Micro-level Reserving for General Insurance Claims using a Long Short-Term Memory Network

Paper and Code

Jan 27, 2022

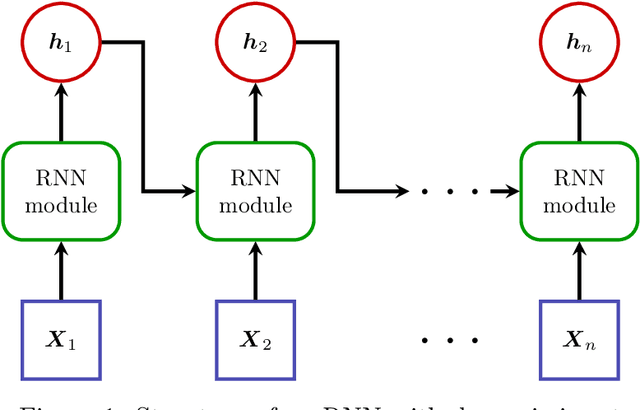

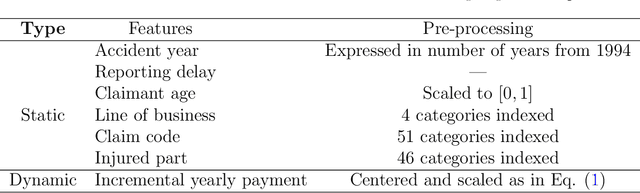

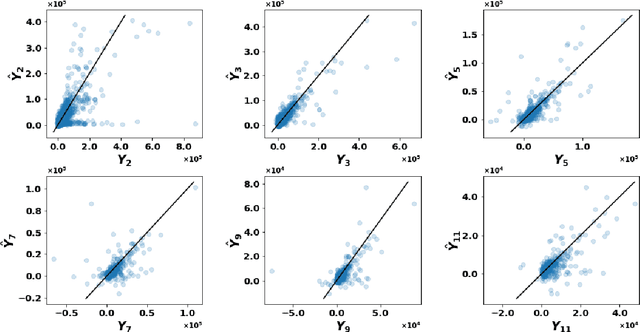

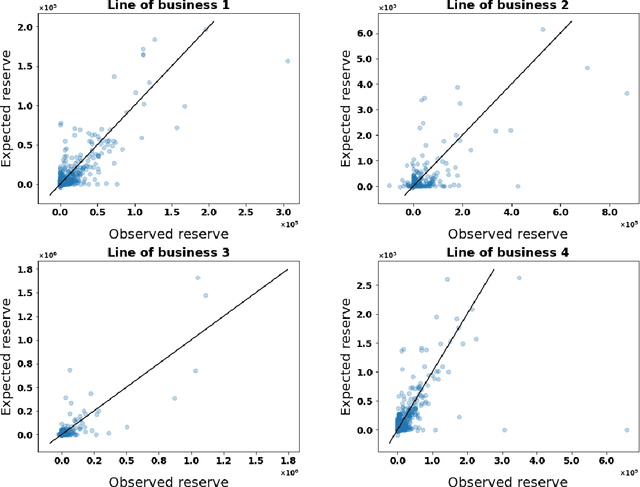

Detailed information about individual claims are completely ignored when insurance claims data are aggregated and structured in development triangles for loss reserving. In the hope of extracting predictive power from the individual claims characteristics, researchers have recently proposed to move away from these macro-level methods in favor of micro-level loss reserving approaches. We introduce a discrete-time individual reserving framework incorporating granular information in a deep learning approach named Long Short-Term Memory (LSTM) neural network. At each time period, the network has two tasks: first, classifying whether there is a payment or a recovery, and second, predicting the corresponding non-zero amount, if any. We illustrate the estimation procedure on a simulated and a real general insurance dataset. We compare our approach with the chain-ladder aggregate method using the predictive outstanding loss estimates and their actual values. Based on a generalized Pareto model for excess payments over a threshold, we adjust the LSTM reserve prediction to account for extreme payments.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge