Infusing domain knowledge in AI-based "black box" models for better explainability with application in bankruptcy prediction

Paper and Code

May 30, 2019

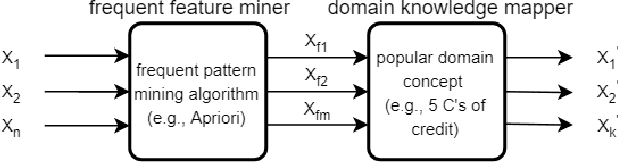

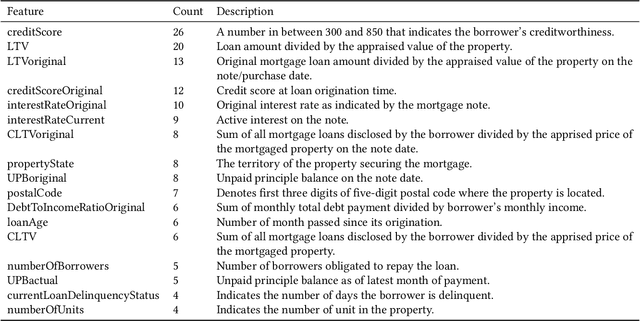

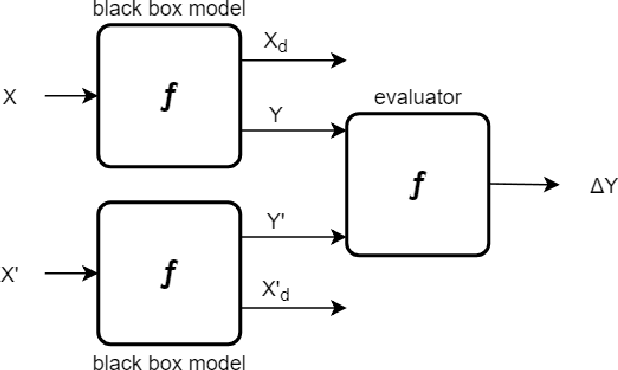

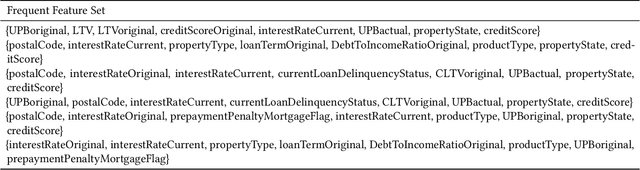

Although "black box" models such as Artificial Neural Networks, Support Vector Machines, and Ensemble Approaches continue to show superior performance in many disciplines, their adoption in the sensitive disciplines (e.g., finance, healthcare) is questionable due to the lack of interpretability and explainability of the model. In fact, future adoption of "black box" models is difficult because of the recent rule of "right of explanation" by the European Union where a user can ask for an explanation behind an algorithmic decision, and the newly proposed bill by the US government, the "Algorithmic Accountability Act", which would require companies to assess their machine learning systems for bias and discrimination and take corrective measures. Top Bankruptcy Prediction Models are A.I.-based and are in need of better explainability -the extent to which the internal working mechanisms of an AI system can be explained in human terms. Although explainable artificial intelligence is an emerging field of research, infusing domain knowledge for better explainability might be a possible solution. In this work, we demonstrate a way to collect and infuse domain knowledge into a "black box" model for bankruptcy prediction. Our understanding from the experiments reveals that infused domain knowledge makes the output from the black box model more interpretable and explainable.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge