Joint Estimation of Conditional Mean and Covariance for Unbalanced Panels

Paper and Code

Oct 29, 2024

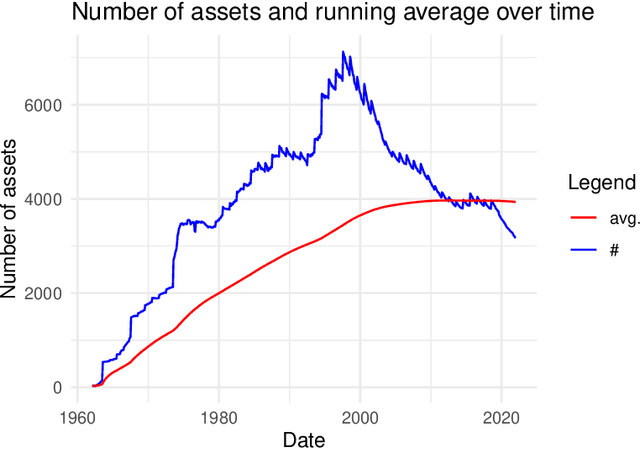

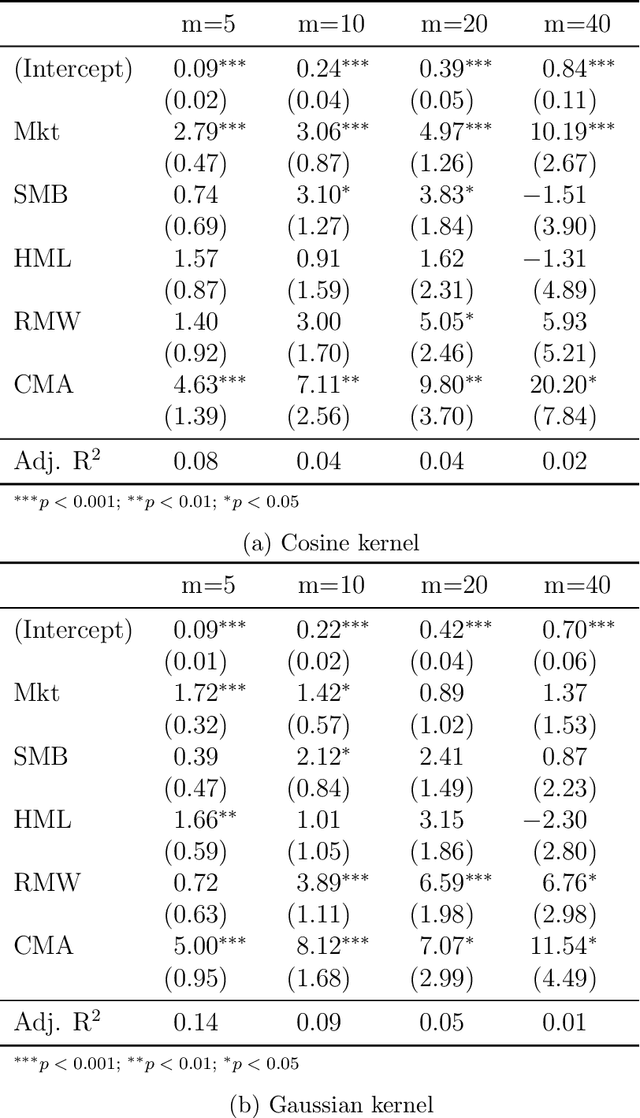

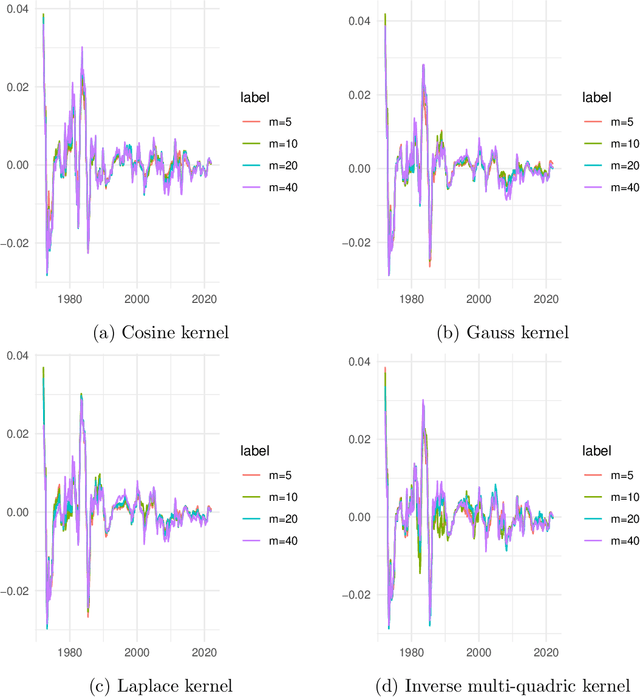

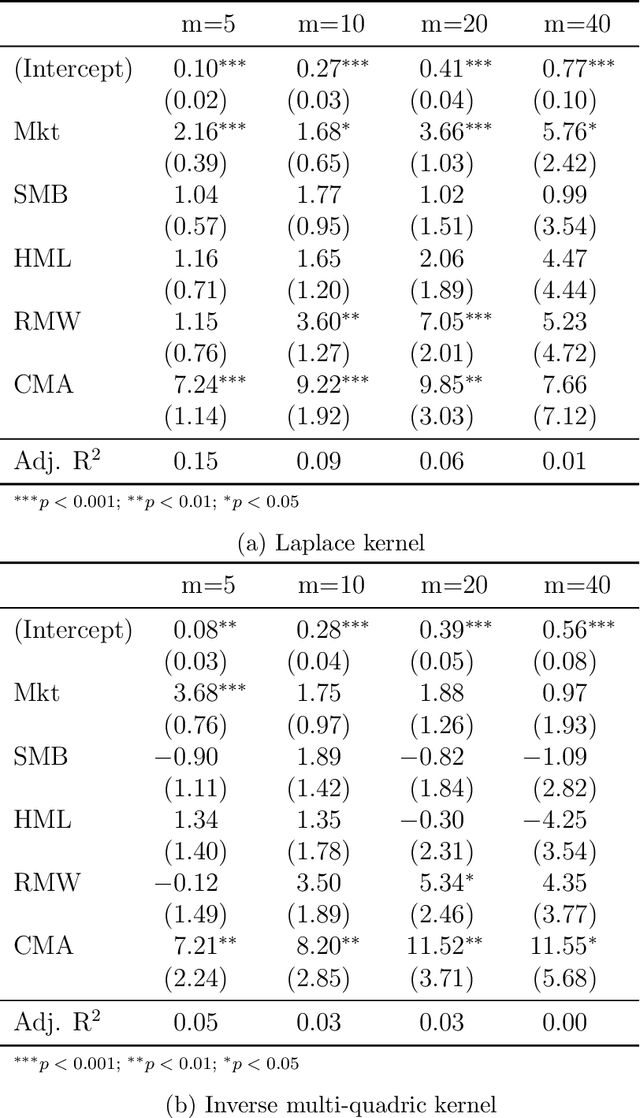

We propose a novel nonparametric kernel-based estimator of cross-sectional conditional mean and covariance matrices for large unbalanced panels. We show its consistency and provide finite-sample guarantees. In an empirical application, we estimate conditional mean and covariance matrices for a large unbalanced panel of monthly stock excess returns given macroeconomic and firm-specific covariates from 1962 to 2021.The estimator performs well with respect to statistical measures. It is informative for empirical asset pricing, generating conditional mean-variance efficient portfolios with substantial out-of-sample Sharpe ratios far beyond equal-weighted benchmarks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge