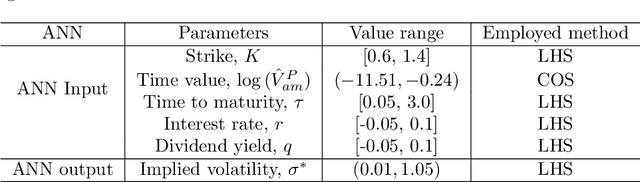

Abstract:Extracting implied information, like volatility and/or dividend, from observed option prices is a challenging task when dealing with American options, because of the computational costs needed to solve the corresponding mathematical problem many thousands of times. We will employ a data-driven machine learning approach to estimate the Black-Scholes implied volatility and the dividend yield for American options in a fast and robust way. To determine the implied volatility, the inverse function is approximated by an artificial neural network on the computational domain of interest, which decouples the offline (training) and online (prediction) phases and thus eliminates the need for an iterative process. For the implied dividend yield, we formulate the inverse problem as a calibration problem and determine simultaneously the implied volatility and dividend yield. For this, a generic and robust calibration framework, the Calibration Neural Network (CaNN), is introduced to estimate multiple parameters. It is shown that machine learning can be used as an efficient numerical technique to extract implied information from American options.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge