Multivariate Bayesian Structural Time Series Model

Paper and Code

Sep 19, 2018

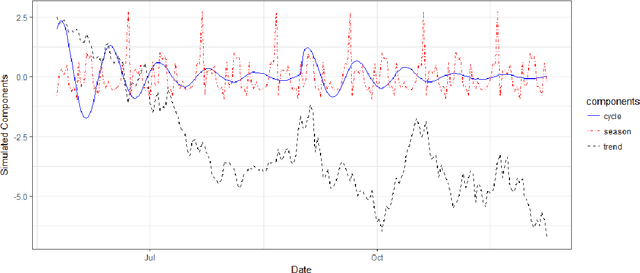

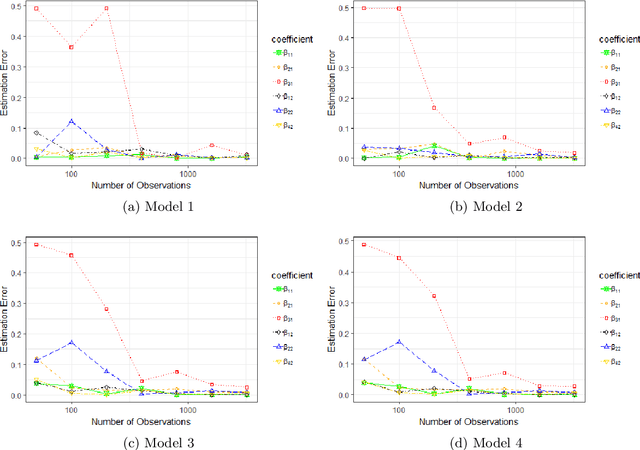

This paper deals with inference and prediction for multiple correlated time series, where one has also the choice of using a candidate pool of contemporaneous predictors for each target series. Starting with a structural model for the time-series, Bayesian tools are used for model fitting, prediction, and feature selection, thus extending some recent work along these lines for the univariate case. The Bayesian paradigm in this multivariate setting helps the model avoid overfitting as well as capture correlations among the multiple time series with the various state components. The model provides needed flexibility to choose a different set of components and available predictors for each target series. The cyclical component in the model can handle large variations in the short term, which may be caused by external shocks. We run extensive simulations to investigate properties such as estimation accuracy and performance in forecasting. We then run an empirical study with one-step-ahead prediction on the max log return of a portfolio of stocks that involve four leading financial institutions. Both the simulation studies and the extensive empirical study confirm that this multivariate model outperforms three other benchmark models, viz. a model that treats each target series as independent, the autoregressive integrated moving average model with regression (ARIMAX), and the multivariate ARIMAX (MARIMAX) model.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge