Learning to Price with Reference Effects

Paper and Code

Aug 29, 2017

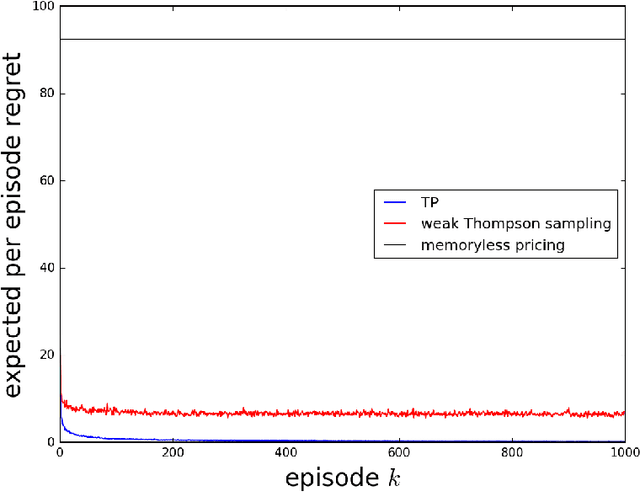

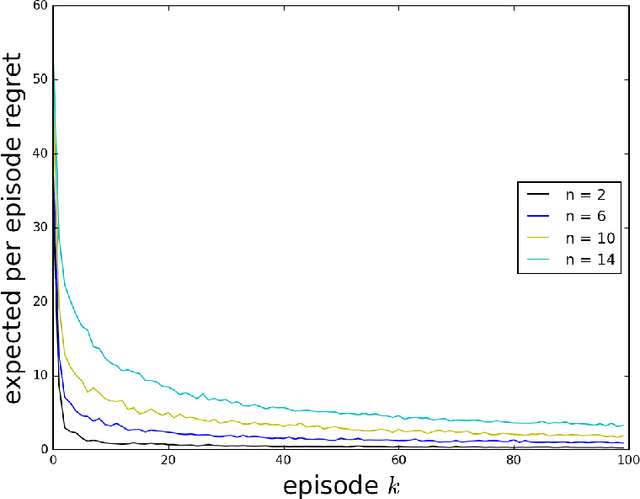

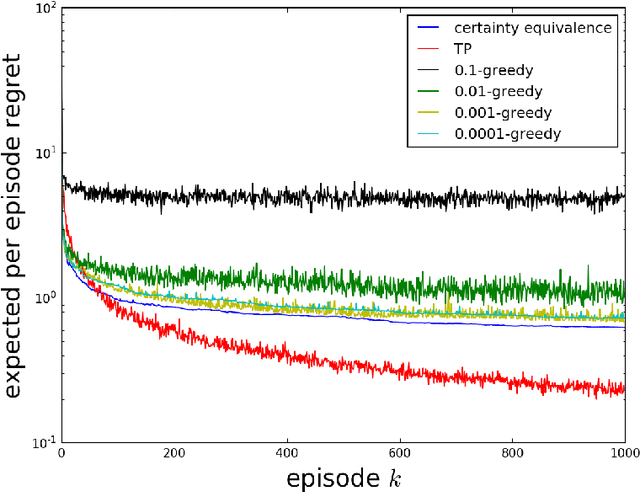

As a firm varies the price of a product, consumers exhibit reference effects, making purchase decisions based not only on the prevailing price but also the product's price history. We consider the problem of learning such behavioral patterns as a monopolist releases, markets, and prices products. This context calls for pricing decisions that intelligently trade off between maximizing revenue generated by a current product and probing to gain information for future benefit. Due to dependence on price history, realized demand can reflect delayed consequences of earlier pricing decisions. As such, inference entails attribution of outcomes to prior decisions and effective exploration requires planning price sequences that yield informative future outcomes. Despite the considerable complexity of this problem, we offer a tractable systematic approach. In particular, we frame the problem as one of reinforcement learning and leverage Thompson sampling. We also establish a regret bound that provides graceful guarantees on how performance improves as data is gathered and how this depends on the complexity of the demand model. We illustrate merits of the approach through simulations.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge