Multi-task Envisioning Transformer-based Autoencoder for Corporate Credit Rating Migration Early Prediction

Paper and Code

Jul 10, 2022

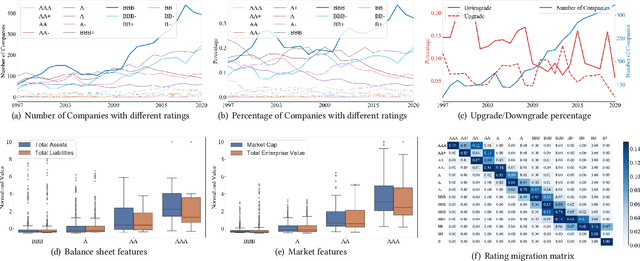

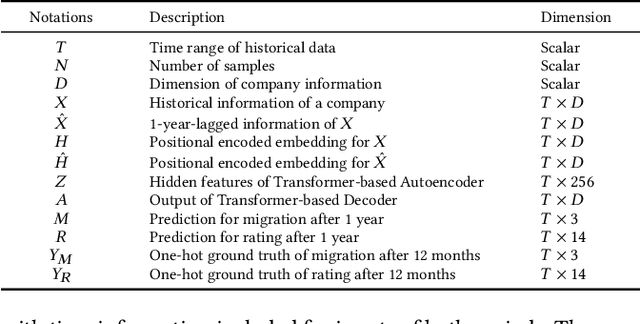

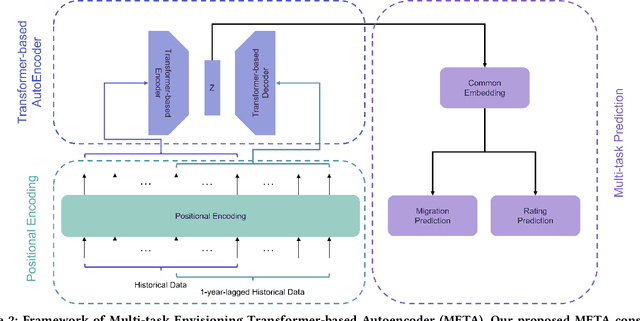

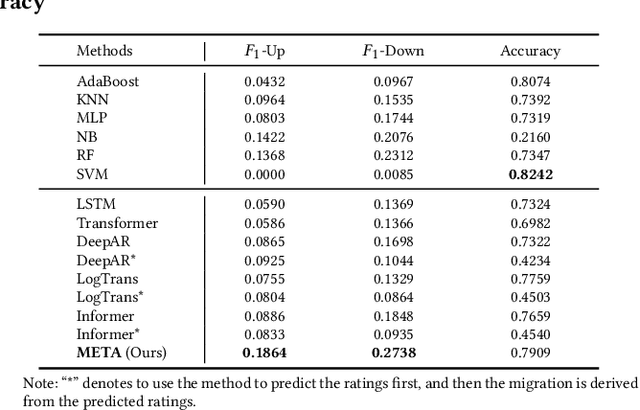

Corporate credit ratings issued by third-party rating agencies are quantified assessments of a company's creditworthiness. Credit Ratings highly correlate to the likelihood of a company defaulting on its debt obligations. These ratings play critical roles in investment decision-making as one of the key risk factors. They are also central to the regulatory framework such as BASEL II in calculating necessary capital for financial institutions. Being able to predict rating changes will greatly benefit both investors and regulators alike. In this paper, we consider the corporate credit rating migration early prediction problem, which predicts the credit rating of an issuer will be upgraded, unchanged, or downgraded after 12 months based on its latest financial reporting information at the time. We investigate the effectiveness of different standard machine learning algorithms and conclude these models deliver inferior performance. As part of our contribution, we propose a new Multi-task Envisioning Transformer-based Autoencoder (META) model to tackle this challenging problem. META consists of Positional Encoding, Transformer-based Autoencoder, and Multi-task Prediction to learn effective representations for both migration prediction and rating prediction. This enables META to better explore the historical data in the training stage for one-year later prediction. Experimental results show that META outperforms all baseline models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge