Robust and Efficient Deep Hedging via Linearized Objective Neural Network

Paper and Code

Feb 25, 2025

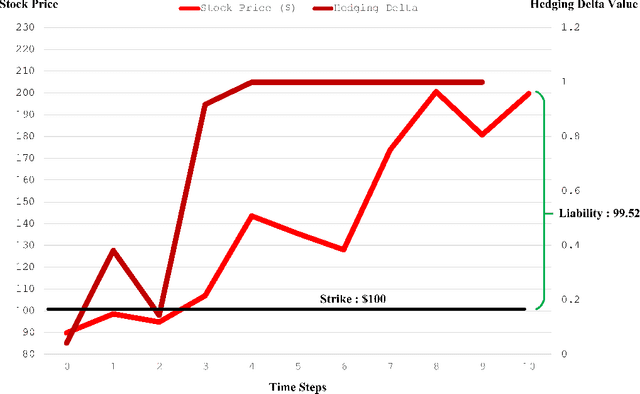

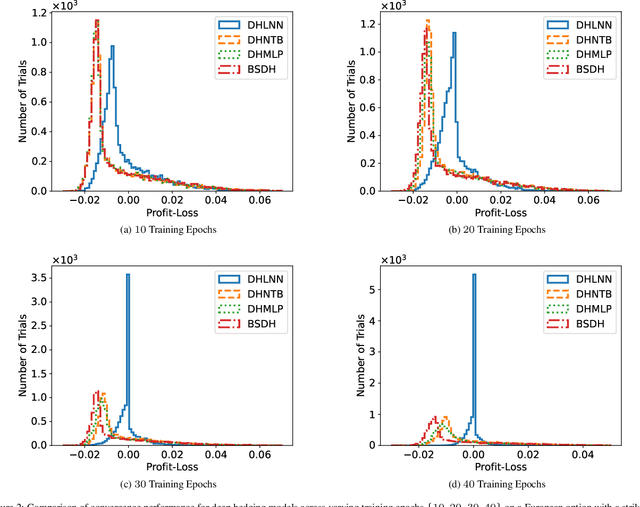

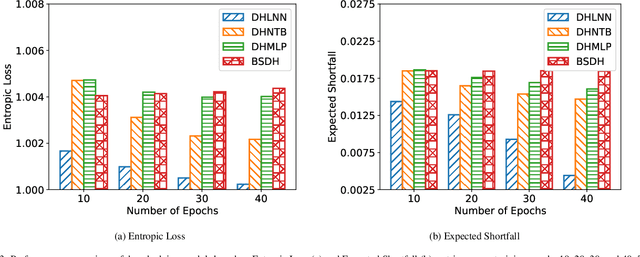

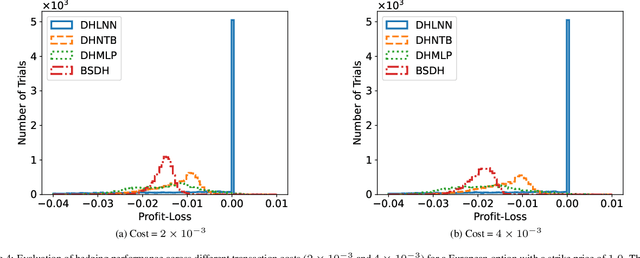

Deep hedging represents a cutting-edge approach to risk management for financial derivatives by leveraging the power of deep learning. However, existing methods often face challenges related to computational inefficiency, sensitivity to noisy data, and optimization complexity, limiting their practical applicability in dynamic and volatile markets. To address these limitations, we propose Deep Hedging with Linearized-objective Neural Network (DHLNN), a robust and generalizable framework that enhances the training procedure of deep learning models. By integrating a periodic fixed-gradient optimization method with linearized training dynamics, DHLNN stabilizes the training process, accelerates convergence, and improves robustness to noisy financial data. The framework incorporates trajectory-wide optimization and Black-Scholes Delta anchoring, ensuring alignment with established financial theory while maintaining flexibility to adapt to real-world market conditions. Extensive experiments on synthetic and real market data validate the effectiveness of DHLNN, demonstrating its ability to achieve faster convergence, improved stability, and superior hedging performance across diverse market scenarios.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge