Mean-Variance Efficient Collaborative Filtering for Stock Recommendation

Paper and Code

Jun 11, 2023

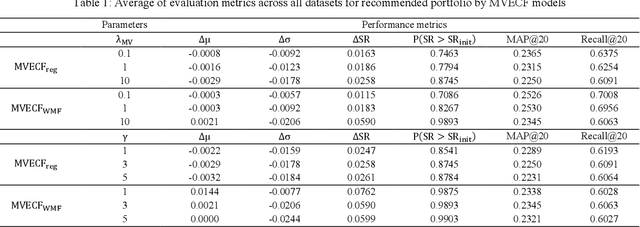

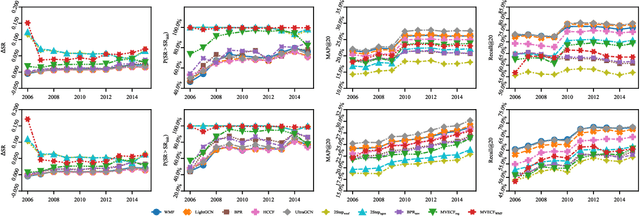

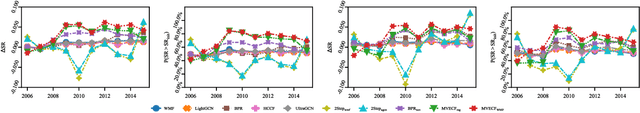

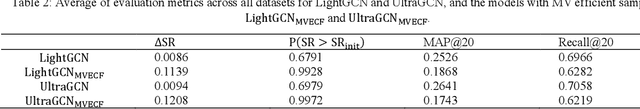

The rise of FinTech has transformed financial services onto online platforms, yet stock investment recommender systems have received limited attention compared to other industries. Personalized stock recommendations can significantly impact customer engagement and satisfaction within the industry. However, traditional investment recommendations focus on high-return stocks or highly diversified portfolios based on the modern portfolio theory, often neglecting user preferences. On the other hand, collaborative filtering (CF) methods also may not be directly applicable to stock recommendations, because it is inappropriate to just recommend stocks that users like. The key is to optimally blend users preference with the portfolio theory. However, research on stock recommendations within the recommender system domain remains comparatively limited, and no existing model considers both the preference of users and the risk-return characteristics of stocks. In this regard, we propose a mean-variance efficient collaborative filtering (MVECF) model for stock recommendations that consider both aspects. Our model is specifically designed to improve the pareto optimality (mean-variance efficiency) in a trade-off between the risk (variance of return) and return (mean return) by systemically handling uncertainties in stock prices. Such improvements are incorporated into the MVECF model using regularization, and the model is restructured to fit into the ordinary matrix factorization scheme to boost computational efficiency. Experiments on real-world fund holdings data show that our model can increase the mean-variance efficiency of suggested portfolios while sacrificing just a small amount of mean average precision and recall. Finally, we further show MVECF is easily applicable to the state-of-the-art graph-based ranking models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge