Optimal Execution Using Reinforcement Learning

Paper and Code

Jun 19, 2023

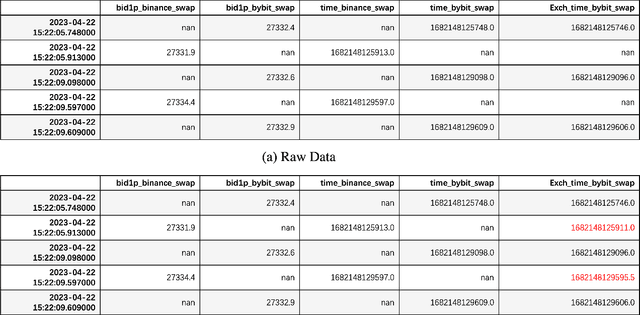

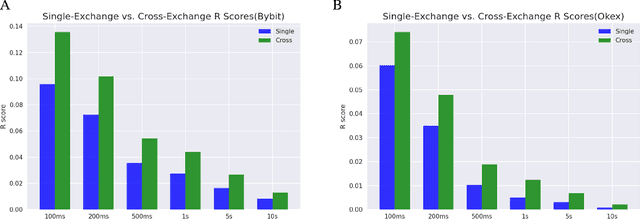

This work is about optimal order execution, where a large order is split into several small orders to maximize the implementation shortfall. Based on the diversity of cryptocurrency exchanges, we attempt to extract cross-exchange signals by aligning data from multiple exchanges for the first time. Unlike most previous studies that focused on using single-exchange information, we discuss the impact of cross-exchange signals on the agent's decision-making in the optimal execution problem. Experimental results show that cross-exchange signals can provide additional information for the optimal execution of cryptocurrency to facilitate the optimal execution process.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge