Performative Power

Paper and Code

Mar 31, 2022

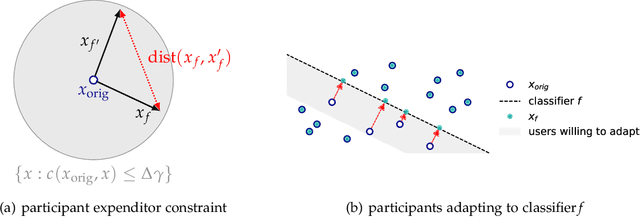

We introduce the notion of performative power, which measures the ability of a firm operating an algorithmic system, such as a digital content recommendation platform, to steer a population. We relate performative power to the economic theory of market power. Traditional economic concepts are well known to struggle with identifying anti-competitive patterns in digital platforms--a core challenge is the difficulty of defining the market, its participants, products, and prices. Performative power sidesteps the problem of market definition by focusing on a directly observable statistical measure instead. High performative power enables a platform to profit from steering participant behavior, whereas low performative power ensures that learning from historical data is close to optimal. Our first general result shows that under low performative power, a firm cannot do better than standard supervised learning on observed data. We draw an analogy with a firm being a price-taker, an economic condition that arises under perfect competition in classical market models. We then contrast this with a market where performative power is concentrated and show that the equilibrium state can differ significantly. We go on to study performative power in a concrete setting of strategic classification where participants can switch between competing firms. We show that monopolies maximize performative power and disutility for the participant, while competition and outside options decrease performative power. We end on a discussion of connections to measures of market power in economics and of the relationship with ongoing antitrust debates.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge