Heterogeneous Ensemble for ESG Ratings Prediction

Paper and Code

Sep 21, 2021

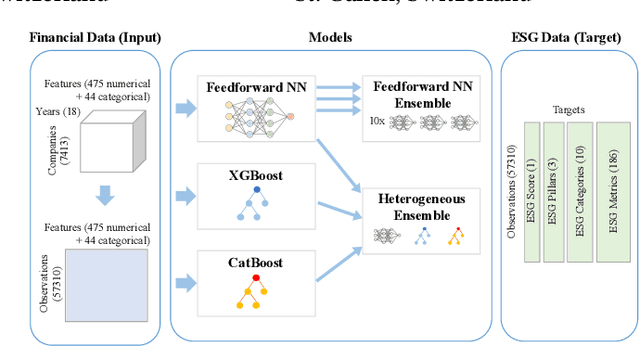

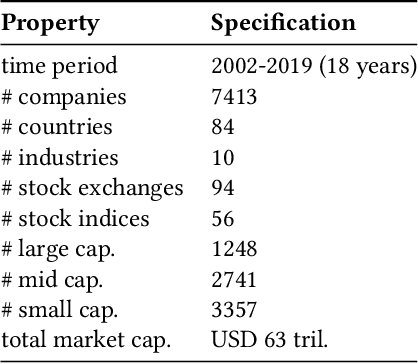

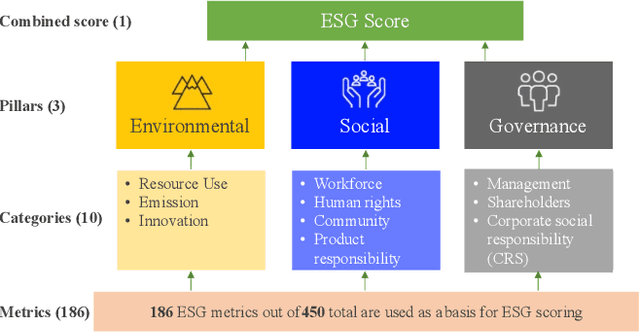

Over the past years, topics ranging from climate change to human rights have seen increasing importance for investment decisions. Hence, investors (asset managers and asset owners) who wanted to incorporate these issues started to assess companies based on how they handle such topics. For this assessment, investors rely on specialized rating agencies that issue ratings along the environmental, social and governance (ESG) dimensions. Such ratings allow them to make investment decisions in favor of sustainability. However, rating agencies base their analysis on subjective assessment of sustainability reports, not provided by every company. Furthermore, due to human labor involved, rating agencies are currently facing the challenge to scale up the coverage in a timely manner. In order to alleviate these challenges and contribute to the overall goal of supporting sustainability, we propose a heterogeneous ensemble model to predict ESG ratings using fundamental data. This model is based on feedforward neural network, CatBoost and XGBoost ensemble members. Given the public availability of fundamental data, the proposed method would allow cost-efficient and scalable creation of initial ESG ratings (also for companies without sustainability reporting). Using our approach we are able to explain 54% of the variation in ratings R2 using fundamental data and outperform prior work in this area.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge