Parsimonious Feature Extraction Methods: Extending Robust Probabilistic Projections with Generalized Skew-t

Paper and Code

Sep 24, 2020

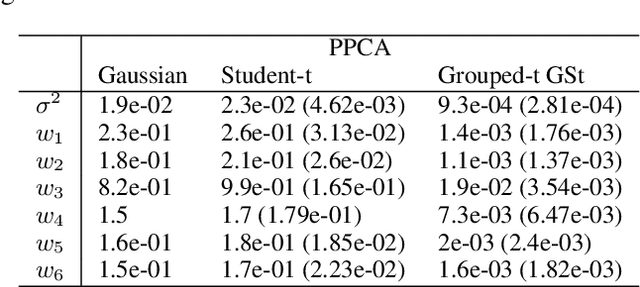

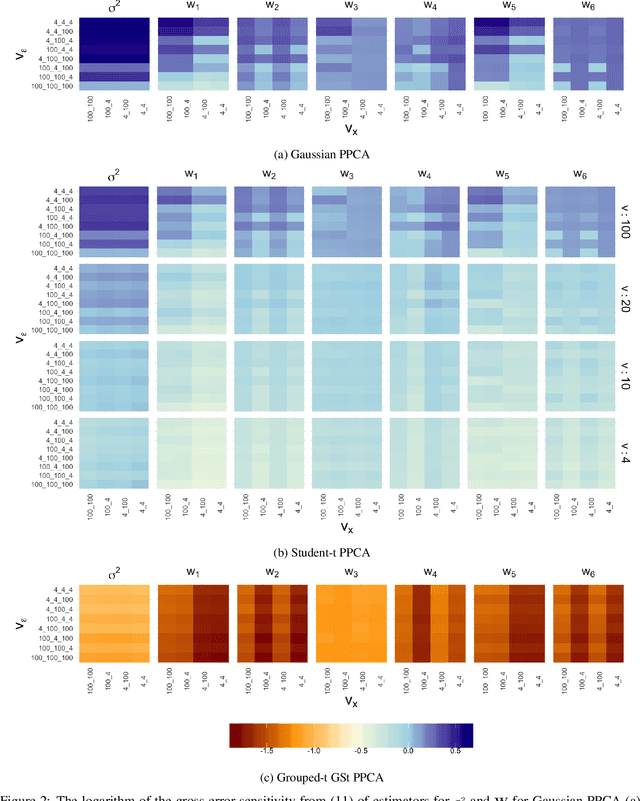

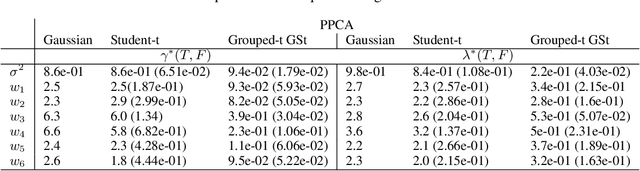

We propose a novel generalisation to the Student-t Probabilistic Principal Component methodology which: (1) accounts for an asymmetric distribution of the observation data; (2) is a framework for grouped and generalised multiple-degree-of-freedom structures, which provides a more flexible approach to modelling groups of marginal tail dependence in the observation data; and (3) separates the tail effect of the error terms and factors. The new feature extraction methods are derived in an incomplete data setting to efficiently handle the presence of missing values in the observation vector. We discuss various special cases of the algorithm being a result of simplified assumptions on the process generating the data. The applicability of the new framework is illustrated on a data set that consists of crypto currencies with the highest market capitalisation.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge