PLUTUS: A Well Pre-trained Large Unified Transformer can Unveil Financial Time Series Regularities

Paper and Code

Aug 20, 2024

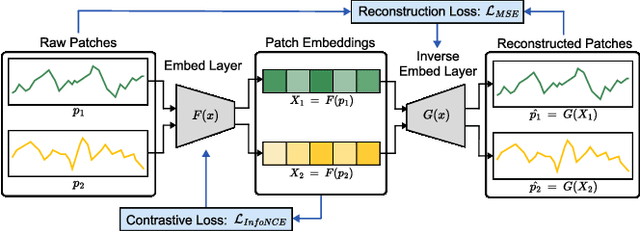

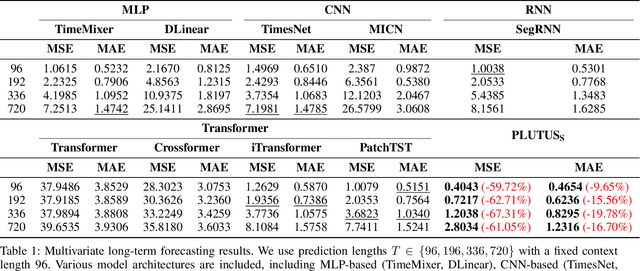

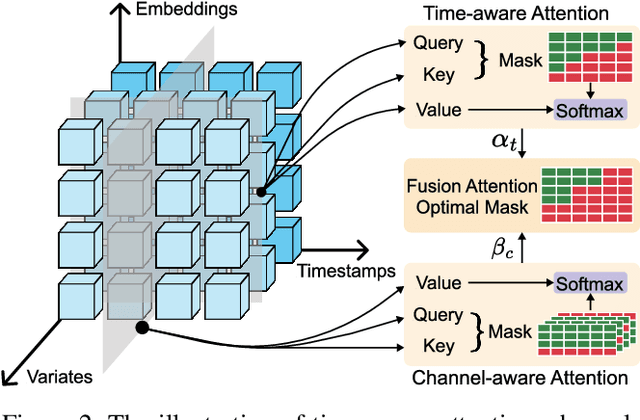

Financial time series modeling is crucial for understanding and predicting market behaviors but faces challenges such as non-linearity, non-stationarity, and high noise levels. Traditional models struggle to capture complex patterns due to these issues, compounded by limitations in computational resources and model capacity. Inspired by the success of large language models in NLP, we introduce $\textbf{PLUTUS}$, a $\textbf{P}$re-trained $\textbf{L}$arge $\textbf{U}$nified $\textbf{T}$ransformer-based model that $\textbf{U}$nveils regularities in financial time $\textbf{S}$eries. PLUTUS uses an invertible embedding module with contrastive learning and autoencoder techniques to create an approximate one-to-one mapping between raw data and patch embeddings. TimeFormer, an attention based architecture, forms the core of PLUTUS, effectively modeling high-noise time series. We incorporate a novel attention mechanisms to capture features across both variable and temporal dimensions. PLUTUS is pre-trained on an unprecedented dataset of 100 billion observations, designed to thrive in noisy financial environments. To our knowledge, PLUTUS is the first open-source, large-scale, pre-trained financial time series model with over one billion parameters. It achieves state-of-the-art performance in various tasks, demonstrating strong transferability and establishing a robust foundational model for finance. Our research provides technical guidance for pre-training financial time series data, setting a new standard in the field.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge