On the universality of the volatility formation process: when machine learning and rough volatility agree

Paper and Code

Jun 28, 2022

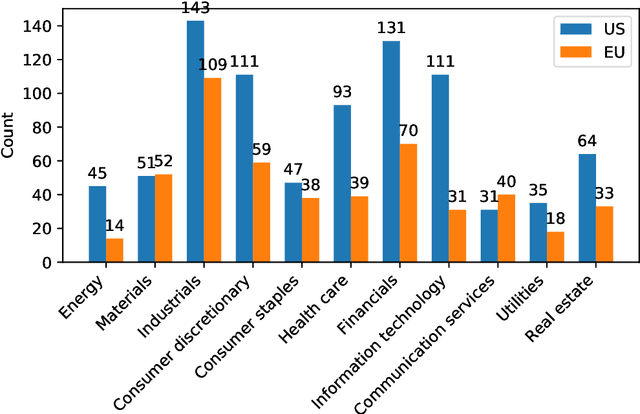

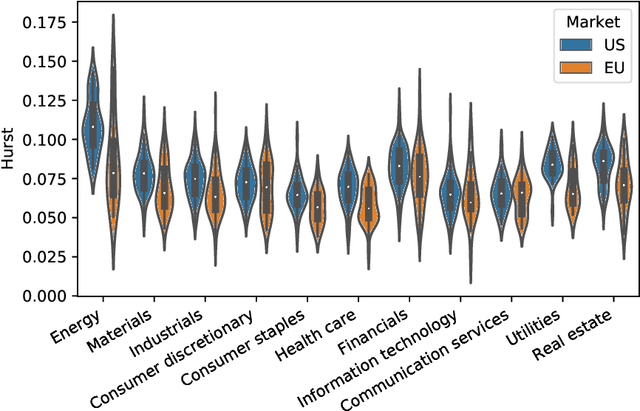

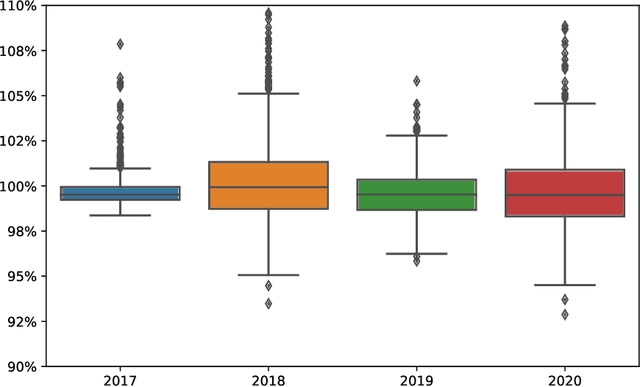

We train an LSTM network based on a pooled dataset made of hundreds of liquid stocks aiming to forecast the next daily realized volatility for all stocks. Showing the consistent outperformance of this universal LSTM relative to other asset-specific parametric models, we uncover nonparametric evidences of a universal volatility formation mechanism across assets relating past market realizations, including daily returns and volatilities, to current volatilities. A parsimonious parametric forecasting device combining the rough fractional stochastic volatility and quadratic rough Heston models with fixed parameters results in the same level of performance as the universal LSTM, which confirms the universality of the volatility formation process from a parametric perspective.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge