QuantNet: Transferring Learning Across Systematic Trading Strategies

Paper and Code

Apr 07, 2020

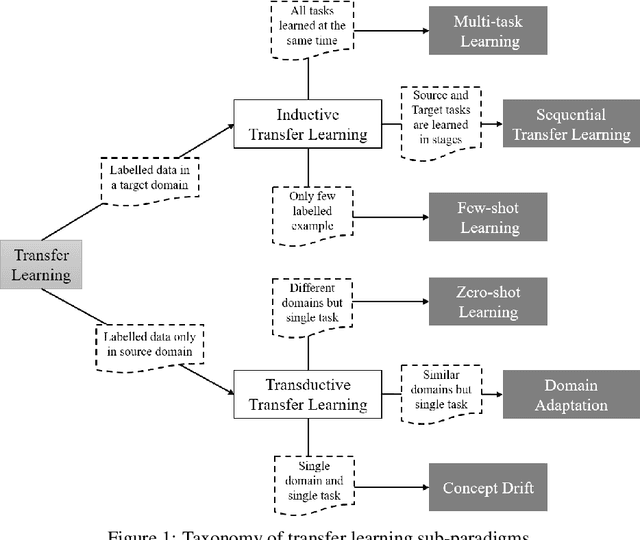

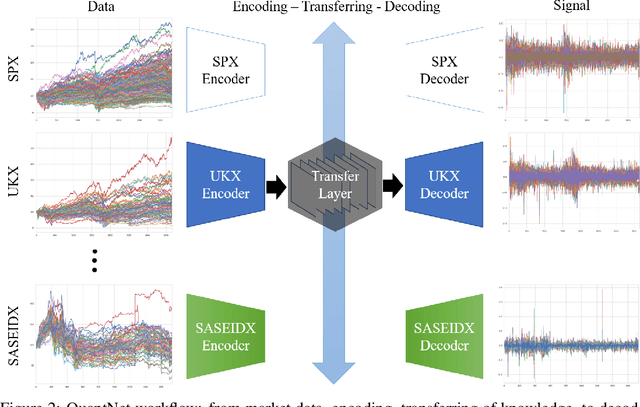

In this work we introduce QuantNet: an architecture that is capable of transferring knowledge over systematic trading strategies in several financial markets. By having a system that is able to leverage and share knowledge across them, our aim is two-fold: to circumvent the so-called Backtest Overfitting problem; and to generate higher risk-adjusted returns and fewer drawdowns. To do that, QuantNet exploits a form of modelling called Transfer Learning, where two layers are market-specific and another one is market-agnostic. This ensures that the transfer occurs across trading strategies, with the market-agnostic layer acting as a vehicle to share knowledge, cross-influence each strategy parameters, and ultimately the trading signal produced. In order to evaluate QuantNet, we compared its performance in relation to the option of not performing transfer learning, that is, using market-specific old-fashioned machine learning. In summary, our findings suggest that QuantNet performs better than non transfer-based trading strategies, improving Sharpe ratio in 15% and Calmar ratio in 41% across 3103 assets in 58 equity markets across the world. Code coming soon.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge