Predicting Mortality from Credit Reports

Paper and Code

Nov 05, 2021

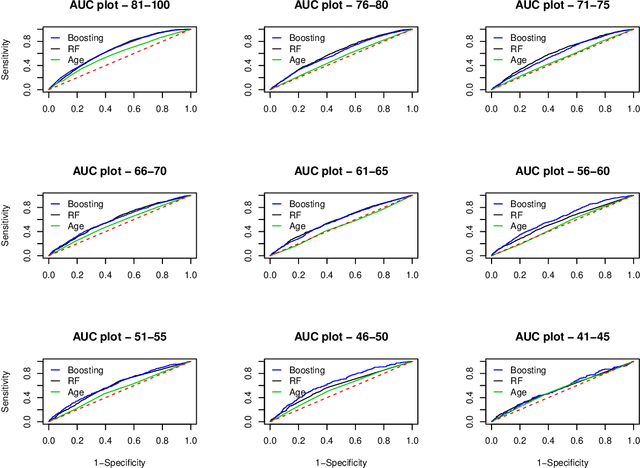

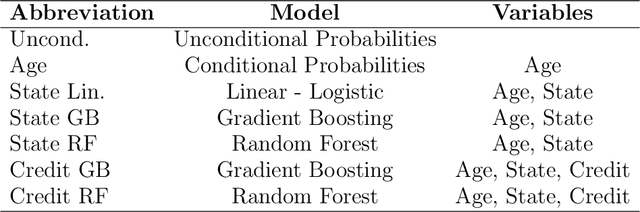

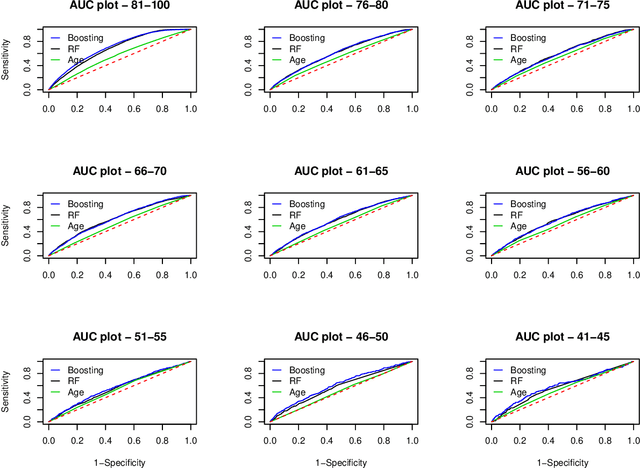

Data on hundreds of variables related to individual consumer finance behavior (such as credit card and loan activity) is routinely collected in many countries and plays an important role in lending decisions. We postulate that the detailed nature of this data may be used to predict outcomes in seemingly unrelated domains such as individual health. We build a series of machine learning models to demonstrate that credit report data can be used to predict individual mortality. Variable groups related to credit cards and various loans, mostly unsecured loans, are shown to carry significant predictive power. Lags of these variables are also significant thus indicating that dynamics also matters. Improved mortality predictions based on consumer finance data can have important economic implications in insurance markets but may also raise privacy concerns.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge