Time-Invariance Coefficients Tests with the Adaptive Multi-Factor Model

Paper and Code

Nov 09, 2020

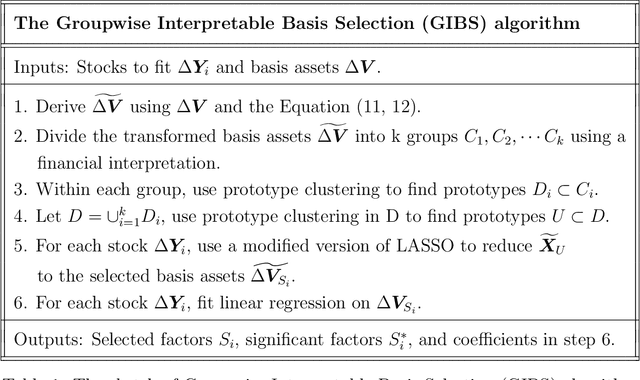

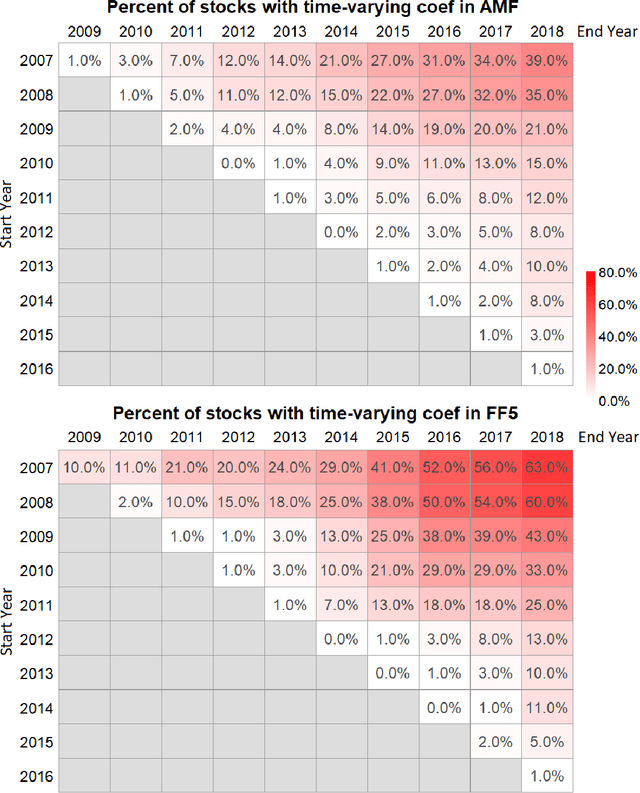

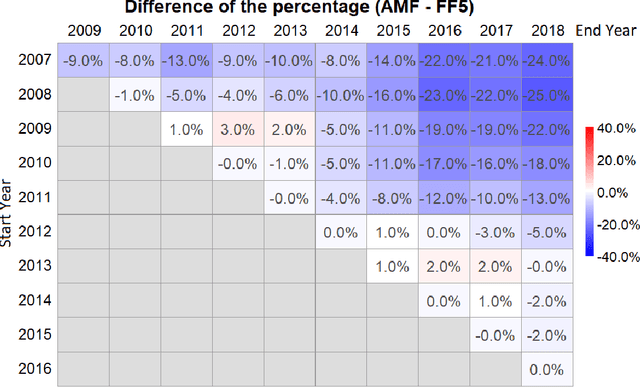

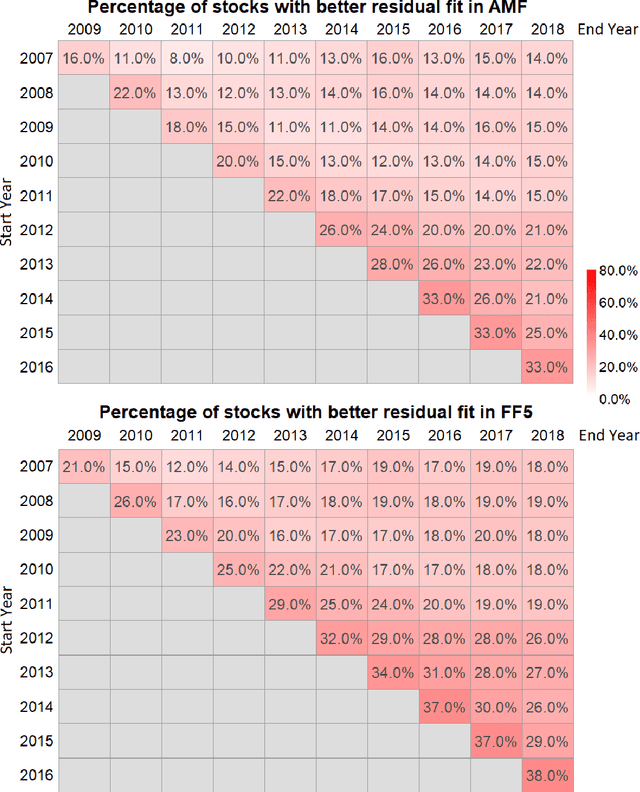

The purpose of this paper is to test the multi-factor beta model implied by the generalized arbitrage pricing theory (APT) and the Adaptive Multi-Factor (AMF) model with the Groupwise Interpretable Basis Selection (GIBS) algorithm, without imposing the exogenous assumption of constant betas. The intercept (arbitrage) tests validate both the AMF and the Fama-French 5-factor (FF5) model. We do the time-invariance tests for the betas for both the AMF model and the FF5 in various time periods. We show that for nearly all time periods with length less than 6 years, the beta coefficients are time-invariant for the AMF model, but not the FF5 model. The beta coefficients are time-varying for both AMF and FF5 models for longer time periods. Therefore, using the dynamic AMF model with a decent rolling window (such as 5 years) is more powerful and stable than the FF5 model.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge